Seeded Acreage Planning in a Post-CWB Canada

Bill C18 received Royal Assent December 15, 2011,ending the CanadianWheat Board’s (CWB) marketing monopoly and giving Western Canadian farmersthe freedom to market wheat and barley. To some of you this is the victorious end to a long fight and you are excited to market your cereal production “your way.” To others, this is a disappointing end to an institution you believed in. Regardless of your position, this development represents change – and with it will come lots of discussion about what will happen next.

I chose to focus on this topic in this issue of the Pulse Market Report because I think everyone in our industry – growers and marketers – are forming opinions about what impact this new legislation will have on pulse acreage in Canada.

One of the initial positive features of pulses was their ability to generate cash flow from inventory as needed for the grower. Since we began growing them, pulses have become more and more attractive because of their positive pricing and movement at harvest, quick payments, marketing flexibility and sound rotational benefits. Cereal grains had become something of an ‘ugly sister,’ as chickpea marketer and processor Colin Young noted a few years ago: “Lentils and chickpeas are something we growthat allows us to afford to grow durum.” For a time, cereals had become an almost reluctant segment of the crop rotation – but will they now compete with lentils, peas or chickpeas for your acres?

The short ambiguous answer is “it depends.” While growers will now have the freedom to market cereals howeverthey want (and to some growers this is very exciting), in my opinion this should not be the significant driving force in influencing acres. While there are other factors that influence a grower’s seeding decision – moisture levels at seeding, storage and delivery options, ease of market or marketing options, etc. – what really influences acreage decisions most is projected net return.

We all know that growers can, and often will, increase seeded acres when they see opportunities in the market. This is why canola and pulse acres have continued to climb and why cerealacres have continued to decline. Growers have been influenced to find acres by positive net returns for pulses (relative to cereals) and by the known benefits of a sound rotation. When the price is right, this has even led to record numbers of seeded acreage.

So back to the original question: Will pulses have what it takes to compete for land with free-market cereals? What price would it take to compete?

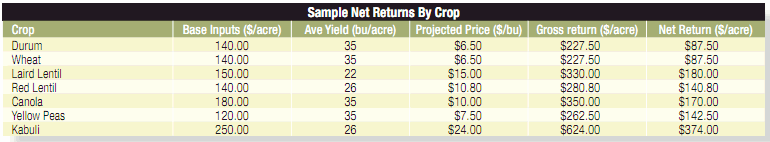

After taking a consensus from a few top-end growers, I created the price matrix on the next page. The input costs assume that fuel, manpower, equipment and land cost are equal for all crops, and so we include only seed, seed treatments, fertilizer and chemicals. The yields are an assumed average.

I’m sure this matrix will lead to great debate about inputs costs and yields, and depending on your location you may find the costs and yields vary. However, they are easily adjustable for your thoughts and comparison, so feel free to pop your own ideas and numbers in – I feel confident the results will be similar.

Based on prices that I believe a grower can budget against with confidence I see pulses again having the potential to be profit leaders for the farm. Twentyfive-cent green lentils may seem lean in comparison with the last while, but this estimate still shows good profits. Eighteen-cent red lentils aren’t exciting for anyone but current conditions will likely keep this price from climbing so we may see a necessary reduction in red lentil acres here in Canada. Peas

seem a good bet to keep in the $7.50-8.00/bushel range. As for kabulis, while the seed and fungicide might break the bank and the risk is greater, this crop willvery likely see the appropriate reward. In any case it appears to me that pulses are once again in a good position to compete with any crop for acres, based on revenue and ease of marketing. Look for marketers to be somewhat aggressivewith new crop contracts in order to distract you from the sparkle and luster of brand new, open-market cereals contracts.

The new calendar year will undoubtedly bring with it significant changes in Canadian agriculture. There will be excitement, challenges and, as always, the unknown. What will remain constant is growers’ search for the highest possiblereturns on the farm. With or without the CWB, I expect pulses in general to remain competitive – if not the leader for your attention and acres.

Jeff Jackson is marketing manager, pulses, for Scoular Canada based in Calgary, AB. He can be reached at jjackson@scoular.com.

The opinions above reflect the writer’s and are not necessarily the opinion of Scoular Canada.

On the Market

The Politics of Pulse Prices

Events unfolding on the world’s political landscape will probably have a profound effect on the average prices of pulses and other field crops in the coming season and beyond.

In Canada, the Canadian Wheat Board (CWB) will no longer be the sole buyer of wheat, durum and malting barley as of August 1, 2012. In the United States (U.S.), there is a good chance biofuel subsidies will be reduced, while subsidies to farmers could be enriched in the Farm Bill, which will be crafted by Congress and the Senate next year. Meanwhile, lack of confidence in certain nations’ abilities to meet their financial obligations is contributing to volatile currency markets. All these factors are creating concerns for buyers, who are worried about owning more product than they need to cover short-term needs.

