By Eva Tesfaye

A slowdown in the agricultural industry is "going to put a strain on farmers." But analysts say the rural economy in the Midwest and Great Plains is still doing well.

The United States' agricultural economy had a good couple of years, with crop prices at record or near-record highs.

But this year, as interest rates rise, banks are lending less money to farmers and agricultural equipment sales are falling. Farmers also have to deal with high costs for inputs like seeds and fertilizers.

“I expect that to spill over into farmland purchases by the farmer,” said Ernie Goss, a regional economist at Nebraska’s Creighton University. “The farmer, like the rest of us, is going to have to be prepared for higher interest rates.”

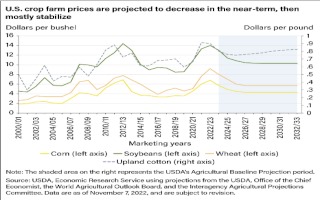

The U.S. Department of Agriculture predicted that farm income would decrease in 2023 after increasing the past two years. Crop prices are expected to decline too.

Overall, however, the rural economy in the Midwest and Great Plains, which is closely tied to the agricultural economy, is still doing well, according to Creighton University’s latest Mainstreet Economy survey, released this month.

“What I expect and what our survey is pointing to is somewhat slower growth in the rural economic growth that we track here at the university, but it's still going to be positive,” said Goss.

However, consumers should also expect food prices to stay high due to inflation.

Increases in land values are also starting to slow down, said Paul Schadegg, senior vice president at Farmers National Company, an agricultural landowner services company.

“They were still increasing, but at a much more moderate rate,” he said of land values, attributing some of the slow-down to rising interest rates.

High farmland prices have made it difficult for new young farmers to get into the industry, but this plateau might change that.

“There can be an opportunity for a new beginning farmer, or it could be for investors also,” said Schadegg.

New opportunities for young farmers could be outweighed as the Federal Reserve continues to raise interest rates, though. Higher interest rates will affect farmers' ability to take out loans for equipment and real estate, said Wade Simpson of Ag Resource Management, an agricultural finance company.

“It’s going to put a strain on farmers to look at what they need to do,” Simpson said, “and how how they need to do it.”

Simpson said farmers need to prepare for these economic changes.

“It's understanding their budget, understanding their crop insurance coverages and not over leveraging, not over borrowing,” he said.

Simpson said keeping crop insurance affordable in this year’s upcoming Farm Bill will be key to making sure farmers can stay in business, especially through extreme weather brought by climate change.

Click here to see more...