By Krista Swanson and Gary Schnitkey et.al

Department of Agricultural and Consumer Economics

University of Illinois

President Biden’s American Families Plan introduced in April 2021 includes provisions that would dramatically change the tax code, specifically the changes for basis valuation in appreciated property and taxing capital income as ordinary income with a higher top tax rate. Although the plan notes protections for family-owned farms if heirs continue to run the business, a delayed tax burden would remain. These tax code changes would likely affect 50% to 70% of Illinois grain farms, with an average transfer tax liability of over $500,000 for those farms. Many farms would face over $1 million in transfer tax liabilities.

Background

The American Families Plan (“the plan”) is President Biden’s proposal to “grow the middle class, expand the benefits of economic growth to all Americans, and leave the United States more competitive” through numerous new and expanded forms of assistance. Also included in the proposal: significant changes to the tax code estimated to offset the plans’ $1.8 trillion price tag over fifteen years.

Three tax reform strategies are presented:

- IRS Enforcement – Would require banks to report account flows and focus IRS resources on large corporations, businesses, estates, and high-income individuals.

- Restore Top Tax Rate – Would increase the top tax rate from current 37% to 39.6%, restoring to the level prior to the Tax Cuts and Jobs Act of 2017.

- Capital Income Tax – Would result in taxation of capital income as ordinary income, change the practice for determining basis level on appreciated property and tax of those gains at death, and when sold or passed as a gift.

Few details were provided in the plan related to the changes noted in the second and third points. The capital income tax strategy appears to be modeled after the approach included in draft legislation for the Sensible Taxation and Equity Promotion (STEP) Act introduced earlier this year (farmdoc daily April 6, 2021).

A notable deviation from the STEP Act is the protections noted in the American Families Plan for family-owned businesses and farms. Without any protections, a recipient may need to sell the farm assets necessary to run the business to pay the tax liability at transfer that would result under this plan. No additional details are given in the plan, but the USDA separately explained one piece of the protections as a deferral of tax liability on family farms as long as the farm remains family owned and operated. However, that explanation also lacks details and definitions as to how protections may or may not apply leaving questions about what happens in certain situations and who can qualify as family. Without additional details, the idea of a deferred tax is also concerning for recipients who may retire in their lifetime or be forced to stop business due to an unforeseen event.

As explained by USDA, the second part of the protections for family farms is an exclusion of the first $2 million of gains per married couple (or up to $2.5 million if the farm also includes the family home) from capital gains tax. Notably, this appears to be a rewording of the same $1 million per individual exclusion outlined in the American Families Plan, though emphasis is placed on the couple as original owners as opposed to an individual.

The USDA explanation goes on to state that the heir would continue to get a step-up in basis on those first $2 million in gains (from married couple). Basis is the value in a property when obtained as a gift, inheritance, or by purchase. Farmland is an example of property that generally appreciates in value over time. Under current law, property that has appreciated in value receives an automatic step-up in basis to the fair market value on the date of death with no limitations. Consider a person who inherits 400 acres from parents who had an original basis of $3,000 per acre, or $1.2 million total. The fair market value on the date of death is $10,000 per acre, or $4 million total. Currently, the heir’s basis in the property would be automatically stepped-up to the full fair market value. Under the American Families Plan, the heir’s basis in the property would be automatically stepped-up to $3.2 million or $8,000 per acre, because the step-up in basis is limited to $2 million of gains from property received from a married couple.

USDA estimates that more than 98% of farm estates would not owe any tax due to the changes at transfer, provided the farm continues to be owned and operated by the family. Regardless of how many are impacted “at transfer” a much larger number of farms which might be impacted by a lingering tax burden would remain and could be detrimental at the time of a later farm retirement or other instance that causes the family to stop farming. Further, terms of the protections could change or end also resulting in a much larger share of farms impacted. Concerns for the tax burden, even if deferred, on family-owned farms and business are echoed by House members of both parties (1, 2).

While the American Families Plan does include a new transfer tax similar to that proposed in the STEP Act, the plan notably omits other estate and gift tax changes proposed during Biden’s campaign and in draft legislation of the For the 99.5% Act. Both indicate interest in lowering the value at which estates trigger estate taxes and increasing estate tax rates owed (farmdoc daily April 6, 2021). The absence of these changes in the American Families Plan does not stop such changes from being addressed in future legislation.

