By Michael Langemeier and Michael Boehlje

Center for Commercial Agriculture

Purdue University

There are numerous motivations for farms to expand their businesses. Even in today's environment of tight margins, many farms are exploring expansion options. When exploring these options, it is important to address key questions pertaining to the farm's strategy. A previous farmdoc daily article (August 5, 2016), discussed ten questions that should be addressed when examining challenges and opportunities associated with farm growth. This article focuses on the fourth question: how should farm growth options be evaluated?

Successful farmers have numerous business venture opportunities to choose from. The options range from business reinvestment including upgrading and modernizing equipment and facilities, acquiring farmland and other capital assets, purchasing distressed assets of those producers who have not been as successful, or deleveraging (paying down debt) the business. In some cases, farmers may also be interested in non-farm investments or maintaining a liquid position to take advantage of future opportunities. The key question is how do you choose which option or new business venture to pursue? The six criteria discussed below can be used to help make these decisions.

Strategic Fit

The first criteria is that of strategic fit or whether the new venture leverages the resource base of the business and is consistent with the strategic direction or focus of the business. If the new venture requires a set of skills that are currently not part of the farm's resource base, it has much less potential for success. For example, a new venture that can only be successful if one maintains intense relationships with customers may not fit well with a management team that is intensely focused on operational efficiency and cost control as is typical in a commodity oriented business. Some characterize strategic fit as what really excites and motivates not only the owners, but the management team.

Expected Returns and Risk

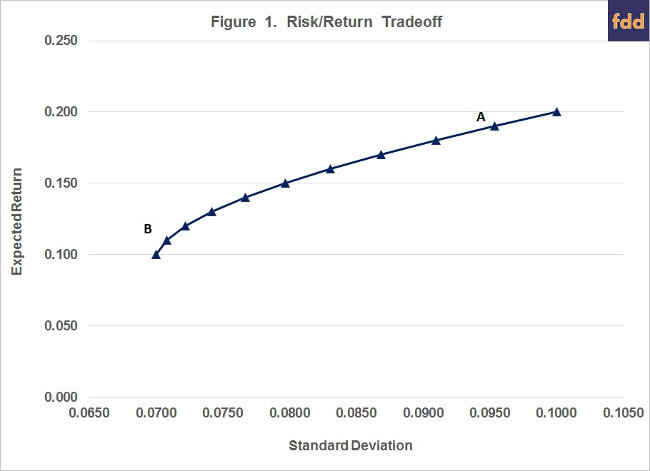

The second criteria that should be considered in choosing a new business venture is the expected returns and risk of the venture. A business venture that exhibits higher expected returns likely exhibits more risk than a venture with lower expected returns. Figure 1 illustrates a typical risk/return tradeoff. Risk can be measured as the variability of expected returns or the probability of falling below a specified target return (i.e., downside risk). In figure 1, the standard deviation of possible outcomes is used as the risk measure. A farm's comfort level for higher risk depends on the management team's risk tolerance. A management team with high risk tolerance may be attracted by venture "A" in figure 1. Conversely, a management team with little tolerance for risk would be more interested in venture "B".

When examining expected returns and risk, it is important to examine current income potential as well as potential growth in earnings or income. This is particularly important to keep in mind when evaluating start-up ventures. These ventures may have losses in the first year or two, and offer substantial income opportunities in subsequent years. Also, if a venture requires the purchase of capital assets, it is important to evaluate the impact of changing values of these assets (e.g., land) on the farm's balance sheet, and ascertain the tax consequences of these asset purchases.

Another consideration pertaining to expected returns and risk is portfolio fit. What are the synergies between the new venture and the farm's existing enterprises? Does the new venture reduce per unit fixed costs (e.g., machinery; labor) of other enterprises? Does the new venture increase or decrease the risk of the farm? In other words, is the income from the new venture highly correlated with the farm's existing enterprises?

Funding

The third criteria that should be considered in any new business venture decision is that of the capital required to implement the acquisition. The sources of funding for the venture, debt versus equity, are an important consideration both in terms of availability and cost, as well as what impact this funding might have on the overall liquidity, leverage, and financial risk of the business. In addition to capital funding, it is also important to evaluate working capital needs. In fact, for many new ventures, the significantly increased working capital requirements to fund the venture through the startup phase may be the greatest challenge.

Entry/Exit

A fourth criteria important in choosing a new venture is the cost and ease of entry and exit. It is important to carefully analyze the costs of entry. Farms should be careful about over-bidding for assets in the start-up or expansion process. However, it is also imperative to analyze the ease of exit. The flexibility of selling the business or dropping the venture if it does not perform as expected or does not fit as well as anticipated in the overall strategy of the business should be considered. Moreover, it is important to determine whether the business venture can be easily spun off if an exit decision is made, and whether there are significant costs and challenges encountered when exiting a venture.

Value Creation

A fifth criteria in choosing a new venture is whether or not it will create value for the entire business. As we noted above, the potential gain or loss in the value of assets is an important consideration in initiating a new venture. Additional dimensions of this value creation process include whether or not the new venture has the potential to be an inflation hedge, will the value of the business increase in inflation adjusted terms as well as nominal terms? Does the new venture create intangible value beyond the "hard" asset value of the capital assets? Does the new venture create "option value" - a value associated with protecting a position or creating opportunities that may not be possible without the assets acquired or the new venture? What is the terminal or residual value of the assets or venture if it would be sold or liquidated? In many cases, the primary objective of initiating a new venture may not be the current earnings and income generated on an annual basis, but its residual or terminal value. In fact, this is the major goal of venture capitalists who invest in new projects - to create value that can be captured at the subsequent sale of the venture. Although this may not be the primary goal of a farm that is expanding, it should not be ignored.

Managerial Requirements

A sixth criteria in choosing a new venture is the managerial complexity and requirements of the new venture. In many cases the new venture may use the managerial skill set of the current business, but a realistic assessment of current management skills and those skills required by the new venture is essential in selecting a venture. The following questions should be addressed. Will adding the new venture increase the managerial requirements beyond the current capacity of the business? Are additional managerial skills needed to be successful in operating the new venture? Can time be allocated by the current management team to "get up to speed" in the new venture? Will the acquisition increase the complexity of the current business? Will managerial resources need to be diverted from the current business to the new venture, thus putting increased pressure on the current management team? Will the farm and the venture have a relatively separate management structure, or will the venture be integrated from both a managerial and operational perspective with the current business? In many instances, managerial requirements of the new venture are one of the major challenges pertaining to the venture's success.

Scorecarding Tool

Table 1 provides a scorecarding tool to use when evaluating new ventures. Each venture that is being considered is evaluated on a scale of 1 (low) to 5 (high) on each of the criteria. Adding these rankings for the six criteria provides some insight into which ventures might have the highest overall score and thus be the most preferred option. The key value created by this scorecard is the systematic evaluation of the various options on the various criteria, not the overall score obtained for the venture.

Concluding Thoughts

When evaluating business venture opportunities, it is important to gauge the impacts of these options on strategic fit, expected returns and risk, capital structure, ease of entry and exit, value creation, and managerial requirements. A good venture opportunity will rank high on several of these criteria. Future articles will explore employee skills, start-up challenges, and financial considerations pertaining to farm growth.