By Bradley Zwilling

Illinois FBFM Association and Department of Agricultural and Consumer Economics

University of Illinois

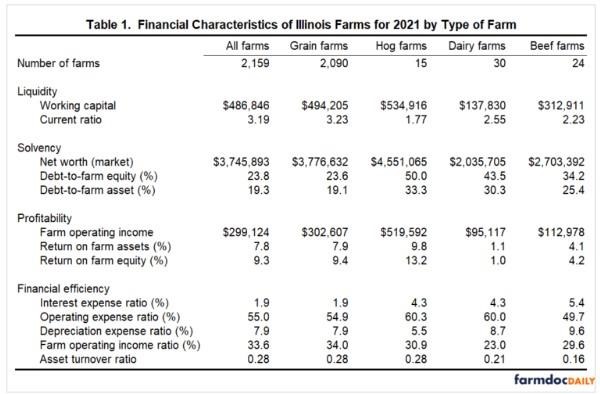

Farm incomes in 2021 were much higher than the year before leading to stronger financial positions on Illinois farms. The Farm Financial Standards Council has identified several key measures to analyze the financial strength of a farm business. These measures are in the areas of liquidity, solvency, profitability, and financial efficiency. The averages for these key measures for 2,159 Illinois farms enrolled in Illinois Farm Business Farm Management (FBFM) can be found in Table 1. These measures are also calculated by farm type. Due to the effects that weather and other outside factors may have on a farm business for any one year, it is better to monitor these measures over time and to identify trends than it is to rely too heavily on these measures for any one year when making business decisions. More detail and in-depth analysis of these financial characteristics can be found in Financial Characteristics of Illinois Farms, published by FBFM and the Department of Agricultural and Consumer Economics at the University of Illinois.

Liquidity is an assessment of a farm’s ability to meet current cash-flow needs. The amount of working capital and the current ratio (current assets divided by current liabilities) are two measures of liquidity. The average amount of working capital as of December 31 for the 2,159 farms was $486,846, up 47 percent from $330,649 a year earlier. Hog farms had the greatest working capital, averaging $534,916, while dairy farms had the least, averaging $137,830. Most of the assets of a dairy farm—the dairy herd, buildings, and land—are noncurrent assets. The average current ratio for all the farms was 3.19, up from 2.42 a year ago. Grain farms recorded the highest (most healthy) current ratio, and hog farms the lowest. The 2021 current ratio was the highest on recent record with 2012 being at 3.07.

Solvency is a measure of the farm’s overall financial strength and risk-taking ability. The average net worth of the 2,159 farms at the end of 2021 was $3,745,893, up from $3,258,983 the year before. Average farm and non-farm incomes in 2021 were well above family living requirements, thus enabling net worth increases. Hog farms had the highest net worth, followed by grain farms, with dairy farms recording the lowest. The debt-to-farm equity and debt-to-farm asset indicators show how debt capital is combined with equity capital. This is useful in looking at the risk exposure of the business. The average debt-to-farm asset percentage for all farms was 19.3. The debt-to-farm asset percentage ranged from 19.1 for grain farms to 33.3 for hog farms. The average debt-to-farm asset level of 18.2 from 2012 was at its lowest level for at least 20 years.

A measure of a farm’s profitability is useful in examining its ability to meet family living demands and retire term debt. It is also useful in measuring the farm’s ability to utilize assets and equity to generate income. The average return on farm assets for the 2,159 farms was 7.8 percent, up from 4.3 percent a year earlier. Hog farms recorded the highest returns, averaging 9.8 percent, while dairy farms recorded the lowest, averaging 1.1 percent. Return on farm equity in 2021 ranged from 13.2 percent for hog farms to 1.0 percent for dairy farms. The average was 9.3 percent, up from 4.5 percent in 2020.

The interest, operating, and depreciation expense ratios relate these various expense categories as a percentage of the value of farm production. The farm operating income ratio measures the return to labor, capital, and management as a percentage of the value of farm production. These measures can be used to evaluate the financial efficiency of the farm business. The interest–expense ratio averaged 1.9 percent for the 2,159 farms, ranging from 1.9 percent for grain farms to 5.4 percent for beef farms. The 1.9 percent was down from 2.9 percent in 2020. The 2021 figure of 1.9 percent was tied with 2012 being the lowest since at least 1995. The farm operating income ratio ranged from a high of 34.0 percent for grain farms to 23.0 percent for dairy farms. The average for all farms in 2021 was 33.6 percent, up from 22.7 percent in 2020. The 2017 through 2021 5-year average farm operating income ratio is 17.5 percent. The 2021 farm operating income ratio was well above the 5-year average.

The author would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

A video representation of this and other 2021 results can be found on the farmdoc YouTube channel at https://go.illinois.edu/FBFM2021

Source : illinois.edu