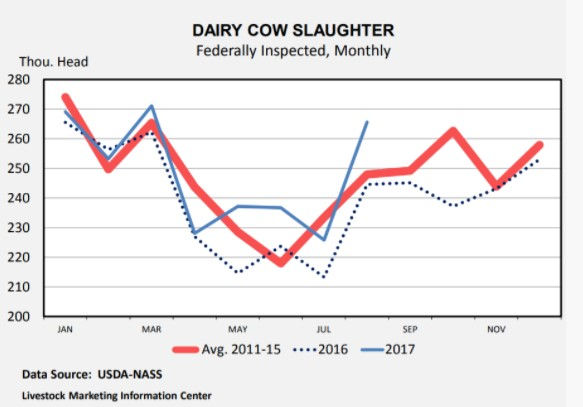

Dairy cow slaughter was up 9% from a year earlier during August, approaching the prior peaks of the year posted in January and March. Dairy cow slaughter has been up from a year earlier in every month this year, except for February due to the Leap Year influence last year. Through the first eight months of 2017, slaughter was up 4% year-over-year and is on track to reach three million head for the year, the largest since 2013. At the beginning of the year, the milk cow herd was pegged at 9.349 million head, up less than 0.5% from a year earlier. In August, the number of cows being milked was up almost 1% from 2016’s. The last two months have seen the milk cow herd increase by one thousand head, which compares to an 8,000 cow increase during the same months a year ago.

Producers are not getting strong market signals to expand or contract their herds, although dairy product usage has not been anything to get excited about. The All Milk price reported by USDA’s National Agriculture Statistics Service (NASS) was $17.30 per cwt. in the latest two months (June and July). In the same two months of 2016, that price was $15.45 but this year’s price pales in comparison to the June-July 2014 price of $23.25. The Class III milk price (largely milk going to cheese makers) was $16.57 per cwt. in August, up more than $1 from the previous month but was still below the prior August price of $16.91. Cheese prices so far in September have been under pressure, suggesting that the Class III milk price for this month will be moving lower.

Milk production was 2% above a year ago in July and August, which is a big increase when compared to milk and dairy product usage in recent months. Fluid milk sales volume in the July (the latest reported month) was down 2% from the prior July and year-to-date fluid product volume also dropped 2% from 2016’s. This leaves more milk to go through butter, cheese, powder and other dairy product markets. Cheese production was up 1% in July from a year ago, but this matches up against American-type cheese usage that was down 4% nonAmerican-type cheese (mostly Italian for pizza) that was down 3% from the prior July. Consequently, cheese inventories in cold storage were at record-breaking levels at the end of July. NASS cheese inventory data in cold storage at the end of August was released on September 22nd. That data showed some reduction in frozen stocks-on-hand, still the percentage comparisons to a year earlier were large.

Click here to see more...