By Mario Parker www.Governorsbiofuelcoalition.org

The glut of corn that’s been plaguing Midwest growers is finally starting to ease, and hedge funds are betting that will help spark a rally for prices.

U.S. corn inventories are set to drop before the 2018 harvest as farmers curb plantings and demand stays robust, the Department of Agriculture said Friday. The decline would be the first since 2013 and signals that the four-year rout for prices could be over.

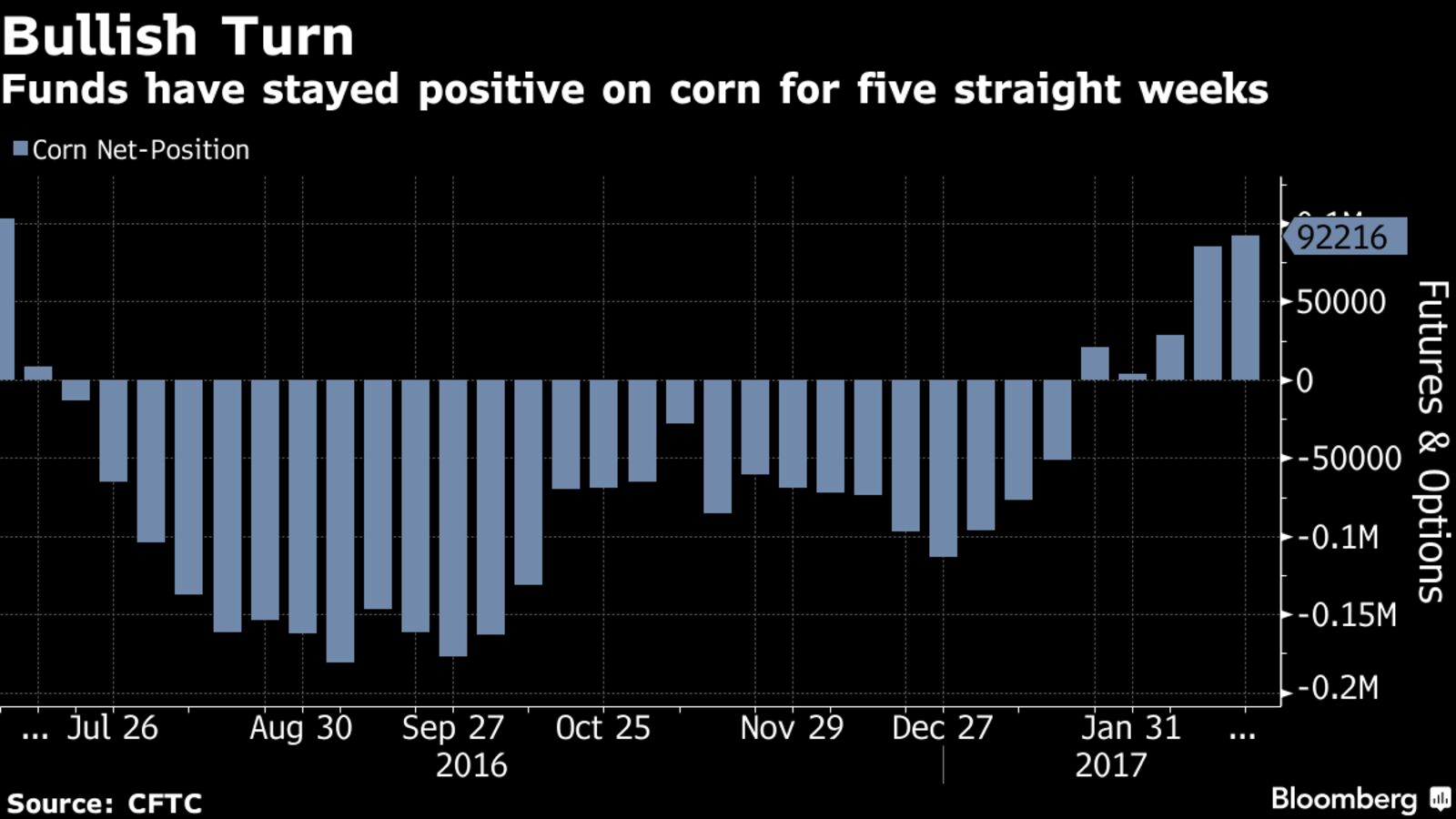

Money managers have stayed bullish on the grain for five straight weeks, the most positive streak since July. Midwest growers are cutting acreage in favor of other crops, including soybeans. That’s helping to breathe life back into the corn market, especially amid near-record production from ethanol makers.

“You can’t say demand’s been bad by any stretch,” said Fiona Boal, director of commodity research at London-based Fulcrum Asset Management LLP, which oversees $5.2 billion.

The corn net-long position, or the difference between bets on a price increase and wagers on a decline, increased 8 percent to 92,216 futures and options contracts in the week ended Feb. 21, according to U.S. Commodity Futures Trading Commission data released three days later. That’s the highest since mid-July.

Monthly Gain

Corn futures for May delivery are heading for a third straight monthly gain. The contract is up more than 1 percent in February, settling at $3.7075 a bushel on Friday in Chicago. It extended its advance on Monday to $3.7250 as of 1:17 p.m. in Singapore.

American reserves will drop to 2.215 billion bushels before the 2018 harvest, the USDA said Friday at its 93rd annual Agricultural Outlook Forum in Arlington, Virginia. That’s down from 2.32 billion this season. Inventories are declining as production is forecast to slump 7.1 percent.

