Steiner and Company produces the Profit Maximizer report on behalf of National Pork Board based on information we believe is accurate and reliable. However neither NPB nor Steiner and Company warrants or guarantees the accuracy of or accepts any liability for the data, opinions or recommendations expressed.

Seasonal Decline in Supplies Wreaks Havoc in Spot Markets but Availability Is Expected to Improve by Late August and September

Production

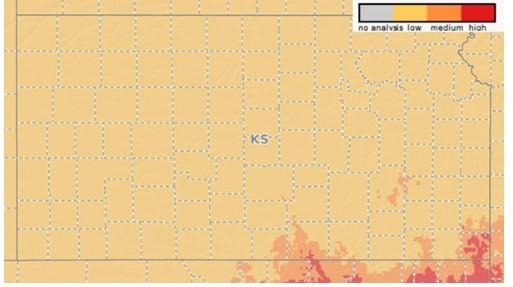

It’s that time of year when pork supplies hit annual lows, both due to fewer hogs coming to market and the impact that hot weather has on hog performance. All the issues that normally affect the spot market only get amplified during this time. USDA estimated total pork production last week at 486.5 million pounds. That is about 0.8% higher than a year ago but well below the +500 million pounds a week that was coming to market in May and first half of June. Indeed even that number may be inflated by about 2M pounds as we think the USDA hog carcass weights estimates are about a pound too heavy.

The decline in slaughter and overall production should not be a surprise. We have been talking about that coming since last spring and then reiterated it upon the release of the June 1 hog inventory data. In that report, USDA noted the supply of hogs weighing over +180 pounds, 0.8% lower than the previous year. We estimate that slaughter during the weeks when those hogs came to market was 0.5% lower. We don’t know the split between producer and packer hogs but our guess is that producers managed to get ahead in their marketings during June. This is evident in the sharp decline in the average weight of barrows and gilts during this period (see chart).

Slaughter

In the last three weeks, hog slaughter has averaged 2.277 million head/week, 1.4% less than a year ago. This is lower than the 0.7% decline we would expect based on the June inventory data. Still, if we take the entire period of June and July, weekly slaughter has been about 0.8% lower than last year. This is largely in line with the USDA survey. As we look towards the next 6-8 weeks, it is important to remember that supply will not remain static. Last year, the weekly hog slaughter in the first week of August was 2.327 million head so we would expect this week’s slaughter to be about 16-20k head less than last year. Weekly slaughter in the following three weeks last year climbed over 2.4 million head and this suggests that we will see a notable improvement in supply availability as this month progresses. Watching slaughter and weights will be important. If slaughter remains low, it could be because a) the USDA survey overestimated supply and so far that has not been the case; or b) producers start to fall behind in marketings and this then shows up in the weight of hogs coming to market. Weather will be an important consideration. If hogs are not gaining then producers are not as much under the gun to move their inventory, at least in the very near term.

Pork Inventory in Cold Storage at the End of June Remains Well Above Year Ago Levels but Supply Available Differs Greatly Between the Products Tracked.

The total inventory of pork in cold storage at the end of June was 541 million pounds, 22.4% higher than last year and 2.4% higher than the five-year average. Normally we see pork inventories decline in June, but this year the decline was only 0.9% compared to a 4.6% average decline in the last five years. Higher pork production in June, and lackluster demand for processing items, likely pushed more product into cold storage. Processors with inventory will find that inventory useful now that supplies have seasonally declined. Last year limited inventory caused prices for bellies and trim to skyrocket. Total inventory of bellies in cold storage at the end of June was 53.2 million pounds, 46.2% higher than a year ago and 19.7% higher than the five year average. Inventories declined 6% from May compared to a 12% average decline in the last five years. Bellies have rallied recently but the larger inventories should help price inflation. Ham inventory was 139.2 million pounds, 6.6% higher than a year ago but 7.1% lower than the five-year average. Ham inventories seasonally increase in the fall but in June inventory increased 10% compared to an average 15% increase in the last five years. Lack of turkeys for the holidays, robust Mexico demand and slower pace of inventory building have all supported ham values so far. Pork trim inventory at 46.8 million pounds was 30.2% higher than last year and 20% higher than the five-year average.

Price Chart

Forecasts

Click here to see more...