One of the basic laws of economics is that the market seeks to establish equilibrium, and agriculture is no exception. When prices are low, farmers reduce production and consumers buy more and prices eventually rise. Of course, 2015/16 has been the opposite scenario for pulse markets. Prices for yellow peas are at record highs and green peas, although lagging, are still at profitable levels. Economics (and common sense) tell us farmers will try to increase production in response to the high prices.

In this environment, there’s considerable nervousness about whether 2016 pea production will increase too much and overshoot expected demand. For this article, we’re going to look at a few acreage scenarios to see what could happen in 2016/17. But before that, we have to warn that these outlooks change considerably based on yield outcomes. The 5-year average pea yield is 36.8 bu/acre but has ranged from 32.4 to 44.3 bu/acre and that uncertainty creates potential for large swings in production. For now though, we’ll use the average yield in our calculation as it has the best odds of occurring.

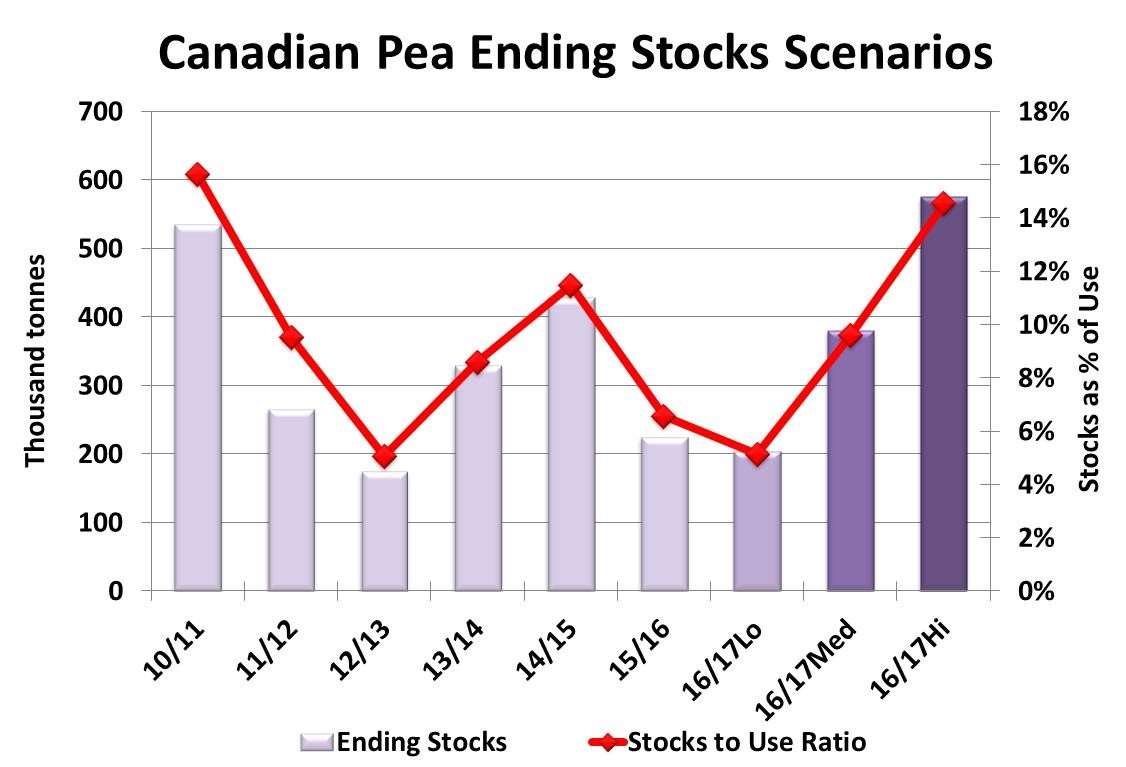

Our own forecast of 2016 pea seeded area is 4.0 million acres (“16/17Lo”), a 9% increase over last year’s 3.68 million acres. On the surface, we would have expected a bigger increase, but the even larger spike in lentil acres (a story for a future report) will cut into pea plantings, especially in Saskatchewan. Others are calling for more pea acres, with Ag Canada at 4.2 million (“16/17 Med”) and the most optimistic at 4.4 million acres (“16/17Hi”).

The differences between the scenarios don’t look large and may not have a huge impact on the market. The lowest outcome would mean a crop of 3.9 million tonnes and the highest would be 4.3 million tonnes. But to repeat our earlier caution about weather-driven variability, yields 10% below average would drop the lowest production scenario to 3.5 million tonnes and if pea yields were 10% above average, the highest acreage forecast would result in a 4.7 million tonne crop. So there’s a lot of uncertainty.

Over the last three years, pea usage has averaged 3.7 million tonnes (75-80% exports), so there wouldn’t be huge increases in ending stocks. In fact, we’re already forecasting 2016/17 usage at 4.0 million tonnes based on more export demand from South Asia, particularly India. So under the lowest acreage scenario, 2016/17 ending stocks could actually shrink. Under the largest acreage scenario, ending stocks would rise to 575,000 tonnes compared to 200,000 under the low acreage forecast.

A few final words of caution however. It’s not just the farmers in Canada that are getting these strong price signals. Farmers elsewhere are also encouraged to plant more peas. For green peas, the US is the only major export competitor for that class and price signals aren’t as encouraging because of the strong greenback. In the US, pea acreage will also be shifting from greens to yellows, which means there’s less risk of a downturn for greens than yellows.

For yellow peas, the US and Australia will ramp up acreage but the biggest threat is probably from the Black Sea region. Farmers in Russia and Ukraine are seeing strong pea prices and their weaker currencies are benefiting them even more than Canadian farmers. Increased acreage there will certainly mean heavier competition into key markets in South Asia.

Fortunately, the risk of overproduction here and elsewhere can be managed by Canadian farmers. New-crop contracts are still available and bids for both yellows and greens are at high enough levels to lock in a solid profit for 2016/17. And it sounds like a lot of farmers have capitalized on that opportunity.

Source : Alberta Pulse