The Falcon Premium rail service consists of Canadian National, Union Pacific, and Grupo Mexico to move goods between the US, Canada, and Mexico.

By Andrew Joseph, Farms.com; Images via Canadian National

To counter the Canadian Pacific-Kansas City Southern (CPKCS) North American merger, three other railroads—one each in the US, Mexico, and Canada—have joined forces.

Known as the Falcon Premium intermodal service, the Canadian National, Union Pacific, and Grupo Mexico railroads have allied to ship goods between the three countries.

Previously, only the CPKCS merger shipped between all three countries.

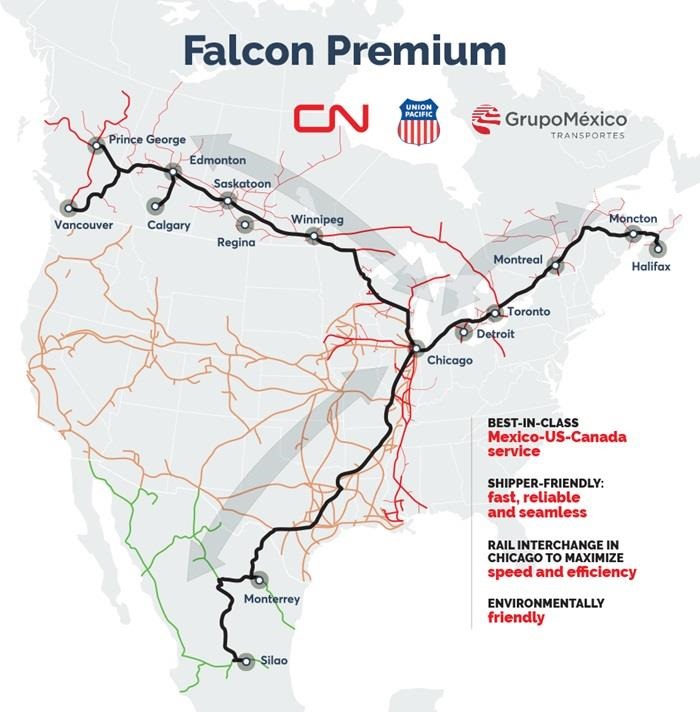

Reports indicate that the Falcon Premium will dip into Mexico via Grupo Mexico railway’s hubs in Monterrey, Nuevo Leon, and Silao, Guanajuato, and enter the US via Eagle Pass, Texas.

From that US point, the Union Pacific railway lines will be followed up into Chicago, Illinois, and Detroit Michigan, where it will then enter from Detroit into Canada and the Canadian National railway network to move goods east through Toronto, Montreal, Moncton, and ending at Halifax.

To the west, from the Chicago hub, the trains will move to Winnipeg, Regina, Saskatoon, Edmonton (with a spur line to Calgary), and then into British Columbia where it splits into two hubs—Vancouver to the south, and Prince George to the north.

The new joint venture is seen in the intermodal industry as a sharp retort to Canadian Pacific’s acquisition of Kansas City Southern this past March for US$31 billion. The CP deal included Kansas City Southern’s subsidiary—Kansas City Southern Mexico.

The CPKCS merger allows grain from the Midwest to move along the Gulf Coast of the US to Mexico. Of course, it also makes it easier to ship goods from Mexico into the US and Canada—though only to the left coast.

The Falcon Premium venture allows everything from food, appliances, auto parts, and more to move from Canada’s east and west coasts into the US and Mexico, if necessary, and vice versa.

According to a phone call to investors on April 24, 2023, the Canadian National, Union Pacific, and Grupo Mexico representative said its service will be better than CPKCS because Falcon Premium has a more extensive network in Mexico, and has Union Pacific’s direct route to the Chicago hub—long considered a central hub of the US and North America.

Regardless of the “fighting words” from Falcon Premium, both it and CPKCS are hopeful their service will encourage more customer usage over the less fuel-efficient truck transport fleets—at least until it can go travel farther without “refueling” with new powertrain technologies.