A New Grain Policy The Canadian Government is scheduled to repeal the Canadian Wheat Board (CWB) Act in August 2012. It is the first major shift in grain policy since the repeal of the Western Grain Transportation Act in 1995 – a shift that resulted in significant elevator rationalization that changed the face of the western Canadian grain handling and transportation system.

The August 2012 policy shift will allow brokers and trading houses to purchase wheat directly from Canadian farmers along with a now voluntary CWB. At stake is a lucrative market opportunity, given that wheat accounts for approximately 50% of total Canadian grain exports. As a result, the shift in marketing policy is again expected to change the face of the grain industry and have a substantial impact on other industries and communities in western Canada.

A New Grain Policy The Canadian Government is scheduled to repeal the Canadian Wheat Board (CWB) Act in August 2012. It is the first major shift in grain policy since the repeal of the Western Grain Transportation Act in 1995 – a shift that resulted in significant elevator rationalization that changed the face of the western Canadian grain handling and transportation system.

The August 2012 policy shift will allow brokers and trading houses to purchase wheat directly from Canadian farmers along with a now voluntary CWB. At stake is a lucrative market opportunity, given that wheat accounts for approximately 50% of total Canadian grain exports. As a result, the shift in marketing policy is again expected to change the face of the grain industry and have a substantial impact on other industries and communities in western Canada.

Historical Impact Since the rationalization of the grain elevator network due to the repeal of Western Grain Transportation Act in 1995, many traditional wood-crib elevators were closed with new concrete and steel high-through-put grain elevators built at an estimated cost of over $1 billion.

Also well documented are the financial difficulties some of the major grain companies have faced. One case in point is the drop in value of Saskatchewan Wheat Pool shares from a high of about $20/share to less than $0.50/share in 2004. Although there has been some important consolidations and a redistribution in grain elevator assets since then, roughly 60% of the high-through-put elevators continue to lose money assuming a break-even of 8 turns. Nonetheless, it is clear that the grain elevator network in western Canada is not as profitable as it should be.

So what happened? Although the answer is complex, we believe that a significant part of the answer lies in a gap in the data and analytics that was used. The problem is that there is no easy way to reconcile the total demand for grain that moves by truck outside the licensed grain elevator system with known production statistics at an actionable detailed level using conventional analytic techniques. As a result, its easiest to use production as proxy for potential licensed grain elevator deliveries, while assuming that domestic truck flows outside of this system are relatively small leakages. The fact is that domestic truck flows vary significantly by region and grain type and average about 30% of production and can often exceed 50% of production in some areas.

This data gap contributed to a misallocation of capital in the western Canadian grain handling network that we roughly estimate to have exceeded $300 million. Furthermore, the total financial impact is staggering when lower long-term operating profitability is combined with the impact on the road network from the additional truck traffic that will now occur over the life of the elevators.

Analysis and Insight To avoid a repeat of history will require a deep knowledge of the grain market. New opportunities often mean new locations. New locations significantly increase the complexity of the data and the analytics to effectively study and position a new site or optimize a network of facilities. Without the appropriate data and location analytics framework, it's difficult to avoid the pitfalls in new site selection that have already reduced the long-term profitability of the current western Canadian grain elevator network. To capitalize on the best potential agri-business opportunities in western Canada will require the ability to analyze key factors and risks at a detailed geographic level. They include:

- Trade Area Analysis - estimate the changes that are expected to occur in the natural grain elevator catchment areas based on new open wheat market freight costs, multi-car freight rate incentives and the existing road network. .

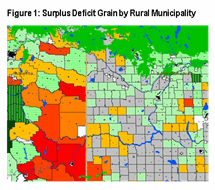

- Supply Demand Analysis − estimate detailed supply/demand by grain type by grain elevator catchment areas and/or small area regions. For example, figure 1 shows grain movements by truck between surplus and deficit regions by rural municipalities

- Market Potential Analysis - estimate market potential by catchment area and by grain type within the natural catchment area of each grain elevator.

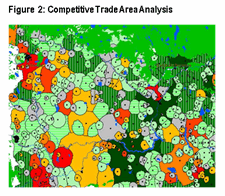

- Market Performance and Competitive Analysis - estimate and compare the performance of grain companies at each delivery point by their strategy and ability to draw grain from within and beyond the natural catchment areas of their facilities. Figure 2 shows an example of licensed grain elevator trade areas and market performance analytics.

- Risk Analysis − potential changes in supply and demand (i.e. droughts, crop rotations and livestock demand)

- Other - labour force availability and demographics, truck and rail transportation considerations.

At Exceed Analysis we are currently conducting a market performance and potential study of the state of western Canadian grain supply and demand using our proprietary location modeling framework. The goal of the analysis is to provide corporations, government, academics and other industry stakeholders with a better understanding of regional grain supply and demand factors. The study will also provide an overview of company grain procurement strategies that influence risk and investment decisions.

Preliminary results suggest that changes in freight costs will affect the ability of grain companies to source wheat under an open marketing system at individual delivery locations. The most important of these changes are expected to occur in Manitoba and eastern Saskatchewan.

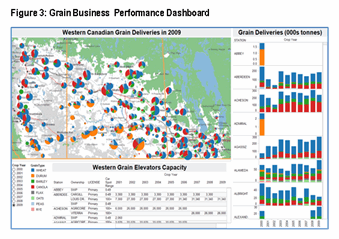

Exceed Analysis Capabilities - We are a market analytics company with the location tools and expertise to help you identify the best business opportunities. We measure market performance, estimate potential, analyze competition and risk, forecast revenue, develop customer mapping and analysis, and build these metrics into dashboards (Figure 3).

If you are interested in the results of this study or require help with your data analytical challenges toward capturing business intelligence, please give us at Exceed Analysis a call (647-992-6058) or view our website for more details at

www.exceedanalysis.com/services/business-intelligence/grain-business/