What’s Happening with Indian Pulse Imports?

When it comes to pulses, we talk a lot about the goings-on in India, for good reason. India is the largest single buyer of Canadian yellow peas and red lentils along with other pulses. What happens in India definitely doesn’t stay in India, but causes significant ripple effects in global pulse markets and the biggest impact in western Canada.

Last year was a prime example of the influence of India on Canadian pulse markets. In 2015/16, prairie bids for yellow peas, red lentils and green lentils all hit record levels but those sky-high prices weren’t caused by production problems in western Canada. The 2015 lentil crop was a new record by a wide margin and the pea crop, while lower than the previous three years, wasn’t particularly small.

Instead of low supplies, extraordinary Indian demand was the driver of the record prices. Two successive rabi (winter) crop failures in early 2015 and again in 2016 triggered a wave of heavy buying that sucked up virtually all of Canadian peas and lentils from 2015/16. And for this year, but that lack of Indian domestic production caused buyers there to start purchasing 2016 Canadian (and other) pulse crops in record amounts long before the crop was even in the ground, just to assure supplies.

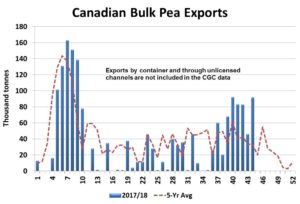

Those record volumes of forward contracted pulses are now starting to show up in India. Just in the first three weeks of November, 570,000 tonnes of peas have arrived, dwarfing the late fall arrivals of 2015. Canada is the largest supplier, with 390,000 tonnes of that total, but is less dominant than in previous years. Farmers in countries such as the US, Russia, Australia, Ukraine and others in eastern Europe have boosted production and are now competing much more heavily in the Indian market.

The chart also shows Indian imports of chana (desi chickpeas) are also just starting to ramp up. The bulk of this increase is coming from the Australian chickpeas being harvested now and a record crop there will mean an unprecedented surge will be hitting Indian shores over the coming weeks. These big volumes of desi chickpeas will also influence the pea market, due to the substitution effect.

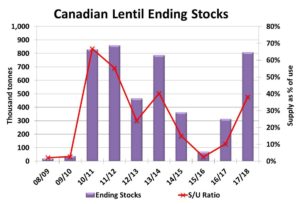

When it comes to lentils, the wave of imports is just at its early stages. Canada has been the largest supplier, but the US is also involved and Australian lentils will start showing up in the next few weeks. The limited response so far is partly because the Canadian lentil harvest was dragged out longer and the quality problems have slowed trade to some degree. Despite the delays, more imports will be showing up in the data soon as Canadian export volumes are slightly ahead of last year.

These large imports won’t necessarily cause a huge buildup in Indian inventories, mostly because the cupboards had been almost bare just a month or two ago and they’re just being restocked. These fresh supplies however have eased some of the recent anxiety and Indian prices are well off the earlier highs. This suggests yellow pea and red lentil bids will be unable to reach last year’s levels.

With these imports, Indian inventories should now be able to bridge the gap until its own rabi harvest in early 2017 shows up. So far, it appears seeded area will be up and there are no serious weather concerns at this early stage. If that situation holds and the rabi harvest is favourable, Indian importers will relax even more and markets could soften further. But in the off chance that the weather turns poor, the “excitement” could start all over again.

Source : Albertapulse