Approach to Estimate Tax Impact on Illinois Farms

In this analysis, we estimate the tax liability impact of tax code changes proposed in the American Families Plan on Illinois farms. Where the plan lacks specific details, provisions more specifically outlined in the STEP Act are assumed. To evaluate, we analyze Illinois Farm Business Farm Management Association grain farms with at least ten owned acres (Data Note 1). This analysis assumes that all current farm property for each farm is transferred at death. Despite the protections outlined in the plan, the burden of the outstanding tax liability is carried forward until no longer owned and operated by the family. Therefore, we consider the estimated impact on all farms in the dataset.

Following are explanations of the tax code changes considered and calculations used:

- New Transfer Tax: Includes a new transfer tax to be taxed as ordinary income for gains over $1 million per individual (or up to $2.5 million per couple with home included). The transfer tax applies to gains in farm property value minus the basis in the property.

- Restore Tax Top Bracket: Utilized current 2021 tax brackets with two adjustments: (1) an increase in the highest tax rate from 37% to 39.6% and (2) reduced the highest bracket cut-off from $518,000 to $452,700 for single filers and from $622,050 to $509,300 for married-filing-jointly filers (Politico).

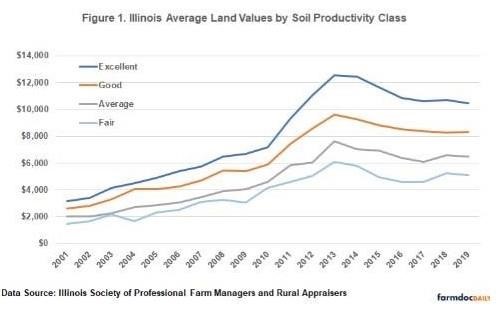

- Basis Calculation: Original basis is needed to calculate the new transfer tax that would be owed. However, actual basis in farmland of FBFM farms is not recorded so basis must be estimated to calculate transfer tax. Illinois land values have changed significantly over time. The Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA) reports the average sales price of completed land sales each year (Figure 1). Aside from a heightened period from 2012 through 2015, current land values are generally higher than at any point in history before that. Therefore, basis values will vary considerably depending on value at the time in which the property was obtained by the assumed deceased. To show the influence of basis values on transfer tax impact, we estimate basis values for two different years. The actual farm fair market value is used for farm market value at death. To estimate basis of that farm in 2001 and 2010, the relative change in ISPFRMA averages for the corresponding soil productivity class over the same period is applied to the farm.

- Taxable Property Gain: Taxable gain in property for each farm is calculated by taking the fair market value of farm property (Data Note 2) less the estimated basis for 2010 and separately for 2001 and further reduced by the allowable exclusion of $1 million for individuals and $2 million for couples. Notably, this could also include any unrealized gains on investments in stocks and bonds and other non-farm property that appreciated in value, though none are considered in this analysis.

- Transfer Tax Owed: Transfer tax owed is calculated based on the estimated taxable gain for both basis years. Under current law this transfer tax does not exist and would be $0 for all farms. The new transfer tax would be taxed the same as capital gains. Under the American Families Plan, capital gains would be taxed as ordinary income with updated income brackets also outlined in the plan. Therefore, the transfer tax is calculated using estimated new income brackets explained earlier. Single person households are assumed to be on an individual tax bracket and others on a married-filing-jointly bracket. In this analysis this is assumed to be the only income on the descendant’s final tax return. The presence of other income could include the transfer tax calculation and result in an income tax on the descendant’s final tax return under current law.