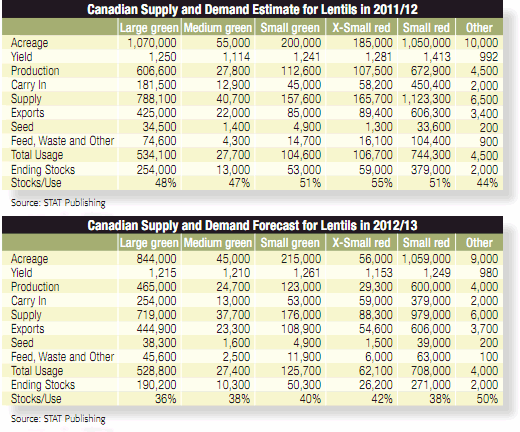

I discussed the possible impact of the changes in the CWB in the November edition of the Pulse Market Report. The bottom line is competition for land use is likely to increase as wheat, durum and malting barley become cash crops. Canola crops have tended to be competition for pulse crops in terms of land use, while grains have tended to be just another crop in the rotation. This will change as farmers will now be able to take advantage of the same kinds of new crop pricing and delivery opportunities as they do with canola.

The fact that pulse markets now need to pay closer attention to the income potential of a wider range of crops than in the past reflects a simple truth: As much as possible, farmers grow more of the crops that have the best income potential. To the extent acreage for acrop needs to stay the same or increase, grower bids need to be at levels that offer returns that are competitive with better-performing crops. As a result, when grain and oilseed markets are strong, bids for pulses may need to rise to keep farmers interested in growing them.

The opposite is true from a consumer’s perspective. While farmers want to maximize revenue, consumers want to minimize costs – to the extent they are willing to substitute one pulse or type of food for another, in order to be able to buy the most food for the least cost. If wheat and durum prices decline, some consumers may eat more pasta and fewer pulses. Similarly, if feed grain or protein meal values drop, meat might become cheaper and therefore preferable to pulses.

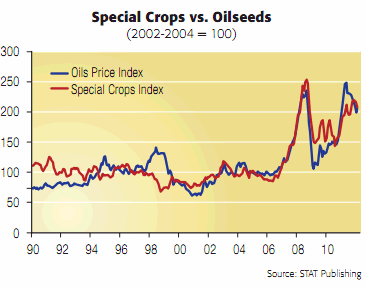

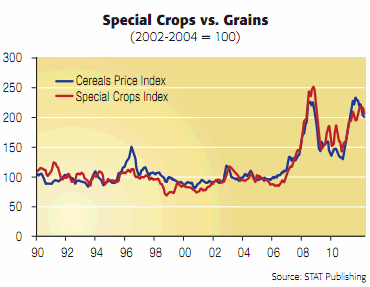

Competition for land use and for consumer attention means that field crop prices tend to follow one another. This means that any factor affecting the price of corn will ultimately affect the price of lentils, peas and chickpeas.

This was made clear in 2006 when markets began to understand the impact of U.S. biofuel policies on demand for corn for ethanol, and vegetable oil for biodiesel. The resulting competition for land use forced prices for pulses higher in order to prevent production from collapsing. Now, it is clear that U.S. biofuel policy is going to change. There is a growing push to eliminate the 45¢/gallon subsidy to ethanol refiners in the U.S. and to repeal or reduce the 54¢/gallon tariff on imported ethanol.

At the time of writing, both the subsidy and the tariff were set to expire on December 31. Even if there is a last-minute extension, there seems to be little will in Congress or the Senate to continue the policy because of the multi-billion-dollar price tag. Uncertainty over the subsidies and the import duty are one of the reasons corn prices have weakened. The March ‘corn futures,’ for instance, was more than $7/bushel most of August and the first half of September, but was less than $6/bushel for most of December.

If the subsidy and import duties are extended, the 2012 election may determine whether they will remain in effect after 2012, along with biofuel mandates. There is bipartisan antagonism toward subsidized ethanol production. Moreover, if it can be freely imported from Brazil, ethanol prices could drop, which would affect the price of corn. If corn prices drop, soybean, wheat and durum do not need to be as high to attract acreage, allowing those markets to ease. If those prices decline, the income potential of pulses would look a lot better and it would be easier to grow too many pulses. So, those markets would likely drop.

The other major uncertainty facing markets is the fate of the U.S. Farm Bill. There is fundamental disagreement over the Farm Bill, with many “Tea Party” Republicans wanting to scrap all forms of price and income support. Others argue that doing so would put the U.S. food supply at risk. While untrue, eliminating price and income support programs would result in a difficult transition to a fully market-driven economy for American farmers. It is beginningto look like there will be higher minimum support prices for commodities covered by the U.S. Farm Bill.

This is not a bullish development. Should markets drop below the support levels in the U.S. Farm Bill, U.S. farmers will more often ignore the market when deciding what to grow. This can result in over-production of corn, driving down the value of protein meals in livestock feed and reducing the price at which wheat effectively competes for land use in the U.S. This should result in lower meat prices, creating downward pressure on pulse values.

The cure for high prices is high prices. The cure for low prices is low prices. But when government policies and programs help bring about either condition, it becomes harder for markets to work the way they should. Like it or not, the political struggles and attempts at deficit cutting in Washington may have a profound impact on the price of lentils, peas, and chickpeas in 2012/13 and beyond.