By Keith Good

In the last few days, USDA’s Economic Research Service (ERS) and Foreign Agricultural Service (FAS) have released three separate reports that contain current information relating to dairy sector analysis in China, U.S. livestock trade, and the the U.S.-Korea Trade Agreement (KORUS). This update briefly highlights core points from the three USDA reports.

Dairy Issues- China

On Friday, ERS released a report by Elizabeth Gooch, Roger Hoskin, and Jonathan Law, titled, “China Dairy Supply and Demand,“ which stated that, “China represents the primary source of demand growth in global dairy markets. Calculations using Euromonitor data show China’s share of the world dairy market grew from less than 5 percent in 2002 to 12 percent in 2016. By 2021, China’s share is expected to equal that of the United States at 14 percent. China’s growth is partly responsible for driving down Western Europe’s share of the world market to less than 25 percent.”

Friday’s report explained that,

With this concept in mind, Gooch, Hoskin and Law pointed out that, “The European Union (EU) is the leading dairy exporter to China, with close to 50 percent of the market value, having surpassed former leader New Zealand in 2015 and 2016. In those same years, the United States moved from the third-largest exporter to China in 2014, with almost 10 percent of the market, to fourth place after Australia. New Zealand and Australia signed free trade agreements with China in 2008 and 2015, respectively, which reduce tariff rates on their dairy exports.”

Focusing more narrowly on U.S. trade issues, the ERS report stated that, “The U.S. dollar-yuan exchange rate has put U.S. exports at a disadvantage relative to those from Europe and Australia, where the exchange rates have been more favorable. However, the United States remains one of the principal suppliers of agricultural commodities to China.

After additional analysis, Friday’s report added that, “In 2016, growth in China’s dairy market was relatively small. This deceleration coincides with a general economic slowdown in China, likely due to its difficulty with a structural shift away from factories and exports and toward growth dependent on domestic consumption. The economic downturn hurt Chinese producers and trading partners. Although China’s economic growth rate is expected to remain relatively flat, its dairy market is projected to continue to grow, possibly reflecting the nation’s gradual transformation to consumption-dependent growth.”

Livestock Analysis

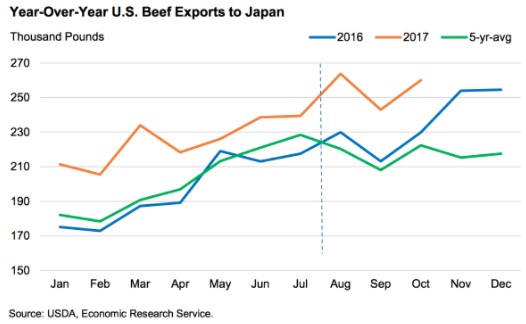

Mildred Haley indicated in this month’s “Livestock, Dairy and Poultry Outlook,” from ERS on Monday that, “Year-over-year October 2017 U.S. beef exports were up 13.1 percent (+30 million pounds) to 260 million pounds. Higher U.S. shipments to all five major destinations, Japan (+31.4 percent), Mexico (+16.8 percent), Canada (+14.6 percent), Hong Kong (+14.1 percent), and South Korea (+2.8 percent) during October contributed to the growth. Higher exports in each month in 2017 through October resulted in a year-to-date export increase of 14.3 percent (+293 million pounds) above the previous-year level. Japan alone contributed more than half of that growth. Year-over-year higher U.S. beef shipments to Japan have been continuing even since the Japanese safeguard tariff was raised from 38.5 to 50.0 percent on U.S. frozen beef, starting in August 2017.”

The ERS report indicated that, “In addition to increased exports to the top five export destinations, year-to-date October 2017 U.S. exports were also higher to Vietnam (+10.8 million pounds), Philippines (+4.9 million pounds), Chile (+4.8 million pounds), Indonesia (+4.3 million pounds), and China (+5.1 million pounds) from year-earlier levels.

Monday’s ERS update also pointed out that, “U.S pork exports in October were 495 million pounds, a volume almost 10 percent higher than a year ago. Strong year-over-year shipments to Mexico, most of Asia, and Colombia drove exports higher in October.”

Benefits of Free Trade Agreement with Korea- FAS Report

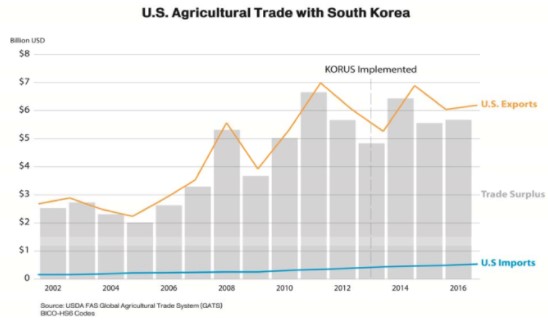

Also on Monday, FAS released an update titled, “U.S. Agriculture Reaps Benefits of Free Trade Agreement with Korea,” which stated that, “U.S. agricultural exports to South Korea have grown in recent years, largely due to tariff reductions and the lifting of non-tariff barriers. The U.S.-Korea Trade Agreement (KORUS) entered into force in 2012, immediately removing tariffs on two-thirds of U.S. farm and food exports to South Korea.”

With respect to the KORUS agreement and corn, the FAS update explained that, “Due to the cyclical nature of agriculture and its susceptibility to climatic events, pests and disease, U.S. agricultural exports to South Korea got off to a slow start in the early years of KORUS. The United States’ two largest exports, corn and beef, declined in the initial years of implementation for reasons unrelated to the agreement. U.S. corn production suffered from the historic 2012-13 drought and, as a result, U.S. corn exports to the world fell from 45 million metric tons (MMT) in 2011 to 23 MMT in 2013. After U.S. corn production and exports recovered, U.S. corn regained its competitive edge in South Korea as well, with exports rising 40 percent, from 3.4 MMT in 2015 to 4.8 MMT in 2016. U.S. corn exports to Korea were valued at $865 million in 2016. Despite improvement in corn exports to Korea, the United States is facing strong competition from South American countries that have had record harvests in recent years.”

While discussing beef related issues, Monday’s update noted that, “U.S. beef and beef product exports to South Korea grew from $806 million in 2015 to $1.1 billion in 2016, an increase of 32 percent. Beef and beef products remain the top U.S. agricultural exports to South Korea.”