By Margaret Lippsmeyer and Nathan Thompson et.al

Center for Commercial Agriculture

Purdue University

Strategic risks stem from a multitude of factors including a shifting political or social environment, changes in government policy, and a growing or contracting macroeconomy (Miller et al., 2004). Industry dynamics involving input markets and product markets as well as competitive and technological uncertainties also present strategic risks to firms (Miller et al., 2004). To respond to strategic risks, businesses should reevaluate their long-run business plans. Previous articles (Lippsmeyer and Langemeier, 2023a; Lippsmeyer and Langemeier, 2023b; Lippsmeyer and Langemeier, 2023c) have established the need for (and benefit from) evaluation, planning, and management of strategic risk, and explained the role of agility and absorption capacity as a means to build resilience to strategic risk.

Using a similar methodology as used to create the monthly Ag Economy Barometer, a survey of 403 U.S. producers was conducted in February 2023 to assess individual farm’s resilience to strategic risk, and relate this resilience to producer sentiment, risk attitudes, farm growth, management practices, and demographic variables. This article reports results from this survey. Specifically, this article uses farm level data on agility and absorption capacity to highlight the importance of resilience to strategic risk to farm metrics such as financial performance and farm growth, as well as to the ability to sustain a competitive advantage. While it remains the decision of each farm manager to evaluate and build resilience to strategic risk, by presenting the benefits of these practices we hope to augment the interest in strategic risk management.

Types of Risk

Risk can be defined as the variability in possible outcomes or the chance of loss. The first step in managing risk is to identify and classify prospective risks (Crane et al., 2013). Major sources of risk include production risk, marketing risk, financial risk, legal risk, human risk, and strategic risk. Production risk emanates from weather, climate change, pests, diseases, technology, and input quality. Changes in supply and demand fundamentals lead to fluctuations in input and output prices, or marketing risk. Financial risk involves items such as the cost and availability of capital, the ability to meet cash flow needs, and the ability to maintain and grow equity. As farms become larger and the organizational structure becomes more complicated, legal risk becomes increasingly important. Anything involving legal issues, such as production and marketing contracts, increases legal risk. Human resource management is not only important to job satisfaction and productivity, it also has important implications related to competitive positioning and strategy. Strategic risks threaten a farm’s ability to meet its long-run objectives and often cause a farm to rethink its long-run strategy.

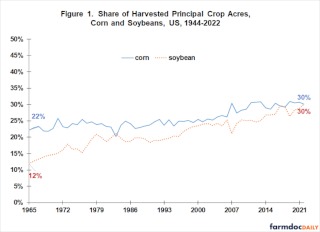

Survey respondents were asked to indicate which major risk source was the most threatening to their farm. Figure 1 presents the results. Despite the prevalence of strategic risks, creating volatility in the agricultural economy, most farmers remain focused on financial, marketing, or production risk. We contend that part of the reason why strategic risk was not identified as the most threatening source of risk for a higher proportion of farms surveyed is due to the perception that strategic risks are external to the operation and cannot be managed. In regard to strategic risk, farmers often take on a laissez-faire mindset, believing management efforts will be futile. However, contrary to this belief, building a more resilient farming operation through increasing agility and absorption capacity can mitigate negative effects from strategic risks.

Absorption Capacity and Agility

Farmers were asked to answer a series of six questions on their farm’s absorption capacity and agility. These questions are adapted from Sull (2009) and aim to gauge farm resilience to strategic risk (Lippsmeyer and Langemeier, 2023a). Responses were split into three groups; those with low, medium, and high resilience to strategic risks. Group membership was determined by measures of central tendency for cumulative scores to the six questions on resilience to strategic risk. Farms in the ‘medium’ group were those which fell within one standard deviation of the average score, while those in the ‘high’ and ‘low’ groups were greater than one standard deviation above or below the mean, respectively. These three groups are referenced in Table 1, and for the remainder of this article as we examine differences in farm characteristics across groups.

