U.S. sees decline while Canada experiences huge jump in combine sales

By Diego Flammini

Assistant Editor, North American Content

Farms.com

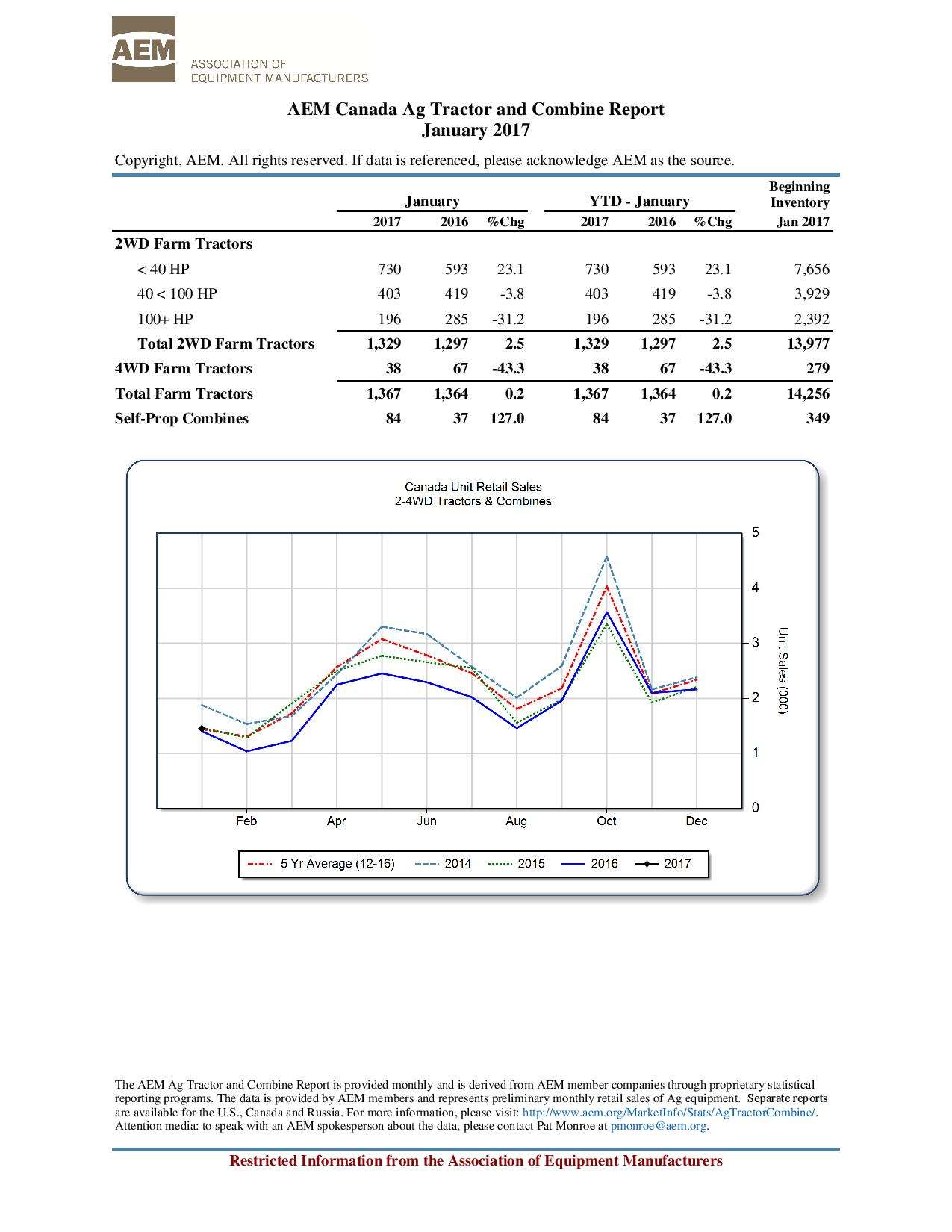

According to a new report by the Association of Equipment Manufacturers (AEM), there was an increased interest in combines across Canada.

AEM’s Ag Tractor and Combine Report for Canada says 84 self-propelled combines sold in January 2017, compared to 37 in January 2016.

That number represents an increase of 127 per cent, according to AEM. And machinery dealers say they’ve noticed more farmers inquiring about combines.

“We had an excellent 2016. We probably doubled sales between new and used (machinery),” Chris Dahms, a precision land management specialist with Robert’s Farm Equipment, told Farms.com in an interview from the London Farm Show. “But 2017 has been slow to start.”

The jump in sales could come down to the importance of the equipment and potential resale value, he said.

“Combines are a necessity and growers realize that trade value is very important on them,” he said.

When it comes to sales of 2WD tractors, those under 40 HP experienced a 23 per cent increase in sales.

