India is set to scrap its duty on wheat imports

By Devin Lashley

Farms.com Risk Management Intern

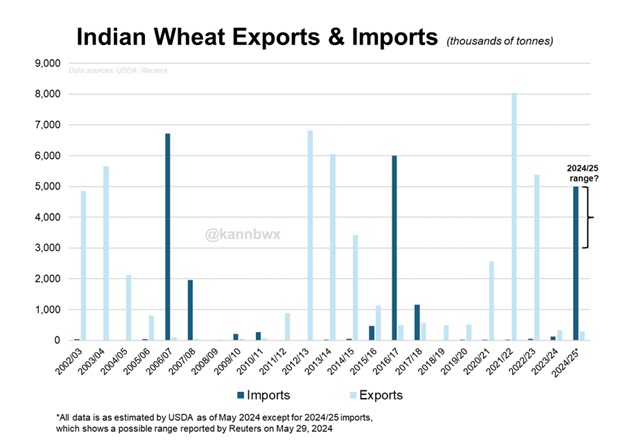

India will likely scrap its 40 percent duty on wheat imports after June, potentially creating 3-5 million tons of imports this season, potentially making it the 11th largest wheat importer in 2024/25.

This move would aim to replenish depleted reserves and control prices, which have surged due to three consecutive poor harvests.

India's wheat crop has been adversely affected by high temperatures, resulting in lower harvests in 2022 and 2023. This year's crop is also expected to be 6.25% lower than government estimates. Domestic prices remain above the state-set minimum purchase rate and have been rising recently.

Combine this with the fact that state wheat stocks also dropped to 7.5 million metric tons in April, the lowest in 16 years, after the government sold more than 10 million tons to control prices. Removing the import duty of course would help maintain reserves above the benchmark of 10 million tons.

The end of the general elections has removed a significant barrier, allowing New Delhi to facilitate wheat imports. Should the decision be made, the government is expected to lift the import tax in time for Russia's harvest, targeting modest volumes. Despite the recent surge in global wheat prices, industry experts believe duty-free imports are viable and essential to ensure adequate market supplies. Pramod Kumar, president of the Roller Flour Millers' Federation of India, advocates for removing the import duty to maintain sufficient market supplies.

A government official also indicated that the import duty would likely be removed after June to enable private trade to import wheat, with the duty reinstated before the wheat planting season starts in October to protect farmers' interests. Prime Minister Narendra Modi's Bharatiya Janata Party (now in a coalition government) is expected to take this course of action.

New Delhi-based traders estimate that around 3 million metric tons of imports would suffice, with Russia being the primary supplier. Imports could prevent a local price surge after the peak demand in October for the festival season, eliminating the need for large reserve sales.

Russia, however, is already dealing with a wheat shortage with Sovecon cutting Russia’s wheat harvest further to 80.7 million metric tons from its previous forecast of 82.1 million, the latest in a series of weather-related downgrades. This has led to the Russian government considering announcing a national state of emergency due to a lower harvest.

The dry/cold weather that impacted the Russian wheat crop send wheat futures surging to a 10-month high. Add the possibility of India importing wheat with global wheat ending stocks at a 16-year low, and it suggests that even more price rationing is needed. For now the news is priced into futures.

State procurement in India has also struggled, with only 26.2 million metric tons purchased against a target of 30-32 million. Despite government advice to refrain from purchases to enable state stockpiler Food Corporation of India to procure large quantities, procurement is unlikely to exceed 27 million metric tons.

India's food welfare program requires nearly 18.5 million metric tons of wheat. The main opposition Congress party has promised a monthly supply of 10 kg of free grain if elected, doubling the current provision under Modi's government.

Although overseas wheat purchases risk angering the influential farmer voting bloc, the limitation ends with the election. Despite the rise in global prices, duty-free imports remain economically viable, prompting calls for the new government to remove the duty and facilitate trade imports.