Pulse markets, especially peas and lentils, are making the shift from old-crop to new-crop dynamics. Spot prices are moving lower and, in some cases, so too are new-crop bids. For most of 2015/16, it’s been a sellers’ market, but that’s now changing. Buyers are becoming more patient as they wait for the 2016 harvest, both in Canada and in other parts of the world.

Most old-crop supplies of peas and lentils have already been sold, so there shouldn’t be any more risk left for 2015/16 marketing. Those farmers who have aggressively sold new-crop supplies have also avoided a good portion of market risk. For those who still have a few old-crop pulses left to sell or want to get some new-crop priced, there are several market events to watch for in the next few weeks.

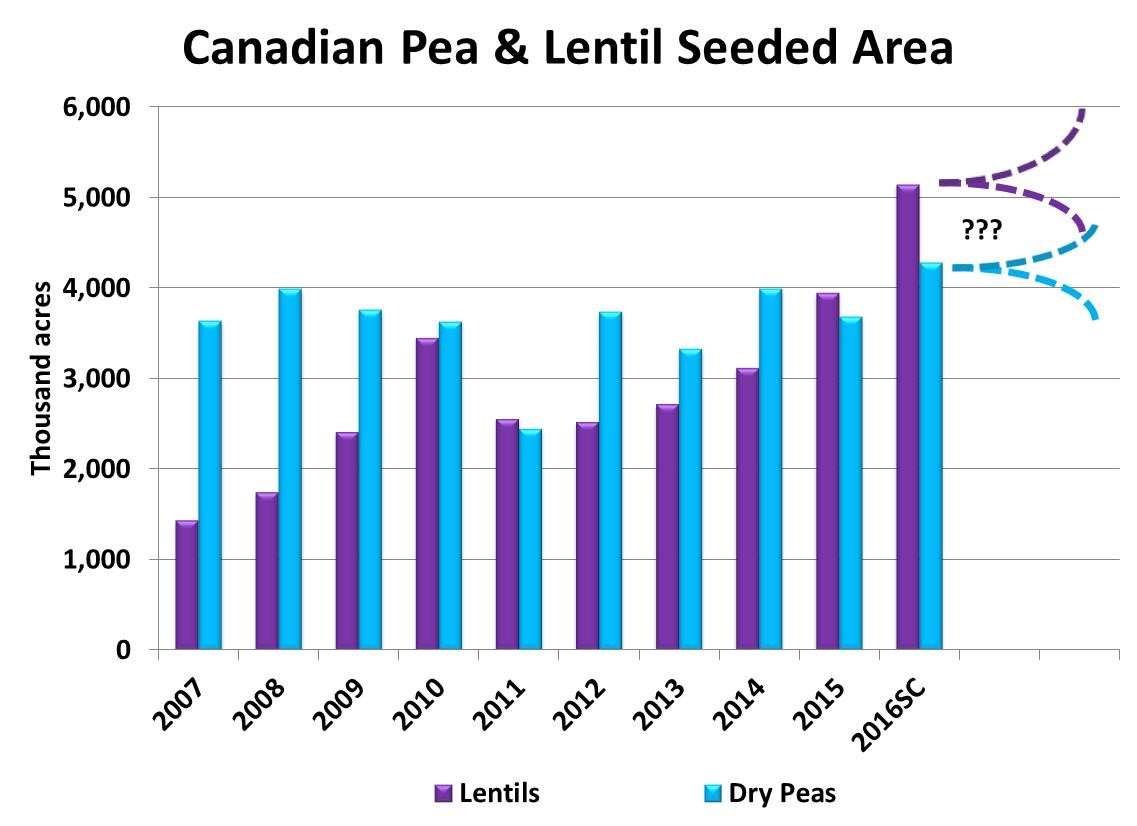

Since Canada is the key exporter of peas and lentils, the industry is nervously waiting for the StatsCan seeded acreage report on June 29. Even though traders (and farmers) often play down the report, it’s the largest survey (by far) and, for all its faults, is still a key signpost for the market. StatsCan did a seeding intentions survey back in March where it forecast record acreage for both peas and lentils of 4.28 and 5.14 million acres, respectively.

Since that report was released, the second-guessing has been even livelier than usual. Some very well-connected industry people have differing opinions about where acreage actually ended up. A few have said acres might actually be lower than the early StatsCan estimates but most are calling for more acres in the upcoming report. In fact, we got wind of one idea that lentil seeded area could be as high as six million acres.

Demand for peas and lentils will be higher in 2016/17 but even so, there comes a point where supplies can overwhelm the market. Keeping in mind that other countries are also boosting pulse production, our view is that the 2016 lentil crop could be very close to that tipping point, based on the earlier seeding intentions report. Even more acres aren’t needed, especially reds. For peas, a few more acres wouldn’t necessarily weigh on the market too heavily. These balancing acts are why we’ll be watching the upcoming StatsCan report closely.

It’s not just the total acreage that matters, the June StatsCan report will also have information about the breakdown by type. Most of the acreage increase will be occurring in yellow peas and red lentils. That means that supplies of both green peas and green lentils could actually get tighter next year, which would be positive for those two crops.

As mentioned, pulse production in other countries is also expected to rise this year. One day after the StatsCan report, the USDA will release its estimates of American acreage which could also have a market influence. The USDA’s earlier forecast had large increases for both peas and lentils and that’s not likely going to change much. Because of the crop types are grown in the US, there would be more impact on green lentils and green peas, although yellow peas will also be affected.

Of course, all the acreage numbers are just the starting point. Crop conditions and yield outcomes have the final say on the crop size and with that many acres, any change in the yield has an exaggerated impact. There’s some concern about wet conditions and disease in some parts of the prairies, but the overall outlook is still very favourable and could lean toward above-average yields. We suggest watching the weekly crop reports from Alberta Ag, Sask Ag and the USDA for clues about crop development. News reports from Australia and the Black Sea region are also worth monitoring.

All the information sources described above – StatsCan, USDA, Alberta Ag and Sask Ag – are all freely available online. In addition, news websites, search engines and social media such as Twitter can all provide good information, although those tend to be anecdotal reports. For those who don’t want to wade through all those numbers and stories, there are services that gather, summarize and interpret the flow of information although most aren’t free.

Source : Albertapulse