By Joe Janzen and Bryn Swearingen et.al

This article was supported in part by Cooperative Agreement 58-3000-9-0047, between the United States Department of Agriculture, Economic Research Service and Kansas State University and by Agriculture and Food Research Initiative award 2020-67023-30970, between USDA, National Institute of Food and Agriculture and Kansas State University. The findings and conclusions are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy.

In recently published research, we estimated the impact of the unprecedented surge in ad hoc farm payments from 2018 to 2020 on grain inventories held by US farmers. Under the Market Facilitation Program (MFP), US farmers received approximately 23 billion dollars during the 2018-19 and 2019-20 marketing years. While USDA designed the MFP to avoid distorting farmer planting and production decisions, these payments may still have affected farm decision making, in particular the decision to store production after harvest.

How can government payments affect the farm’s sell-versus-store decision? Government payments like the MFP increase the working capital farmers have available to fund their operations; more working capital means farmers may have less need to sell commodities or use costly debt to meet financial obligations. In this way, government payments lower the implicit, or opportunity cost of post-harvest storage.

Our research shows MFP payments increased grain storage by US farmers. However, the impact of MFP payments on the market-level inventories was modest. Even in the case of soybeans in December 2018, the market and quarter where we find the largest impact, we estimate US soybean stocks were only 226 million bushels or 6% higher than they would have been in the absence of MFP payments. Our results show the sizable government aid provided through MFP did impact outcomes relevant to commodity price levels, though any potential market distortion was likely small.

For farmers and other firms along the grain supply chain, our research points to an important link between working capital and grain marketing decisions. When evaluating the sell-versus-store decision after harvest, farms should estimate both physical storage costs related to handling, deterioration, and logistics of storage, and the opportunity cost of deferring revenue. This opportunity cost of foregone revenue is becoming more important in a period of higher capital costs as interest rates rise. (See: farmdoc daily, March 28, 2023)

Background

The MFP was a major ad hoc farm payment program in 2018 and 2019. It made two rounds of payments to compensate farmers for “trade damage from unjustified retaliation” in the US-China trade conflict. Earlier articles discuss the details of the program and the distribution of payments across commodities and regions: farmdoc daily, August 28, 2018; July 30, 2019; December 12, 2019. For our research, note that some commodities, especially soybeans and sorghum, received larger payments. However, the distribution of payments across farms was through a complicated calculation based on current and historical acreage, production, and crop mix, both at the individual farm and county level. While payments were designed to avoid distorting planting and production decisions, MFP was so large that payment receipt may have impacted farm decisions on some other margin.

We consider MFP’s impacts on inventory holding decisions for two reasons. First, there is a plausible mechanism, the reduction in opportunity cost of foregone revenue discussed above. Second, there were large increases in commodity inventories after MFP payments were first announced and these inventory increases were concentrated in farmer-held inventory for commodities that received more payments.

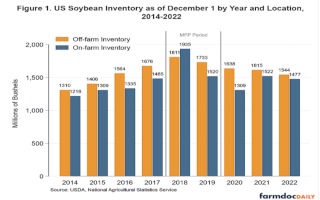

Figure 1 shows estimated inventories of soybeans on December 1, following harvest. While post-harvest soybean inventories had been building between 2014 and 2017 as soybean prices were relatively weak, inventories jumped in 2018 as the bottom fell out of soybean prices following the onset of the US-China trade conflict earlier that year. What is unusual about this jump is that it was stronger for on-farm inventories which are typically owned by farmers. Though on-farm soybean inventories are usually smaller than off-farm stocks, the opposite was true in 2018. This led us to investigate whether MFP payments may have played a role.

Analysis

To assess grain inventories held by farmers and how they changed in response to MFP payments, we used data from the National Agricultural Statistics Service quarterly Grain Stocks reports from 2014 to 2020. We consider four commodities: corn, sorghum, soybeans, and wheat. (See farmdoc daily, November 25, 2020 for more information on these data.) These reports assess the inventory quantity, our outcome of interest, by commodity, state, and storage location, either on-farm and off-farm.

