By Tristan R. Brown

The last three weeks have been filled with bad news for independent ethanol producers, causing their share prices to mostly give back the gains from last year’s post-election rally.

Production margins have experienced compression as corn prices have rebounded from their earlier lows and gasoline prices have fallen on strong crude production figures.

The Trump administration has contributed to the negative outlook by adding several anti-ethanol and pro-oil names to its Cabinet.

Uncertainty resulting from the EPA regulatory freeze has also caused RIN prices to fall sharply, which could reduce ethanol demand if the decline persists.

I consider additional downside to ethanol share prices to be more likely than a rebound given its increasingly-challenged operating outlook.

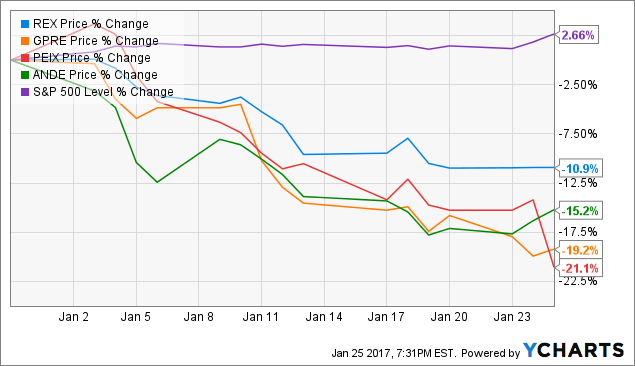

Most people’s New Year’s Eve hangovers dissipate the following day. In the case of the fuel ethanol sector, however, the headaches have just increased in intensity with each progressive week. A strong post-election rally has been mostly retraced since January 1 as the sector has begun to feel some of the effects of Donald Trump’s new presidency. While the S&P 500 has gained another 2.7% since the beginning of the year, independent ethanol producers The Andersons (NASDAQ:ANDE), Green Plains, Inc. (NASDAQ:GPRE), Pacific Ethanol (NASDAQ:PEIX), and REX American Resources (NYSE:REX) have all experienced double-digit share price percentage losses over the same period (see figure). Diversified producers such as Archer Daniels Midland (NYSE:ADM) and Valero (NYSE:VLO) have fared better, on the other hand, as weakness in their ethanol segments have been offset by their other segments (ag production in the case of the former and refining for the latter).

Too good to continue

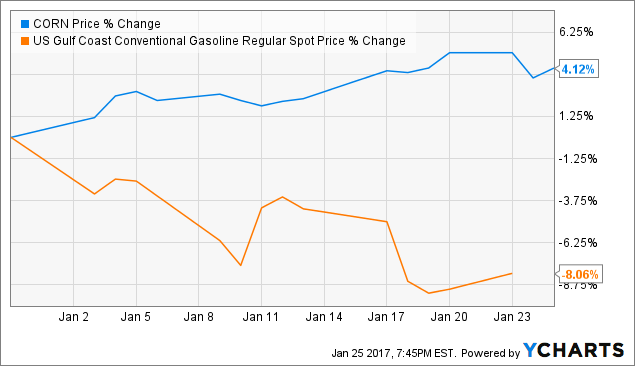

The Q4 2016 rally was unlikely to persist given its precarious underpinnings. As I wrote last month in an article on REX American Resources, the fact that corn prices had fallen near record lows on an especially strong autumn harvest made still-lower prices unlikely. Similarly, the gasoline price rally that followed last year’s shaky output reduction pledge by OPEC’s member countries was inevitably going to be offset by increased production by U.S. shale producers. Sure enough, corn prices have increased and gasoline prices have declined in recent weeks, causing corn ethanol production margins to compress sharply. This compression on its own explains much of the share price decline for independent producers.

The prices have not operated within a vacuum, however. President Donald Trump has finished nominating his primary Cabinet officers and the results have done little to reassure an ethanol industry that was already worried by the Trump campaign’s ambivalence on the subject of renewable fuels policy prior to the election. Whereas President Obama routinely selected ethanol boosters for major positions, led by former Iowa governor Tom Vilsack as Secretary of Agriculture, President Trump has primarily selected ethanol foes and/or Big Oil executives to important positions at the Environmental Protection Agency, Department of Energy, Department of Agriculture, and Department of State. Bloomberg recently noted the unprecedented lack of renewable fuels supporters and Midwesterners in the new Cabinet.

It is possible to overstate the impact that the Cabinet selections will have on the outlook for the corn ethanol sector. President Trump’s election victory was primarily attributable to his strong performance among Corn Belt voters in Iowa, Wisconsin, Michigan, and Ohio. Candidate Trump frequently went on the record as supporting corn ethanol production, at one point calling for the volume of ethanol that must be blended under the revised Renewable Fuel Standard [RFS2] to exceed the levels established by the Obama administration. Moreover, President Trump is unlikely to win re-election in 2020 without winning the Corn Belt, and walking back the RFS2’s blending volumes would be a fool-proof method of losing voters in those states.

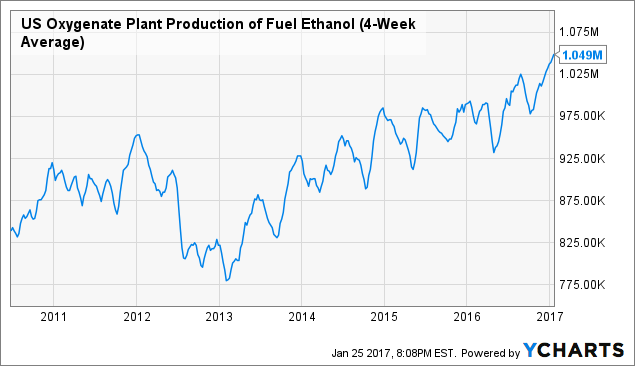

The more likely scenario is that the lack of renewable fuels supporters in the Cabinet will cause the industry’s priorities to be of only secondary importance compared to the Trump administration’s other priorities. For example, America’s looming trade war with China took its first major victim last week as the latter country imposed steep import tariffs on U.S. ethanol and dried distillers grains and solubles [DDGS]. U.S. ethanol producers had responded to last year’s cheap feedstock costs by achieving record production (see figure) and relying on robust global demand to pick up any slack resulting from slowing domestic consumption growth. China’s new focus on reducing urban pollution made it a likely target for ethanol exports, while its growing livestock sector had already made it into an important destination for DDGS. The tariff increases weaken an important backstop to domestic demand for the sector.

Look out below

In the meantime, investors can expect policy uncertainty to reach new highs as the Trump administration acts to place its stamp on the federal bureaucracy. The recent decision to freeze regulatory implementation and begin cutting jobs at the Environmental Protection Agency, which oversees the RFS2, has caused the rollout of the high blending volumes released last November to be delayed by at least one month pending review. D6 Renewable Identification Numbers [RIN] prices have fallen by 41% over the last month, with the largest decline occurring yesterday following the news of the regulatory freeze (see figure).

Click here to see more...