Of course, bad weather could further hamper the harvest. After multiple years of nearly ideal growing conditions, money mangers could be loading up on corn now as a hedge against Mother Nature, said Donald Selkin, the New York-based chief market strategist at Newbridge Securities.

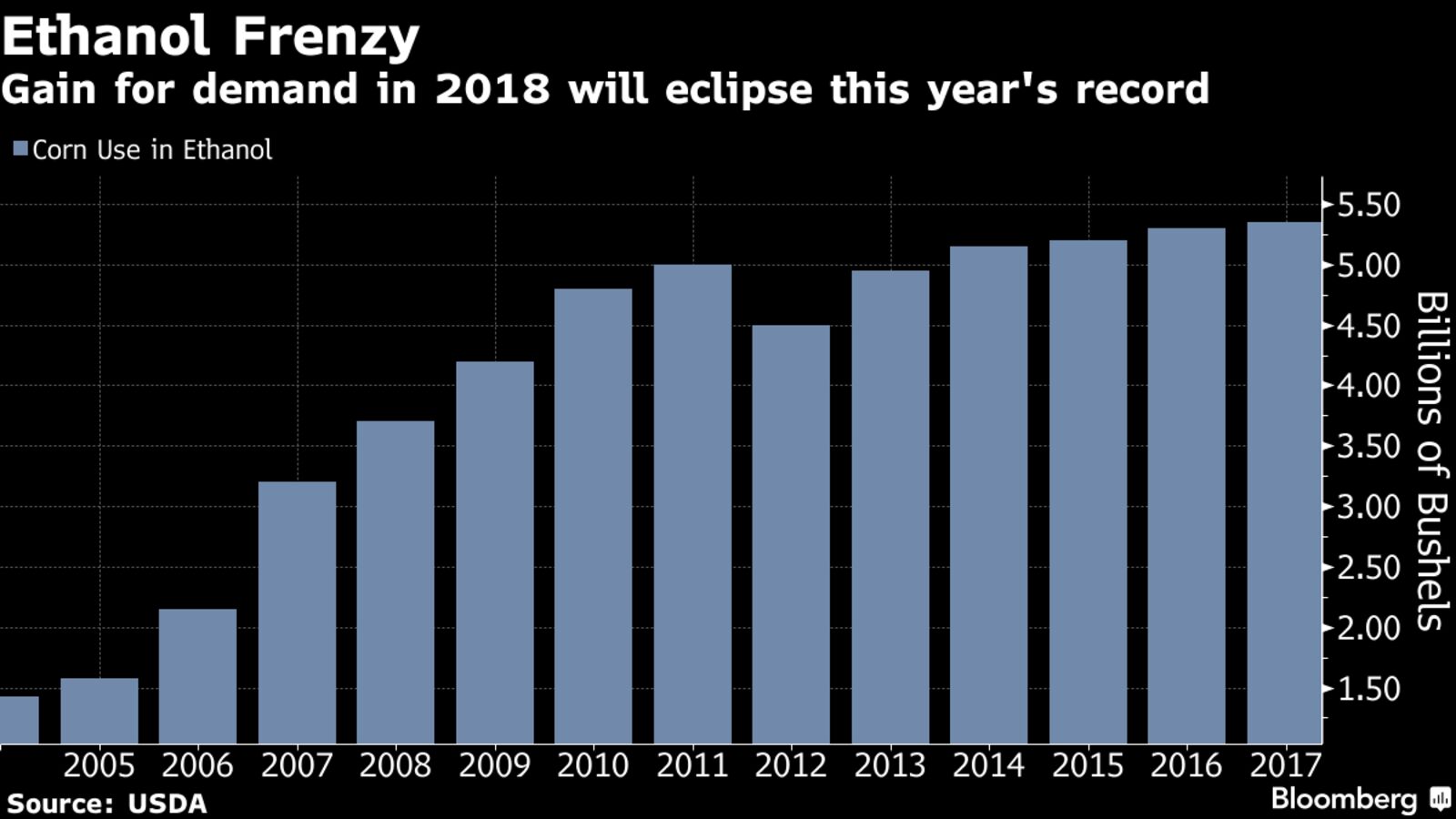

As output slides, demand is climbing from the U.S. biofuel industry. Total consumption of corn by ethanol makers will rise 0.9 percent to an all-time high of 5.4 billion bushel next season, up from the current record of 5.35 billion this year, the USDA projects.

Demand from biofuel producers could stay strong as President Donald Trump reiterated his backing for the American industry last week. He sent a letter of support during the National Ethanol Conference in San Diego, saying that he regretted not being able to attend.

Record Output

Rising ethanol production has helped to keep a floor under corn prices in the past few months even amid ample supplies. U.S. output reached a record high in late January.

“Imagine what the farm economy would look like without 5.3 billion bushels of demand coming from the ethanol industry,” Renewable Fuels Association President and Chief Executive Officer Bob Dinneen said in his state of the industry address during the San Diego conference, which had about 1,000 attendees.

Still, there are signs that the appetite for corn from biofuel plants could ease in the short-term.

U.S. ethanol production dropped for three consecutive weeks for the first time since September, an Energy Information Administration report showed Feb. 23. Meanwhile, stockpiles have increased seven straight weeks, the longest such streak in more than two years. Output could slow further because the industry typically starts its annual maintenance season in March to prepare for the peak summer driving season.

Click here to see more...