Commodities were a big casualty of the escalating trade war between the U.S. and China, but are now set to be a major beneficiary of Beijing’s pledge to import more American goods.

U.S. President Donald Trump had threatened to impose tariffs on as much as $150 billion in Chinese imports, including some steel and aluminum products, to punish Beijing for allegedly violating American intellectual property and unfair trade practices. The Asian nation vowed to retaliate with tariffs on everything from soybeans to fruit and wine.

But after two days of talks in Washington, the two countries on Saturday declared an economic truce, putting their tariffs plan on hold. In a joint statement released by the White House, China said it agreed to “meaningful increases in U.S. agriculture and energy exports” with details to be worked out later.

Focus now swings to which U.S. commodities could benefit as China buys more, and which countries stand to lose business in the world’s biggest market for most raw materials.

Soybeans

The oilseed has been one of the major battlegrounds of the trade war and will very likely feature in the truce. China’s planned tariffs on U.S. exports were seen as a politically charged strike at America’s agricultural heartlands, which had supported Trump’s presidency.

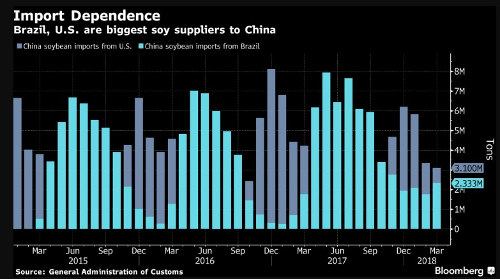

China is the world’s biggest importer of soybeans and America’s largest buyer in trade worth $14 billion last year. While about a third of U.S. production goes to the Asian country annually, China last year bought more of the oilseed from Brazil.

China could potentially increase annual U.S. soy imports to more than 40 million to 50 millions metric tons, according to Li Qiang, chief analyst with Shanghai JC Intelligence Co. It purchased almost 33 million tons from the U.S. last year and 50.9 million from Brazil. Buyers have recently been shunning American supplies due to uncertainty over whether the government would follow through on its planned tariffs. Soybeans on the Chicago Board of Trade climbed more than 2 percent on Monday on news of the truce.

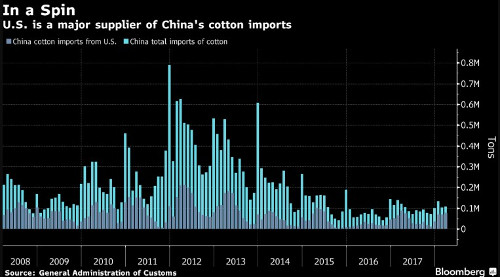

Cotton

Cotton represents another major trade flow from the U.S.: exports of raw cotton fetched $5.8 billion last year, government data show. China was the top destination after Vietnam. Futures on the Dalian Commodity Exchange have surged to a four-year high after bad weather damaged crops in Xinjiang, the top producer, potentially putting pressure on China to import more as stockpiles decline. The country kept its 2018 cotton import quota unchanged at 894,000 tons.

Other U.S. agricultural products that could benefit from increased Chinese imports include sorghum and distillers dried grains, according to Li. Beijing last week scrapped an anti-dumping and anti-subsidy probe into purchases of American sorghum, a trade worth almost $1 billion in 2017.

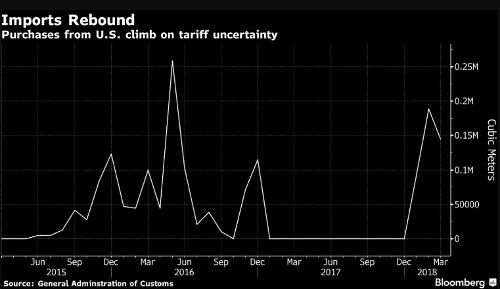

Ethanol

China could also increase its ethanol imports as the government expands its use in vehicles nationwide by 2020, according to Shanghai JC Intelligence. Purchases surged in the first quarter as buyers sought to secure supply ahead of extra tariffs and as expensive domestic corn made imports attractive.

Click here to see more...