Announcement was made during Canada’s Outdoor Farm Show

By Diego Flammini

Assistant Editor, North American Content

Farms.com

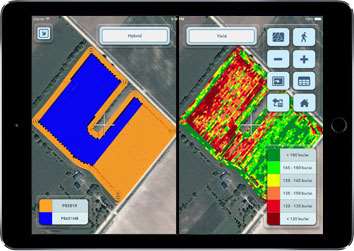

During Canada’s Outdoor Farm Show, Climate Corporation announced that farmers in Eastern Canada will have access to the FieldView digital agriculture platform for the 2017 growing season.

Producers will be able to collect, organize and analyze data from their fields on one platform.

Having all their information in one place can help farmers make informed decisions a little easier.

FieldView

Photo: The Climate Corporation

"Through the advanced digital tools in the Climate FieldView platform, Canadian farmers can instantly visualize and analyze crop performance with field data maps and satellite imagery, so they can tailor their agronomic practices for the best outcome at the end of the season,” said Mike Stern, chief executive officer for The Climate Corporation.

Some of FieldView’s features include:

- Yield analysis tools that allow farmers to evaluate seed performance by field and hybrid.

- Field-level weather to help producers prioritize their course of action for the day.

- Cloud-to-cloud connection with a variety of agricultural software systems.

- The ability for farmers to drop geo-located scouting pins on field health images and navigate back to those spots for a closer look.

Farmers in Eastern Canada will be able to purchase Climate FieldView this winter so they can implement it for the 2017 growing season.

For farmers that sign up for Climate FieldView by January 1, 2017, they can try field-level weather insights for free on two trial fields.