Farm sector profitability is forecast to decline for the third straight year. Net cash farm income for 2016 is forecast at $94.1 billion, down 13.3 percent from the 2015 estimate. Net farm income is forecast to be $71.5 billion in 2016, down 11.5 percent. If realized, 2016 net farm income would be the lowest since 2009.

Cash receipts are forecast to fall $25.7 billion (6.8 percent) in 2016, led by an $18.7-billion (9.8 percent) drop in animal/animal product receipts and a $7.1-billion (3.7 percent) decline in crop receipts. Nearly all major animal specialties—including dairy, meat animals, and poultry/eggs— are forecast to have lower receipts, as are feed crops and vegetables/melons, down $3.2 billion (5.5 percent) and $1.5 billion (7.5 percent), respectively. While overall cash receipts are declining, receipts for several commodities are expected to increase by at least 1 percent above 2015 estimates, including cotton, up $0.6 billion (12.5 percent). Direct government farm program payments are projected to rise $2.7 billion (24.8 percent) to $13.5 billion in 2016, in part due to the expected price environment.

For the second year in a row production expenses are down. Total production expenses are forecast down $10.1 billion (2.8 percent) over 2015, led by declines in farm-origin inputs (feed, livestock/poultry, seed) and fuel/oils.

Farm asset values are forecast to decline by 2.2 percent in 2016, and farm debt is forecast to decrease by 0.8 percent. Farm sector equity, the net measure of assets and debt, is forecast down by $61.2 billion (2.4 percent) in 2016. The decline in assets reflects a 1.5-percent drop in the value of farm real estate, as well as declines in animal/animal product inventories, financial assets, and machinery/vehicles. The decline in farm debt is driven by lower nonreal estate debt (down 4.6 percent), reflecting a change in farmers’ management decisions (such as reducing input expenditures) but also an increase in short-term commercial bank loan rates, which make debt more expensive.

Get the 2016 forecast for farm sector income.

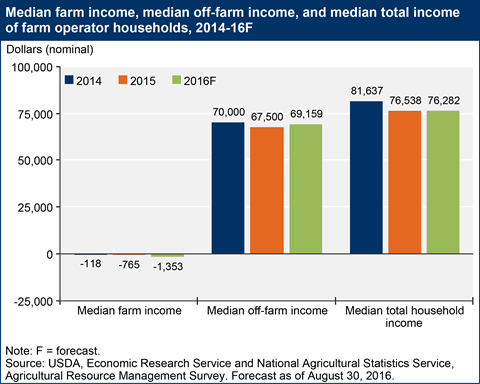

Median Income of Farm Operator Households Expected Down Slightly in 2016

The median income of farm households increased steadily over 2010-14, reaching an estimated $81,637 in 2014. After dipping in 2015 to $76,538, median household income is forecast to fall slightly in 2016 to an expected $76,282. Median farm income earned by farm households is estimated to be -$765 in 2015 and forecast to be -$1,353 in 2016. Most farm households earn all of their income from off-farm sources—median off-farm income is forecast to increase 2.5 percent, from $67,500 in 2015 to $69,159 in 2016. (Because farm and off-farm income are not distributed identically for every farm, median total income will generally not equal the sum of median off-farm and median farm income.)

Get the 2016 forecast for farm household income.

Source: usda.gov