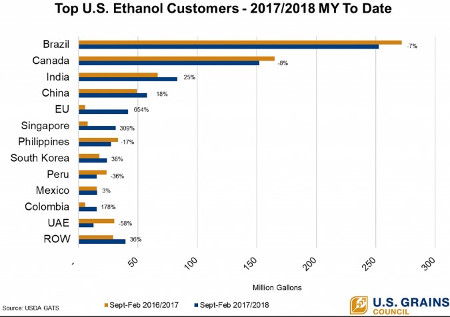

The United States recorded the highest-ever monthly exports total for U.S. ethanol in February 2018 at 218.7 million gallons, according to data from the U.S. Department of Agriculture (USDA). February sales bring U.S. ethanol exports to nearly 768 million gallons thus far in the 2017/2018 marketing year (September 2017-February 2018), a six percent increase over last year’s record-setting pace.

Brazil applied a 20 percent tariff in September 2017 on all imports of ethanol after a 600 million liter (158.5 million gallon) tariff rate quota (TRQ). Even with the full tariff applied, 103 million gallons of U.S. ethanol were shipped to Brazil in the month of February – the most ethanol exports to Brazil in a single month. Overall, Brazil has imported nearly 253 million gallons of U.S. ethanol this marketing year.

“Inter-harvest sugar shortages in Brazil have raised domestic ethanol prices and opened the market even further to U.S. imports,” said Mike Dwyer, U.S. Grains Council (USGC) chief economist. “Continued sales despite the restrictive TRQ demonstrate how the Brazilian market values U.S. ethanol.”

Canada ranks as the second largest importer of U.S. ethanol halfway through the 2017/2018 marketing year at nearly 152 million gallons. The Council continues to support provincial and national policies in Canada that expand biofuels mandates to E10.

India, which currently only imports ethanol for industrial uses like textiles and agrochemicals, increased U.S. ethanol imports 24 percent year-over-year to 83 million gallons. And, despite ongoing trade tension between the U.S. and Chinese governments and tariffs on the U.S. biofuel, China increased ethanol exports 18 percent over the previous year to 57.7 million gallons.

Smaller importers of U.S. ethanol have also increased their purchases. The European Union jumped purchases significantly to 41.8 million gallons year-to-date, while U.S. exports of ethanol to Singapore increased 309 percent year-over-year to 31.1 million gallons thus far in the marketing year. Both markets are widely used as transshipment points, with ethanol sold to the European Union largely transshiped to the Middle East and exports to Singapore shipped to other markets in Asia.

Click here to see more...