The U.S. and China are slated to sign a phase one trade agreement next week

By Diego Flammini

Staff Writer

Farms.com

Chinese officials aren’t saying which commodities the country will increase its imports of in order to meet trade figures with the U.S.

What the Chinese are disclosing, however, is which import quotas they won’t touch in order to increase their American ag purchases.

China’s annual quotas for wheat, rice and corn are 9.64 million metric tonnes (mmt), 7.2 mmt and 5.32 mmt, respectively, and the country has no intention of increasing these purchases.

“These are global quotas. We will not adjust them just for one country,” Han Jun, vice-minister of agriculture and rural affairs, told Caixin, a Chinese financial news site, CNBC reported.

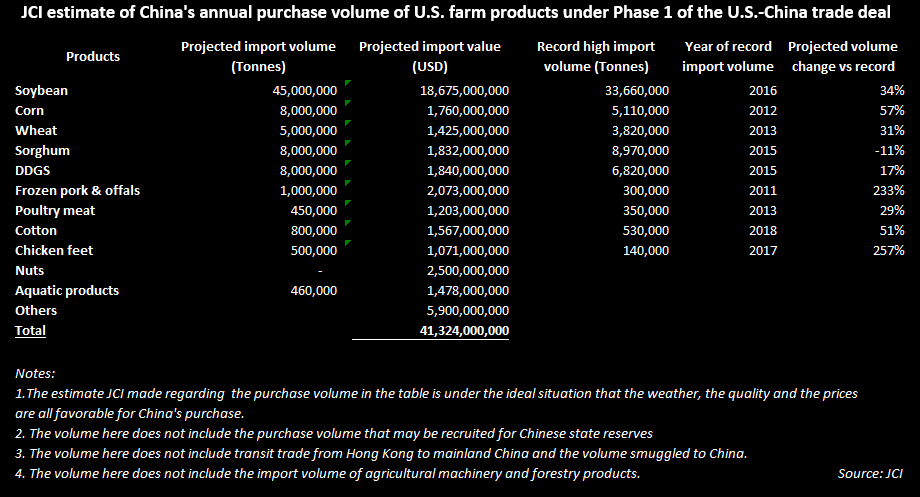

Chinese market analysts had projected U.S. crop import figures under the phase one trade deal. The two countries are scheduled to sign said agreement on Jan. 15 in Washington, D.C.

Those annual numbers sat around 8 mmt for corn, worth about US$1.76 billion, and 5 mmt for wheat, worth around US$1.42 billion, JCI Intelligence, a Chinese analyst, said in December.

China’s decision not to raise import quotas raises some worries.

“It’s a concern because it puts into question whether China can import those amounts,” said Moe Agostino, chief commodity strategist with Farms.com Risk Management. “The Chinese could use past tariff-rate quotas that have been unfulfilled to hit those targets.”

China’s decision hasn’t affected market prices, though.

Markets are waiting until Friday’s USDA crop reports come out, Agostino said.