What’s Ahead for Lentil Markets?

This year’s lentil market has been fascinating to watch, in the same way that people slow down and look at a car crash. Crop prospects that had been “ginormous” earlier in the year have given way to doomsday forecasts. Traders are nervously watching whether there will be enough lentils to fill this fall’s big shipping program. All because of a few inches of rain.

All joking aside, this year’s crop losses are serious business for those farmers affected. There are also potential losses by traders who had made sales on the expectation of plentiful supplies. The key question (mostly unanswered so far) is how a smaller and lower quality crop will affect the market.

The difficulty is that until combines get into the fields, the extent of the losses isn’t known. There are plenty of reports of crop wrecks and those aren’t in question. The uncertainty relates to how many acres have been lost completely, the yield losses on salvageable acres and how much of the crop is still in decent shape. Because of the huge differences in crop conditions and quality, it will take a large number of harvest results to get a clear picture.

Until those outcomes are known, price signals may be the best indicator of market opinions. Because of the huge crop expected (earlier), the general consensus was that lentil bids would keep dropping this summer and fall as crop outcomes became more certain. The fact that this downward momentum has reversed is a clear signal that buyers are concerned about sourcing enough lentils to meet their sales commitments. Compounding this change in market tone is the fact that farmers have stopped selling. Some don’t have lentils to sell anymore, while others who still have a decent crop have turned bullish and are waiting for stronger prices.

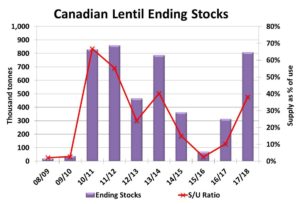

Traders have been cutting their production forecasts. Way back in mid-July (a month ago), the average guesstimate of the lentil crop was 3.9 million tonnes with the numbers ranging from 3.5 all the way up to 4.3 million tonnes. A few days ago, a new survey showed the average trade number had dropped to 3.1 million tonnes, with a range of 2.8 to 3.5 million tonnes. Our own forecast is toward the lower end of the range. It’s worth noting that even the low end of the range is still 400,000 tonnes more than last year’s crop. Just as concerning about crop size is the deteriorating quality of Canadian lentils. While the extent of the problem hasn’t been quantified yet, it’s clear overseas buyers will need to make do with more X3 and #3 lentils.

Lentil demand in the next few months will be very heavy as global supplies are next to nil. Bigger crops in the US (mostly greens) and later in Australia (mostly reds) will help meet that demand, but the export pace will be exceptionally strong, as long as supplies are available. India has already purchased large amounts of red lentils for fall shipment and other south Asian countries will also be taking sizable volumes. Lower grades at reduced prices could actually help encourage more purchasing.

Even though it’s still a few months away, developments for the second half of 2016/17 are starting to take shape. In particular, Indian demand is being influenced by very favourable monsoon rains this summer. This is easing concerns about tight pulse supplies in the country, although the kharif harvest won’t show up until November. The rains are also replenishing soil moisture and adding optimism for the rabi crop, when Indian lentils are grown, but that harvest won’t occur until February at the earliest. Until then, India will need large imports.

The inevitable question is how high lentil prices will go in response to the shrinking Canadian crop, but a meaningful answer isn’t really possible until the Canadian harvest is in the bin. Suffice to say there are bright prospects for prices of #2 and better lentils, but discounts for lower quality will be wider than normal.

Source : Albertapulse