By James Mintert

The Purdue/CME Group Ag Economy Barometer drifted lower to a reading of 126 in December, the second month in a row that the barometer has declined. The Ag Economy Barometer is based on monthly survey responses provided by 400 agricultural producers from across the U.S. December’s barometer value was the lowest reading since March and the second-lowest reading of 2017 (Figure 1).

The decline in the Ag Economy Barometer over the last two months was driven entirely by producers adopting a more pessimistic perspective regarding the future. The Ag Economy Barometer has two sub-indices, the Index of Future Expectations and the Index of Current Conditions, which provide insight into the drivers behind changes in barometer readings. December’s results revealed that producer optimism about the future declined sharply for the second month in a row. As recently as October, the Future Expectations index was at 137. The index fell to 127 in November and in December, dropped again to 120 –the lowest reading for the Index of Future Expectations since October 2016 (Figure 2).

In sharp contrast to the increased pessimism about the future, producers have become more optimistic about current economic conditions in U.S. agriculture. The Index of Current Conditions, the barometer’s measure of producers’ short-run expectations, increased in December to 139 – the highest reading since July and the second-highest reading since data collection began in October 2015.

In short, a paradox has developed in recent months. Producers’ optimism about current economic conditions has remained strong, and arguably even strengthened, while optimism about the future has faded to a 14-month low.

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015-December 2017.

Figure 2. Index of Current Conditions and Index of Future Expectations, October 2015-December 2017.

Fading Optimism Regarding Financial Conditions

Two specific survey questions capture the recent erosion in producers’ forward-looking sentiment. Figure 3 shows the share of respondents expecting their farms’ financial conditions to be “better” and “worse,” respectively, a year ahead. The share of producers expecting “better” financial conditions for their farms fell to 20 percent in December, while the share expecting “worse” financial conditions climbed to 30 percent. Both of these sentiment measures are at the most extreme levels recorded in over a year. Figure 4 provides a comparison of responses to this question in December 2017 vs. December 2016. Compared to a year earlier, the percentage of producers expecting their farms to be worse off one year ahead rose to 30 percent from 23 percent, and the percentage of producers expecting their farms to be better off one year ahead declined from 32 percent to 20 percent.

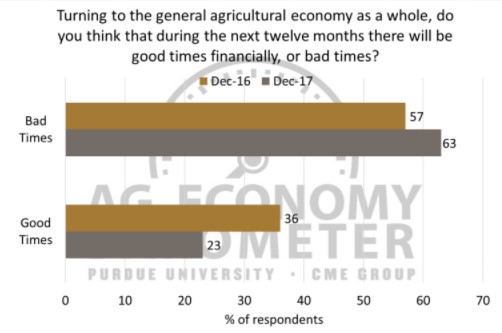

When asked about expectations for the overall agricultural economy, a similar trend unfolded. For example, the share of respondents that chose “bad times” to describe expected conditions in the ag economy over the upcoming 12 months has been climbing since July, reaching 63 percent in December (Figure 5). Correspondingly, the percentage of respondents expecting “good times” in the ag economy declined for the second month in a row in December. When compared to a year earlier the shift in sentiment becomes even more clear. The percentage of producers expecting good times in the agricultural economy during the upcoming 12 months declined from 36 percent in December 2016 to just 23 percent in December 2017 (Figure 6). The share of respondents expecting good times in the next 12 months fell from 36 percent in December 2016 to 23 percent in December 2017.

Figure 3. Share of respondents expecting their farms to be financially “better” and “worse” a year out, October 2015 to December 2017.

Figure 4. Share of respondents expecting their farms to be financially “better” and “worse” off one year ahead, December 2016 and December 2017.

Figure 5. Share of respondents expecting “good times” and “bad times” in the general agricultural economy over the upcoming 12 months, October 2015 to December 2017.

A Better Time to Make Large Farm Investments?

When considering whether to make large farm investments in things like farm machinery and buildings, producers have to consider both current economic conditions and their expectations for the future. Despite producers’ more pessimistic attitudes regarding future prospects for both their own farms’ financial conditions and the overall agricultural economy, they seem to be somewhat more willing to make large investments than they were a few months ago and a year ago. When asked if it is currently a good time to buy large investment items, such as buildings or machinery, 32 percent of respondents said it was a “good time” in December 2017 (Figure 7). This was a markedly stronger response than four months ago (August 2017), when just 21 percent of producers reported it was a “good time” to make large investments.

The shift in attitudes toward farm investments compared to a year earlier is also interesting, in part because year-end is a time frame when many farms are making investment plans for the upcoming year. In December 2016, 69 percent of respondents thought it was a “bad time” to make large farm investments, but that changed to 62 percent of respondents on the December 2017 survey. Similarly, in December 2016, 27 percent of producers thought it was a good time to make large farm investments versus 32 percent who felt it was a good time to make large investments in the December 2017 survey. It appears that when considering farm investments, producers’ stronger impressions of current economic conditions are outweighing their increasing concerns about future conditions, both on their own farms and in the overall agricultural economy.

Figure 6. Share of respondents expecting “good times” and “bad times” in the general agricultural economy over the upcoming 12 months, December 2016 and December 2017.

Figure 7. Share of respondents that think now is a “good time” and “bad time” to make large farm investments, October 2015 – December 2017.

A New Generation

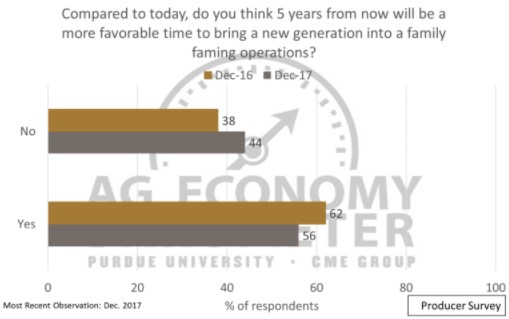

Given the nature of farming, a farm operator’s perspective regarding bringing a new generation into the operation provides insights into long-run expectations for the farm economy. In December, producers were asked if, given the current agricultural climate, they would consider now to be a good time to bring a new generation into a family farming operation. Respondents were split on the question, with a slight majority (51%) responding “yes.” This is essentially unchanged from the results when the question was last posed in December 2016. However, as a follow-up question, respondents were also asked if they believe five years from now would be a more favorable time to bring a new generation into the operation. In December 2017, 56% said that they expected conditions would be more favorable in 2022 than now (figure 8). This represents a drop from the 62% that believed five years out would be a more favorable time to bring a new generation into a family farming operation when the question was posed in December 2016. This seems to be consistent with the erosion in producers’ confidence about the future economic conditions in agriculture.

Figure 8. Survey Responses to 5 Years from now Being a Better Time to Bring a New Generation into a Family Farming Operation, December 2016 and December 2017.

Conclusion

The latest results from the Purdue/CME Group Ag Economy Barometer reflect a paradox regarding agricultural producers’ sentiment. While producers have become more optimistic regarding current economic conditions in agriculture, they also have become more pessimistic about future prospects for the agricultural economy. This is markedly different from late fall 2016 and early winter 2017 when producers were more optimistic about future than current economic conditions in agriculture. However, despite the erosion in optimism about future economic conditions, producers seem to be somewhat more willing to make large investments in farm machinery and buildings than a year earlier.