In the last Pulse Market Insight, we looked at whether the pea market would be adversely affected by the expected increase in acres. For lentils, it looks like the boost in 2016 acres will be even more severe. Record-high prices have a way of doing that. Canadian bids for both red and green lentils have hit all-time highs, helped by the weak Canadian dollar. New-crop prices have also been exceptional, allowing farmers to lock in solid profits.

In this report, we’ll throw around a few acreage scenarios to see how they could affect lentil markets. Some of the acreage forecasts have been extreme, as they tend to be in these circumstances, and these are causing concern among both buyers and sellers. Buyers are nervous about locking up too many lentils at high prices and farmers want to capitalize on the opportunities before they disappear.

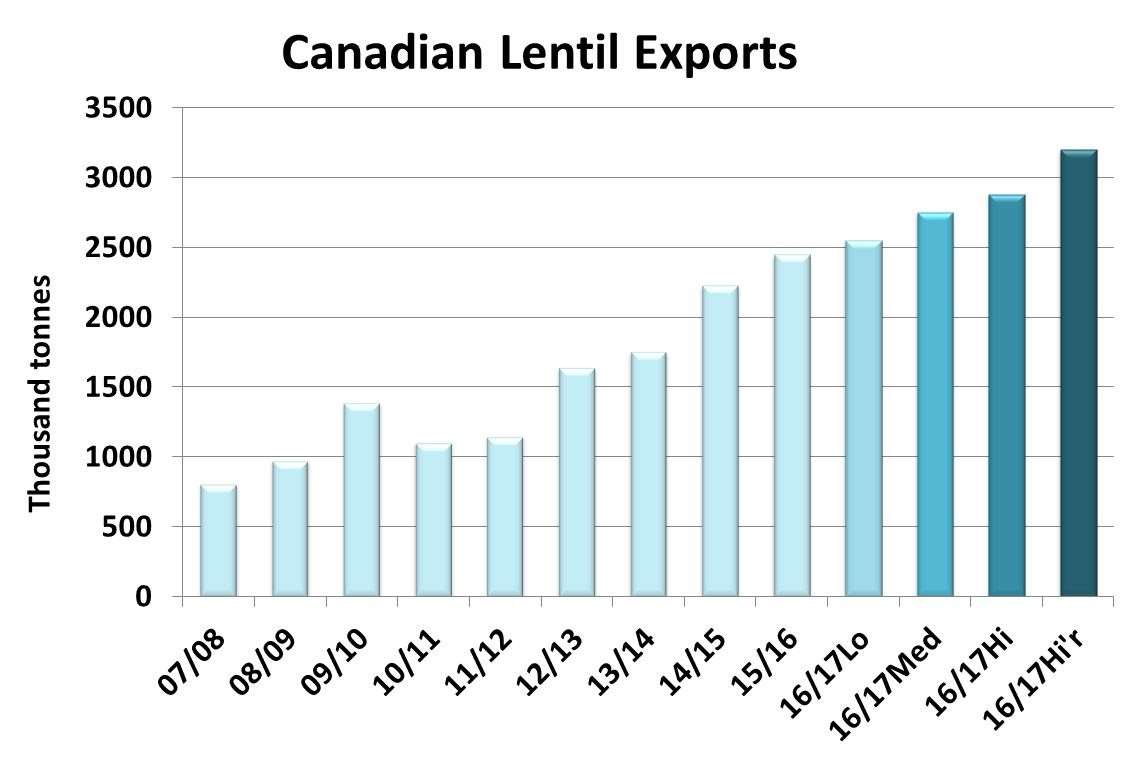

Earlier, we forecast 2016 lentil seeded area at 4.45 million acres (“16/17Lo”) and we now view that as the low end of the possible range. Now it looks like 4.75 million acres (“16/17Med”) is more likely, but we’ve also heard higher forecasts of 5.0 (“16/17Hi”) and even 5.5 million acres (“16/17Hi’r”). We think that the top end is unlikely but with prices at unprecedented levels, we can’t rule out any of the guesses.

For each of the scenarios, we’re using the 5-year average yield of 1,480 pounds per acre (25 bu/acre) but yields have been highly variable over the past few years, ranging from 1,330 to 1,850 pounds per acre, which adds a large variability to the possible production outcomes. But based on the average yield, 2016 production could be as low as 2.9 million tonnes or as high as 3.6 million tonnes. That difference of 700,000 tonnes may not seem like much, but it can make the difference between “tight” and “heavy” supplies.

There are a couple of things to note though. Keep in mind, there will be very few 2015 lentils carried over into next year, so the market will be depending nearly entirely on the 2016 crop to meet demand.

It’s also important to remember that the green and red portions of lentil market demand are largely unconnected, which means supplies can be heavy for one type but tight for the other. It looks like red lentil acreage will expand considerably more than greens, which adds a greater risk of overproduction for that class. At the same time though, red lentil usage has more room to expand while green lentil demand tends to be steadier with less ability to grow.

The crop size is only one half of the equation. Over the past three years, Canadian lentil use has ranged from 2.0 to 2.7 million tonnes. So even the low end of the production scenarios above would be able to meet that level of demand and allow ending stocks to expand. If we look at the level of exports needed to keep ending stocks at reasonable levels, we see that under the low production scenario, exports would only need to expand slightly but at the high end of acreage estimates, 3.2 million tonnes of exports would be needed, 700-800,000 tonnes more than the record level expected in 2015/16.

Indian demand will likely grow and larger Canadian exports are expected in 2016/17, but they may not expand enough to consume the production levels possible under the top-end scenario. That makes the price outlook somewhat risky. And, as mentioned in our previous pea outlook, we also know farmers in other countries will be boosting lentil acreage, adding more competition. Canadian farmers have seen plenty of opportunities to lock in historically high new crop contracts, and that will help manage that risk of lower prices next year.