But other 2WD tractor categories saw sales decreases:

- Sales of 2WD tractors between 40 and 100 HP dropped by almost 4 per cent and

- Sales of 2WD tractors of 100 HP and over were down by 32 per cent.

Canadian sales of 4WD tractors dropped by 43 per cent between January 2016 and 2017.

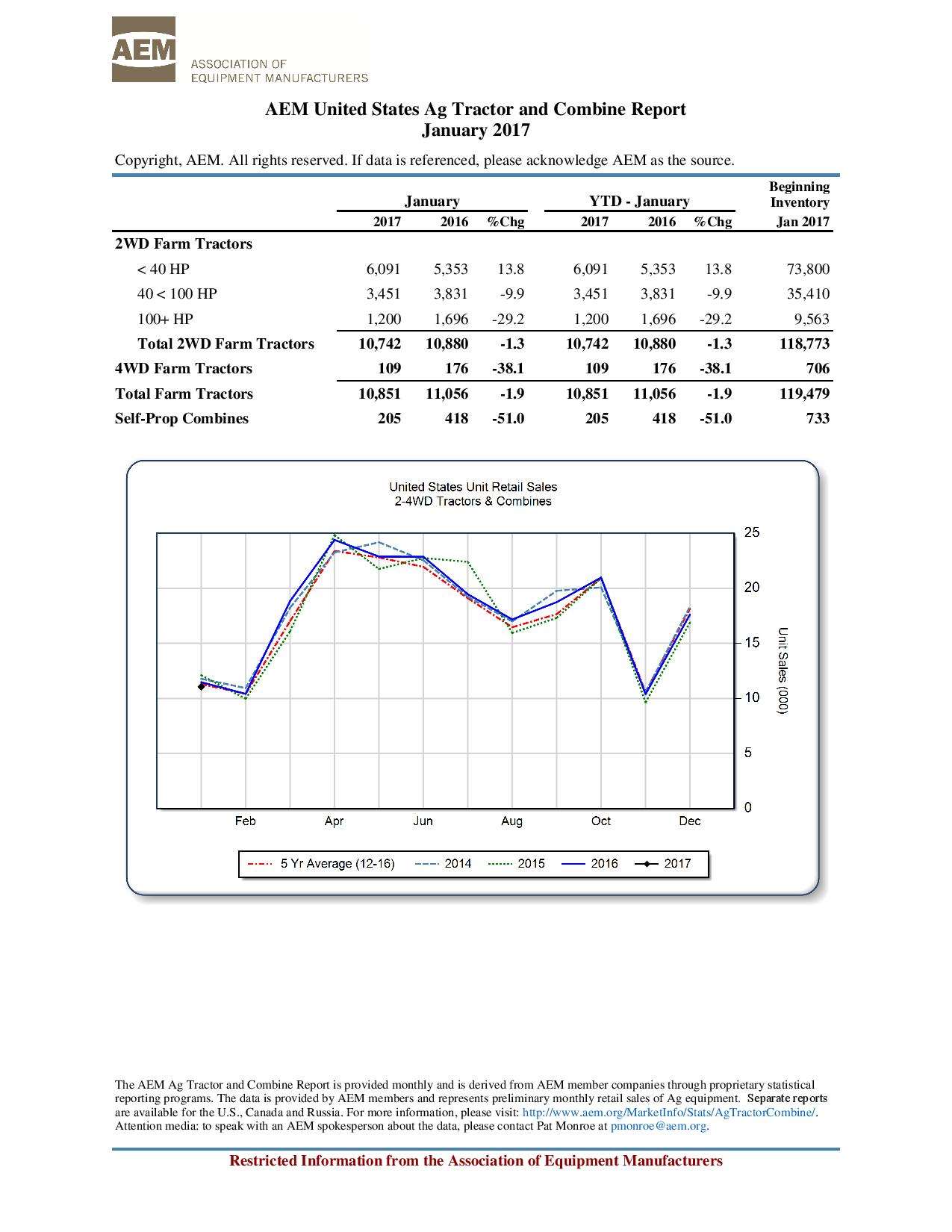

When it comes to tractor and combine sales in the United States, numbers were generally down, with the exception of 2WD tractors under 40 HP. Sales of those tractors rose by almost 14 per cent between January 2016 and 2017.

Sales of 2WD tractors between 40 and 100 HP dropped by 9 per cent. Sales of 2WD tractors 100 HP and over dropped by nearly 30 per cent.

Sales of 4WD tractors fell by 38 per cent and combine sales decreased by 51 per cent between January 2016 and 2017.

Farms.com has reached out to Farm Credit Canada and Agricultural Manufacturers of Canada for comments on the sharp rise in combine sales.