Precision Ag speakers talk dream-building

By Joe Dales, Vice-President, Farms.com

“We are just getting started. There is so much to be done yet.”

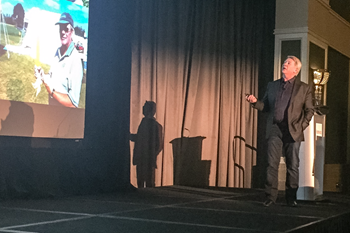

That was the look-ahead Rob Saik offered a packed house at the closing presentation today at the third annual Precision Agriculture Conference.

And it’s that enthusiasm and excitement that the founder of Agri-Trend and global business development lead at Agri-Trend/Trimble has brought to the industry since his earliest days.

In fact, Saik’s opening slide was a photo of him watering his family vegetable garden as a yound child.

“Agriculture is in your blood, and it’s in your blood from Day 1.”

Saik spoke along with Jason Tatge, president of Farmobile, on “Building a Dream from the Ground Up” at the two-day conference in London, Ontario.

Tatge had earlier explained that Farmobile was “built from the ground up with hard work and nothing else to our name, except a love of agriculture, the ability to write code, and a deep desire to do the right things for the right reasons while promoting progress in the global food chain.”

The Kansas-based Tatge told the audience “it’s all about trust. The company that is trusted will be successful in the long run.”

This will be Farmobile’s third planting session coming up, “and every year has gotten better and better. We are very excited about what’s to come.”

When Saik closed out the day with his words of wisdom, farmers and agribusiness professionals listened intently.

“You have to have a passion to teach,” he said. “And forget about protecting everything. Give away your information. Farmers want to be taught. And they will come back for more. They will value you as a coach.”

Another point from Saik was to employ “constant integration of technology,” which certainly connected with the Precision Ag audience. “It’s not always fun. It’s what’s called the bleeding edge.”

But it’s important to be there.

Still, after all his business success, Saik said his “best days are still in the field.”