As you would expect, the high resilience group had much higher percentages of respondents that agreed with the six questions than the low and medium groups. Let’s take a closer look at the six questions. The first three questions in Table 1 measure absorption capacity, which measure a farms ability to withstand shocks. Farms with high resilience tended to have low per unit fixed costs, were more diversified today than they were five years ago, and had a strong balance sheet. The second three questions in Table 1 measure agility. Responses to these questions indicate the level of flexibility within the farming operation. Farms with high resilience tended to have established goals and objectives, looked for opportunities that new enterprises may provide, and regularly assessed their advantages and disadvantages compared to other farms. We encourage farms to think about how they would answer the six questions in Table 1. In terms of agility, it may be helpful to identify whether your farm has a unique resource or capability that enables you to achieve a competitive advantage (Langemeier, 2016).

Relationship between Farms Characteristics and Resilience to Strategic Risk

In addition to asking questions pertaining to strategic risk, questions related to producer sentiment, risk aversion, farm growth, management practices, and demographics were also posed to survey participants. In this article, we focus on the variables that were strongly related to strategic risk. Forthcoming articles will elaborate on all the questions posed in the survey.

Table 2 presents the average responses to several survey questions. Many of the variables or questions listed in Table 2 are closely related to one another. Rather than focusing on these inter-relationships, we will focus on average responses by strategic risk group. Again, respondents with high resilience to strategic risk had high cumulative scores for the six questions in Table 1.

The Ag Economy Barometer index and its two sub-components, Index of Current Conditions and Index of Future Expectations, were computed for each farm (https://ag.purdue.edu/commercialag/ageconomybarometer/). The average Ag Economy Barometer index for all of the farms surveyed was 122.2. The average current conditions index was 130.3 and the average future expectations index was 118.3. Given these averages, the farms with low resilience were relatively pessimistic. In contrast, the farms with high resilience were relatively optimistic. Without establishing causation, these results suggest farms that are more optimistic have higher levels of absorption capacity and agility.

Risk aversion has been studied extensively in agricultural economics and economics. The primary motive behind these studies has been to find a quantifiable attribute of personality that can be used to explain why an individual makes a particular decision. Stronger risk aversion has been connected with farm operators adopting business-as-usual models, hesitation to adopt new farming practices or technologies, lack of self-efficacy, and reluctance to engage in social networks (Finger et al., 2022). Previous research also indicates the relevance of the risk-return tradeoff which indicates that a higher willingness to take on risk generally correlates with higher farm performance, and vice-versa (Purdy et al., 1997; Harwood, 1999). Risk aversion for the farms surveyed varied significantly across the three levels of resilience to strategic risk. Results show that farms with high resilience to strategic risk are most willing to take on risk, followed by those with medium and low levels of resilience.

Higher proportions of farms with high resilience think their farm will be better off financially a year from now, are thinking about making large farm investments, and have the highest planned annual farm growth rates. In contrast to groups with low and medium resilience to strategic risk, a higher proportion of farms within the high resilience group believe that opportunities to expand their farm will be greater in the next five years.

Clear differences across the three groups are also apparent with regard to farm management practices. When making decisions, a higher proportion of farms with high levels of resilience to strategic risk use agronomic consultants, financial ratios, and evaluate crop pricing alternatives than corresponding proportions of farms in the low and medium strategic risk groups.

Concluding Remarks

More than 15 years ago, Hardaker (2006), proposed a focus for future risk analysis research on risks associated with disease, political pressures, changes in regulation, and natural catastrophes. Prevalence of trade disputes, disease epidemics, wars, and natural disasters in recent years have emphasized the importance of this shift of focus for farmers towards strategic risks. However, despite the prevalence of strategic risk, to this day, most farmers do not prioritize managing strategic risk, instead focusing most of their attention on other risk sources such as financial risk, marketing risk, and production risk.

Off-the-shelf strategic risk management tools remain unavailable for farmers (unlike availability of forward pricing commodities, hedging commodities using futures and/or options, locking in input prices, etc., for financial, marketing, and production risk), furthering the misconception that strategic risks are “unmanageable”. Strategic risk management requires a more deliberate approach (i.e., enhancing farm agility and absorption capacity). Results presented in this article reveal how resilience to strategic risk relates to future growth expectations, optimism on the state of the agricultural economy, use of management practices, and financial performance. For farms hoping to expand and ensure positive future performance, improving resilience to strategic risk is critical.

Source : illinois.edu