By Claire Hutchins, USW Market Analyst

It is no secret that these are uncertain times. As countries across the world work to contain and combat the novel coronavirus (COVID-19) outbreak, U.S. Wheat Associates (USW) is closely monitoring the effects of the outbreak on global wheat trade dynamics. According to a host of U.S. grain traders, it is too soon to tell the immediate effects of the pandemic on the international demand for U.S. wheat.

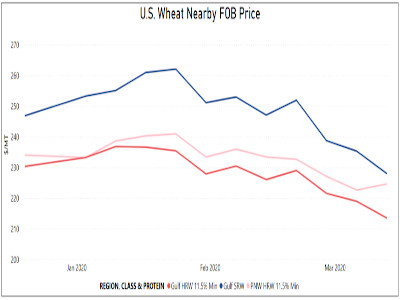

However, there is a clear relationship between the turbulence in global economic markets and the export price of U.S. wheat. Over the past several months, the export price for all classes of wheat out of the Gulf and Pacific Northwest (PNW) has fallen due to substantial pressure in the U.S. wheat futures markets, pressure that the pandemic has only increased.

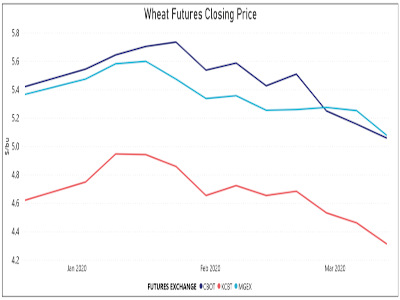

Between late January and mid-March 2020, nearby Chicago Board of Trade (CBOT) soft red winter (SRW) wheat futures fell 12% from $5.74/bu to $5.06/bu. Nearby Kansas City Board of Trade (KCBT) hard red winter (HRW) wheat futures fell 11% from $4.86/bu to $4.32/bu. Nearby Minneapolis Grain Exchange (MGEX) hard red spring (HRS) wheat futures fell 7% from $5.48/bu to $5.08/bu.

During the same period, PNW HRW 11.5% protein (on a 12% moisture basis) FOB prices fell 7% from $241/MT to $224/MT. Gulf HRW 11.5% protein FOB prices fell 9% from $235/MT to $214/MT and Gulf SRW FOB prices fell 13% from $262/MT to $228/MT.

Click here to see more...