Caledon East farmer sells farm to a residential developer

By Jennifer Jackson

A Caledon farmer sold his 150 acre farm for $97 million to a residential developer, according to a March 29 article in the Caledon Enterprise. The property, known locally as the former McLeod farm, was located on Airport Road, in Caledon East.

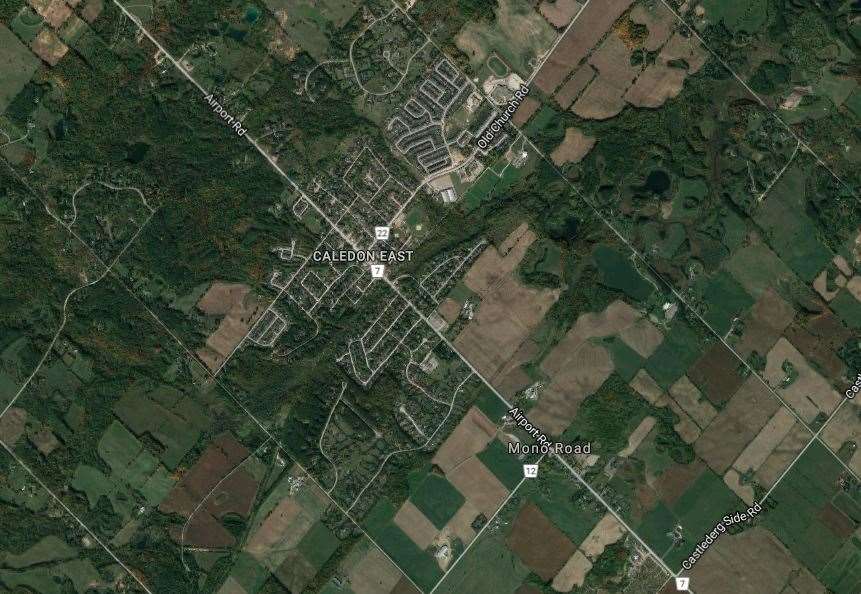

In 2016, Caledon East was home to 4,282 residents. The town is located almost an hour and a half from Toronto’s downtown. Caledon East, however, is still primarily surrounded by agricultural land, according to Google Earth.

Less than a five minute drive from the old McLeod farm are two additional former agricultural properties that will soon house residential subdivisions, boasting some 535 various housing units.

The developing group that bought the McLeod farm plans to build a similar housing development on the property, but has yet to complete a subdivision application, according to the article.

Google Earth photo of Caledon East