Discussion of Results

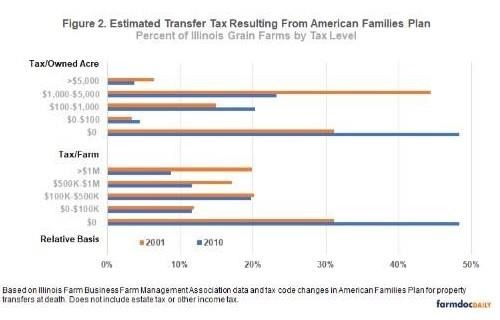

In the first evaluation using a relative 2010 basis level for all farmland, 52% of farms owning at least 10 acres had a gain in property value that would be taxable under the plan’s transfer tax proposal. The tax liability would range from $63 to $10 million per farm with the largest share of farms owing between $100,000 and $500,000 as shown in Figure 2. Though the transfer tax is calculated on the value of all farm property, generally the appreciation in value is from the land. To put it into context related to farm size, the transfer tax is also divided by owned acres for each farm. The largest share of farms would owe between $1,000 and $5000 per acre in transfer tax (Figure 2).

For farms owing a transfer tax, the average transfer tax owed would be $577,139 per farm and 17% of those farms would incur a transfer tax liability of more than $1 million. The average transfer tax would be $1,916 per owned acre for farms owing a transfer tax. Collectively these farms would owe nearly $400 million in a new tax that does not currently exist.

In the second evaluation using a relative 2001 basis level for all farmland, 69% of farms owned at least 10 acres had a gain in property value that would be taxable under the plan’s transfer tax proposal. The tax liability would range from $902 to $12.4 million per farm with the largest share of farms owing between $100,000 and $500,000 (Figure 2). Though the transfer tax is calculated on the value of all farm property, generally the appreciation in value is from the land. To put it into context related to farm size, the transfer tax is also divided by owned acres for each farm. As in the evaluation with 2010 relative basis, the largest share of farms would owe between $1,000-$5000 per acre with 2001 relative basis (Figure 2).

For farms owing a transfer tax, the average transfer tax owed would be $847,122 per farm, or an average of $2,563 per owned acre. The transfer tax liability would exceed $1 million for 29% of farms owing a transfer tax. Collectively these farms would owe over $784 million in a new tax that does not currently exist.

A larger percentage of farms has a taxable property gain for transfer tax when using an older 2001 relative basis level. This is because of the change in farmland values. As shown in Figure 1, land values were much lower in 2001 than in 2010 or today. When basis is lower, a smaller basis value is subtracted in the calculation of the taxable property gain resulting in a larger taxable property gain.

Under current law this does not matter for two reasons. First, because the farmland gets the automatic step-up in basis if the transfer occurs at death. Second, because this transfer tax does not exit.

In this analysis, we specifically consider the impact of the new transfer tax proposed in the American Families Plan in a transfer at death situation. This also includes the plan’s proposed changes to how gains in property value are taxed and changes to the income tax brackets. This analysis does not include existing estate taxes. It also does not account for any other impacts of tax related change in the American Families Plan or taxes at the state level.

Summary

We estimate approximately 50% to 70% of Illinois grain farms would incur a tax liability from the new transfer tax when the farm property is transferred at death. The actual share of farms affected would be dependent on actual basis values for the property owned, which is not known in this dataset. Regardless of basis year, it is likely most farms incurring transfer tax would incur a transfer tax liability of $1,000 to $5,000 per acre. For farms who would owe a transfer tax, the average transfer tax liability is over $500,000. Many farms would owe more than $1 million, particularly in situations where basis in the land is low compared to current fair market value.

The American Families Plan does include a protection to defer this tax liability as long as the transferred property continues to be owned and operated by the family. While a deferral may provide initial relief, that tax burden remains and could become due in the case of a retirement or in an unexpected situation if there is not a qualifying family member who can continue to operate.

The transfer tax proposed in the American Families Plan is a new tax on property gains when transferred. Though it applies to transfer at death it is calculated separate from estate taxes. Until more details are released, it is unclear if the transfer tax will be deductible on the estate value.

Data Notes

- Includes certified usable FBFM grain farms with data from 2019, the most recent year available. To avoid duplication of total farm balance sheets, only primary operators are included. The dataset was reduced to farms with at least 10 owned acres to eliminate what is primarily farmsteads and farms with fair market value of between $2,000/acre and $18,000/acre to eliminate those skewed outliers.

- Farm property included in this analysis: crops and feed, market livestock, prepaid expenses, assets under capital lease, machinery and equipment, breeding livestock, farmland, and buildings and improvements.

Source : illinois.edu