Silver prices influence agriculture mostly in an indirect way – but that has not stopped farmers from talking about it.

Silver has been the second-best performing commodity, up 426 percent since 2020. Chat forums like Agriville.com had farmers chatting about its performance on a regular basis, as they believe it serves as a leading indicator. However, the so called “safe havens” -- silver and gold -- fell 19% and 31% in one day (January 30) -- so they can no longer be considered safe havens?

The original thread on the chat forum was posted on December 21, 2025, by a nuser named wheatking16. Before even the collapse some Agriville.com users were advising caution, “With silver I believe it is almost time, as Warren Buffet would say, to be scared as everyone is starting to be greedy,” said AllisWD45.

“When the coffee shop talk is about silver and advice about silver abounds, it may be time to be careful with these investments if we have any.”

On January 16, user errolanderson said, “There is now a huge disconnect between precious metal futures and the miners. Translation: The basis is now exceptionally weak ‘n wide. Mining shares have not remotely kept pace with the spec-driven futures.”

Moe Agostino Chief Commodity Strategist with Farms.com Risk Management and the host of the Ag Commodity Corner+ Podcast says “when futures have gone parabolic in a very short-term period of timeline in gold and silver, and trading is well above the 200-day moving average or mean, it is time to take your original capital and risk the profits. It never ends well.”

“If you bought physical a long-time ago you can continue to play the long game, but if you bought paper late, its over, the bubble has burst!” exclaims Agostino. “The trade was focused on the wrong bubble, it was not AI, it was in gold and silver and you could include the ‘digital’ gold, Bitcoin!”

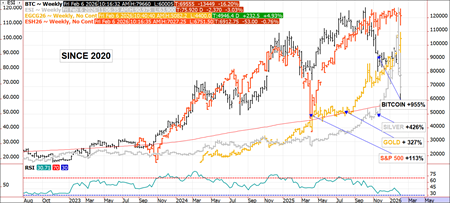

Farms.com asked Agostino to provide background on silver’s connection to agriculture. He says Bitcoin was the best performing asset/commodity since 2020, up 955%, followed by silver. Even after the recent plunge, with gold up 327% and the S&P 500 gaining 113%. Bitcoin was considered a “digital” gold but has lost that lustre in the past year falling 50%.

“The dollarization and debasement trade since 2016 has led to central banks around the world, led by China and India, to sell the American dollar to trade against U.S./Trump trade policies, replacing the global reserve currency, the U.S. dollar Index, with safe-havens like gold and silver,” explains Agostino.

The safe-haven trade had been gathering steam since early 2025 and coincided with the second Trump presidential term. Trade wars, global economic uncertainty, and a general lack of economic direction/stability caused investors to flock to safe-haven assets like precious metals, including gold, silver, copper, and platinum.

As noted above, the move to the upside where demand outpaced supply finally came to an end and the bubble burst on January 30. Continues Agostino, “the unwinding of leveraged positions from institutions had made the drop lower much worse.”

Silver prices influence agriculture mostly in an indirect way

“Rather than acting as a core input cost for farming, silver tends to serve as a leading indicator of broader commodity inflation,” explains Agostino.

Although silver does play a role in certain advanced agricultural technologies—such as nano fertilizers, seed treatments, and antimicrobial pesticides—the stronger connection between the two sectors emerges when macroeconomic forces like high inflation, a weakening U.S. dollar, or increased demand for safe haven assets push both silver and agricultural commodities (including soybeans) upward at the same time.

Silver nanoparticles (AgNPs) are becoming more common in modern farming because they can boost seed germination, enhance photosynthesis, and function as low toxicity pesticides. Rising silver prices can therefore signal higher input costs or inflationary pressure across agriculture, even though they do not directly affect the everyday expenses of traditional farming operations.

The real interest in silver prices was based on safe-haven barometers, not a substantial connection to agriculture.

Photo Credit: QT