How Will US Pulse Acreage Affect Markets?

Everyone knows pulse acreage would be up in 2016; the record high prices for some crops are having the normal result of encouraging planting. While most eyes are on the possibilities in Canada, the USDA got a head start by releasing its survey-based estimates of seeded acreage south of the border. And those estimates were enough to raise some eyebrows.

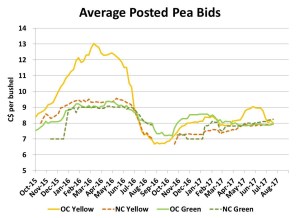

Seeded area for 2016 peas was pegged at 1.42 million acres, 25% more than last year and continuing the expanding trend of the last few years. Acreage in most states flat to lower, but in North Dakota, seeded area is expected to rise 66%. Acreage in some other states such as Nebraska and South Dakota is also starting to show up in the stats.

Last year’s US crop was nearly 50% greens and 50% yellows, but the stronger yellow pea market will have likely pushed more 2016 acres into yellows. For the most part, this 280,000 acre increase won’t be enough to sway the global markets on its own, especially if most of the increase is yellow peas. That’s because global demand for yellow peas is expected to expand next year.

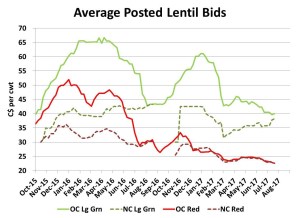

For lentils, the USDA estimated a whopping 72% increase in seeded area, putting the total at 850,000 acres or 357,000 acres more than last year. Still, compared to the expected increase in Canada, the change isn’t huge.

The USDA doesn’t break down lentil acres by type. Typically, medium green lentils make up two thirds of the US crop and small greens and pardinas have been about a quarter of the acreage. A big increase in green lentil acres could add some weight to that portion of the market. That said, red lentils will likely make more inroads into the US crop. On their own, more US red lentil acres won’t be enough to impact that side of the market, which is waiting to see what happens in Canada.

It wasn’t a surprise, but the USDA is projecting a record of 246,000 acres of chickpeas in 2016, 19% more than last year. Large calibre kabulis account for 163,000 acres, 20% more than last year. This increase won’t be enough to really weigh on the market, especially in light of strength in overseas markets.

The one area that could see some support from US estimates is in the dry bean crop. The USDA is estimating a 12% drop in seeded area, especially in places like Michigan and Minnesota. No breakdowns by type were provided, but black and pinto beans could see some firmer prices based on a smaller US crop.

Finally, the USDA estimates also raise some interesting possibilities for Canadian pulse crops. StatsCan will release its seeding intentions report on April 21 and those numbers might include some big surprises. In fact, the wide spread in analysts’ estimates almost guarantee someone will be surprised.

Source : Albertapulse