What Do Changes in New-Crop Prices Mean?

Tracking grain prices and comparing the behaviour to previous years can provide a great deal of information about what’s going on in Canada and in overseas markets. Over time, a person can develop a “feel” about what’s normal and what’s out of the ordinary. These clues can provide guidance for 2016/17 market direction.

The first inkling that 2016/17 pulse markets could be “different” came last fall, when new-crop bids showed up earlier than ever before. Buyers started issuing aggressive new-crop bids already in October, a full year before delivery and months earlier than usual. In some cases, these new-crop bids were at levels higher than spot bids had ever been (prior to this year). This was a clear signal of concern among overseas traders who wanted to encourage Canadian production and lock in supplies. Since then, there’s been a fair amount of movement in new-crop bids, and these changes over the winter are signals about where the market is heading.

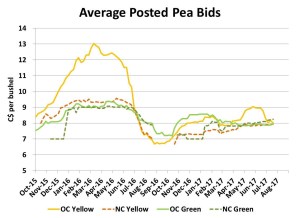

New-crop bids for yellow peas came out before greens, a signal that supply concerns are greater for that portion of the market. No surprise there. Those bids gradually gained until late January and have moved sideways since then. Those new-crop bids have flattened out, but the fact that they’ve stayed historically high even with record 2016 acreage forecast, means the demand for yellow peas in 2016/17 hasn’t been fully satisfied yet.

Green pea bids came out a little later and a lot lower, at least initially. By late December though, new-crop bids turned higher and are now close to yellow pea contract prices. This tells us that early on, green pea supplies still seemed they would be comfortable for 2016/17. But as most 2016 pea acres looked like they would be planted to yellows, buyers realized they also needed to encourage some green pea production too, and raised bids. Even so, green peas typically need a $2 per bushel premium over yellows to attract acres, so it still may not be that urgent.

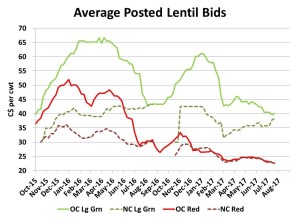

Red lentil new-crop bids also came out early as there was considerable concern among overseas buyers about securing supplies for 2016/17. Those bids continued to rise and were high enough to attract a lot of acreage. As the lentil acreage numbers continued to rise and the fall export program filled up, bids for red lentils started to decline. Now however, red lentil bids have started to turn higher again, largely because of fresh concerns about the size of the Indian rabi red lentil crop. This means the market still wants Canadian farmers to produce more red lentils.

New-crop green lentil bids (especially for large greens) started at the same level as reds but quickly turned even higher as it seemed Canadian farmers were more interested in growing reds. Those bids for large green lentils have remained high as buyers are still in interested in encouraging more green lentil production. This tells us there’s still an even greater need to encourage green lentil plantings than reds.

The fact that both pea and lentil new-crop bids are remaining at historically high prices tells us next year’s demand has not been fully satisfied. New-crop bids for chickpeas aren’t very common, but those that are available are quite strong and imply firm demand again next year. These signals suggest that overall, 2016/17 will be another year of historically high pulse prices.

Source : Albertapulse