We recognize there are many factors besides government payments and farmer working capital that affect farmer storage decisions. We did not want to attribute changes in observed storage levels caused by other factors to the presence of MFP payments. Our study accounted for the confounding influence of factors including:

- Observed state-level production: In years where farmers produce more, they also store more.

- Commodity-specific factors: While grains and oilseeds use common storage infrastructure, the typical use of storage varies by crops. For example, a greater proportion of corn is typically stored on-farm relative to soybeans and wheat.

- Market-level price shocks that affect all farmers: Inventories are typically larger when markets offer greater returns to storage by pricing deferred deliveries at a premium to current prices. (This is often called a “carry” market.)

- Seasonal patterns in storage levels: Grain inventories typically jump immediately after harvest and then fall as stocks are drawn down through the remainder of the marketing year.

- Regional differences in typical storage behavior: Due to proximity to commodity end-users, climatic conditions, and other factors, some states store more grain than others in typical years. For example, states in the southern plains store considerably more grain off-farm than on-farm in part to deal with pest issues.

After adjusting for these factors, we identify the effect of MFP payments on grain inventory by comparing states that received relatively more MFP dollars to states that received relatively less. As a further check, we also measure the effect of the same MFP payments on off-farm inventories for the same states and commodities. If MFP payments increased inventories through the opportunity cost mechanism we discuss above, then payments should not have affected inventory decisions for non-farm firms who did not receive MFP.

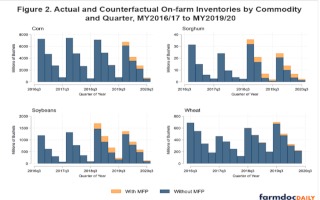

We find that MFP payments led to statistically significant increases in commodity inventories. In other words, it is statistically likely that these effects were attributable to MFP payments. These increases are concentrated in the first two quarters following harvest. Using our estimate for the impact of one dollar of MFP on farm inventory at the state level, we construct a counterfactual, what-if, estimate of inventories in the absence of MFP payments. Figure 2 plots the sum of these estimates for all states in our data by commodity and quarter. MFP impacts are found in the 2018/19 and 2019/20 marketing years where payments were made. Quarterly inventories for the previous two marketing years are shown for context. We find the largest impacts for soybeans and sorghum. These commodities were favored in the MFP payment calculation since they faced large retaliatory tariffs from China and other importing countries in the trade conflict.

Note: Actual inventories shown here do not sum to aggregate US inventories shown in Figure 1. The difference is due to commodity inventories held in states that are too small to report state-level inventory data in the USDA Grain Stocks report.

To place these estimates in perspective, consider both the MFP-induced stocks increase relative to all US stocks and relative to the increase in stock from the year prior. For soybeans in 2018 where we find the largest MFP impacts, Figure 2 shows the difference between on-farm inventories with and without MFP payments was 226 million bushels. This was 11.6% of total US on-farm soybean stocks or just over 6% of all US soybean stocks. Post-harvest soybean inventories increased by 450 million bushels between 2017 and 2018. Our estimates suggest about half of this increase was due to MFP payments, with the other half due to farmer responses to changing market conditions – the change in price spreads for harvest and deferred post-harvest delivery.

Conclusion

We found MFP payments made in 2018-19 and 2019-20 to US farmers led to small but statistically significant increases in on-farm inventory. Farmers held more grain after harvest than they would have in the absence of the payments. We propose this effect operates through an opportunity cost mechanism: with additional working capital from MFP payments, farmers did not need to sell commodities immediately after harvest to meet financial obligations. The size of this effect was relatively small compared to the overall size of US commodity markets, so the market distortion caused by higher inventories was likely small as well. However, our results suggest it is difficult to deliver sizable government aid to farmers in a way that does not impact market-relevant outcomes in some way.

Source : illinois.edu