No matter the scale or size of Canada’s dairy operations, a focus on operational efficiency will generate the most profits.

The sector faces an increasingly complex environment, with slow consumption growth over the last decade that’s hampered profitability. There are some bright spots of course – butter, yogurt and specialty cheeses are now popular consumer choices.

Dairy’s production opportunity and challenge

But the sector also faces an unusual dilemma in that consumption growth represents both an opportunity and a challenge. The challenge comes from the fact milk has two components: butterfat and “non-fat milk solids” (SNF) which includes proteins and other solids. But because there’s more demand for butterfat (used to make butter, cheese and yogurt), producing enough butterfat to meet demand means more SNF are also produced.

Excess SNF are marketed in lower-value milk classes (e.g., animal feed) compared to the class of milk used to produce cheese or yogurt. The price of milk in these lower value classes is often driven by world dairy market conditions – which most recently have been depressed. Also recently, processors have increasingly used protein concentrates and isolates imported from the U.S., displacing Canadian-produced SNF even further towards lower value milk classes.

The result? Canadian dairy farmers received a lower overall farm price in 2015. Similar pressures on the price of milk could emerge in 2016 with a global outlook for dairy markets that’s mixed. Within this environment, Canadian dairy producers must manage increasing costs and new trends in milk prices.

Canada’s dairy sector: efficient, regardless of size

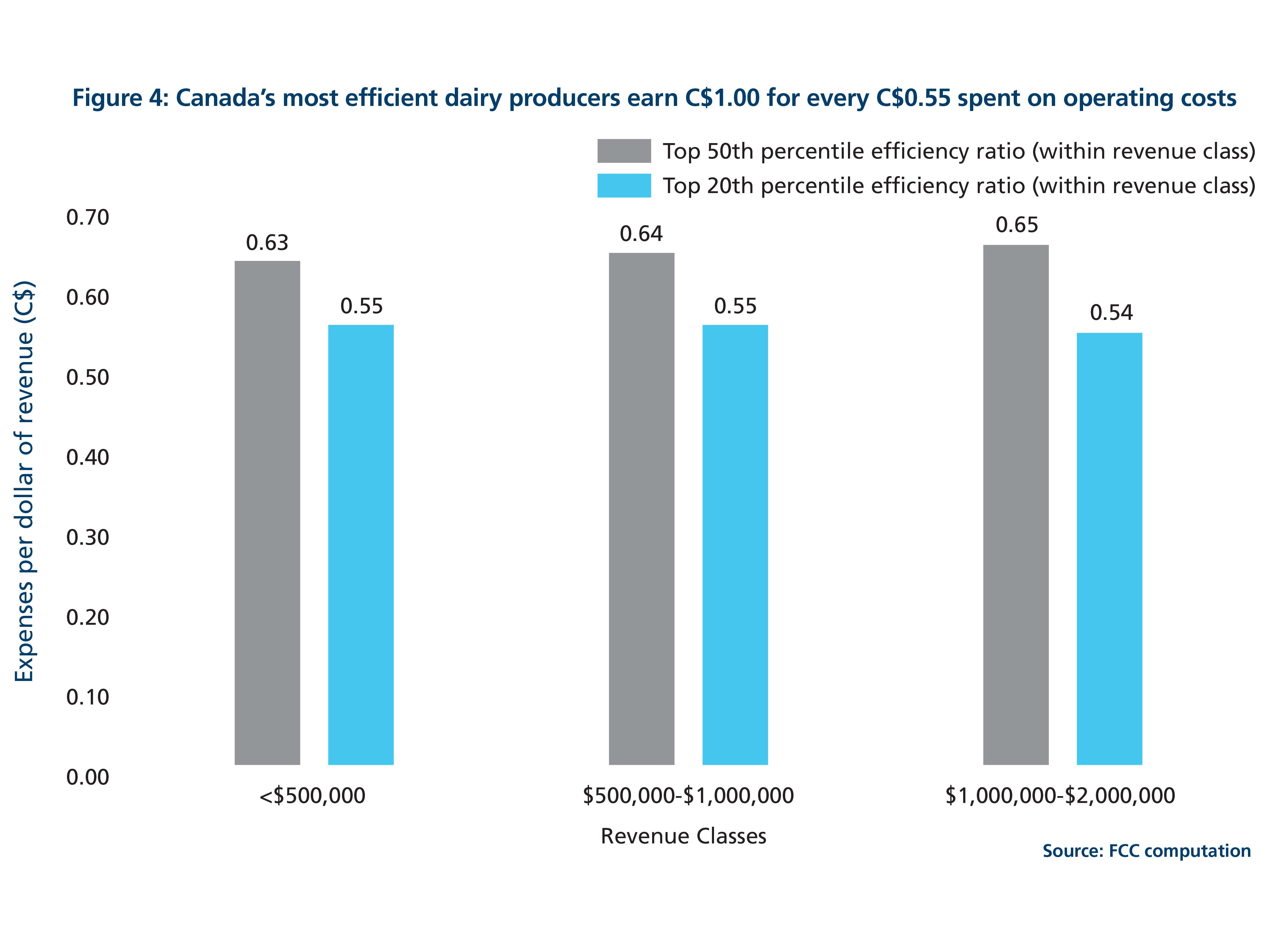

As in all sectors of the economy, the ability to manage costs varies across enterprises. This is especially true in a sector as widely dispersed as Canadian dairy. The figure below illustrates the Canadian sector’s operating expense ratios, which compares operating expenses (i.e., variable expenses such as feed) to overall revenues in three classes (under $500K, $500k - $1 million and $1-2 million). A lower ratio means operations use fewer variable resources to earn a dollar of revenue.

The graph shows the operating expense ratios of operations at two levels of efficiency: the 20th percentile and the 50th percentile. At the 50th percentile (the “median” operation), 50% of producers in the same revenue class have higher operating expense ratios and 50 per cent have lower ratios.

What this means for dairy producers

It doesn’t matter which revenue class you look at. The top 50 per cent of Canadian producers in each class spend no more than C$0.64 on operating expenses for every C$1.00 in revenue.

And the median operation in each revenue class spends about C$0.10 more on operating costs per C$1.00 in revenue than the producer operating at the 20th percentile. These highly efficient operations spend roughly C$0.55 on operating expenses for each C$1.00 earned.

This analysis doesn’t mean all operations are similarly profitable.. It does suggest however producers with the smallest revenues are as likely to be as efficient as those with the highest revenues, a sign of a resilient industry. In many cases, efficiency can only be improved through the careful, and sometimes extended, learning of on-farm technologies (e.g., robotic milking machines).

The way forward for Canada’s dairy sector

Finding ways to meet consumer preferences is one important strategy for Canada’s dairy sector. But continued modernization of production and management will bolster the efficiency gains, no matter the size of operation, that will support a healthy dairy sector in the long run.

Source : FCC