How Will Quality Issues Affect Markets?

It wasn’t that long ago that pulse markets looked like they were heading toward a glut situation. Seeded area of peas and lentils were at record levels and chickpea acres had rebounded as well. Early growing conditions were positive and analysts (including me) were wondering where all those pulses could find a home.

But then the rain started to fall and problems started to develop. The heavier rains in summer promoted disease, which cut into yields but also damaged seed quality. This was followed by harvest rain (and snow) which further reduced crop quality. Of course, that wasn’t universal; some areas saw better yields and quality than others and some crops were hit harder than others.

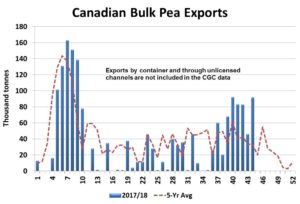

Peas managed to perform better than other pulse crops, in part because most were grown where the rains weren’t as heavy. Farmers reported to StatsCan that the 2016 yield was the second-best on record, just over 40 per acre. Harvest progress in Alberta trailed somewhat but in Saskatchewan, kept up to the average pace. By the end of September, over 95% of the prairie crop was in the bin.

Provincial reports indicate roughly three-quarters of the 2016 pea crop is a 2Can or better, generally good enough to meet export requirements. If so, that would mean at least 3.5-3.7 million tonnes would be eligible for export, although some will be needed for domestic food use and the next year’s seed supplies. Those adequate supplies of decent quality peas will keep prices from rallying too far through the winter months.

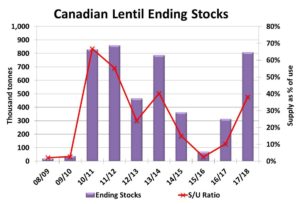

Lentils didn’t fare nearly as well as peas this year. Disease issues already caused problems early on and the harvest progress lagged behind normal, adding to the downgrading. In Saskatchewan, less than half of the crop was graded as a 2Can or better back in mid-September and further harvest delays would have raised the percent of Sample grade since then. The quality of the 2016 crop rivals the ugly situations seen back in 2014 and 2010.

Keep in mind, the 2016 lentil crop is record large at an estimated 3.2 million tonnes. Even so, there will be considerable constraints in trying to meet export demand. Supplies of red lentils will be a little more comfortable, due to the larger acreage boost along with processors’ ability to work with discoloured and wrinkled seed. For green lentils, those quality issues are more of a stumbling block and exportable supplies are low. These dynamics are already at play, causing bids to rebound for green and, to a lesser extent, red lentils. Both markets (for better quality lentils) should perform better than was expected prior to harvest.

Chickpeas have been hit the hardest of all. The longer growing season pushed most of the harvest into October, when more rain and snow hit the crop. As of October 17, Sask Ag was reporting only one-quarter of the crop had been harvested. Since then, a bit of progress has been made but reports suggest the quality is very poor. Global markets had been counting on this Canadian harvest to provide “bridge supplies” until the Australian crop arrived, followed by Indian and Mexican crops. Now that very few Canadian chickpeas are available, prices are reflecting extremely tight global supplies of kabuli chickpeas, especially large calibres.

For all three pulse crops, the tighter supplies of higher quality seed have caused grade spreads to widen out. Even so, X3 and 3Can pulses are moving to various markets, albeit at a discount. Unfortunately, this still leaves sizable quantities of the lowest quality pulses, especially lentils and chickpeas, that need to find a home in feed channels that are also dealing with heavy supplies of downgraded cereal crops.

Source : Albertapulse