By Jack Davis

Planting decisions for this spring are complicated given the recent spread of COVID-19. A very busy planting season is approaching quickly. Input suppliers and farmers will be met with a requirement to complete tasks timely to evade economic losses from delays. Planting is reliant on optimal conditions and weather and cannot be suspended because of COVID-19.

The recent changes in price may adjust the mix of planted acres. USDA projected 2020 plantings in the US at 94 million acres of corn, 85 million acres of soybeans, and 45 million acres of wheat. Projected corn acres for 2020 are the fourth highest since 1990. Actual planting will differ from projections and will be reliant on conditions this spring.

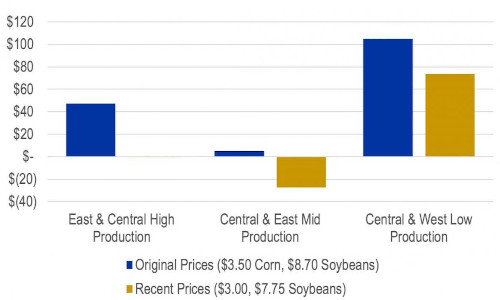

To gauge potential impact of price changes, projected profitability of corn and soybeans in South Dakota were reevaluated with recent price changes. Corn-minus-soybean returns are projected for two scenarios in each of the growing regions of SD high productivity, mid productivity, and low productivity. Original planning prices were $3.50 per bushel for corn and $8.70 soybeans. Green bars in Figure 1 show corn-minus-soybean returns with original prices. Positive values indicate corn is more profitable than soybeans and negative prices indicate soybeans are more profitable. Table 1 shows calculations, with yields and costs coming from South Dakota Crop Budgets.

In a $3.50 corn price and $8.70 soybean price, corn is projected more profitable by $48 per acre in high production, $5 per acre in mid-level production, and $105 in low production. The differences in profitability are farm dependent and can be evaluated using the expected net income tool.

Current fall bids in South Dakota have been near $3.00 per bushel for corn and $7.75 per bushel for soybeans. These prices lower corn profitability more than soybean profitability. Corn and soybeans are equal under high production, -$28 lower than soybeans in mid-level production, $74 for corn in low production. Planting, prevent plant, and individual farm profitability conditions will have the largest impact on acreages planted in South Dakota.

The current market circumstances are unique and dealing with uncertainties will take some time. Expect unpredictable markets as the nation works through current conditions.

Lower prices have a negative impact on cash flow. These price changes lower gross revenue by up to $100 per acre in corn and $52 per acre in soybeans. Farmers will want to be pro-active in talks with their agronomist, input suppliers, and landowners about recent impacts on their farms.

Table 1. Projected corn and soybean returns in South Dakota, Pre-COVID-19 and Current.| | Corn | Soybeans | Corn | Soybeans |

|---|

| Prices | $3.50 | $8.70 | $3.00 | $7.75 |

|

| East and Central High Production |

| Yield | 200 | 55 | 200 | 55 |

| Direct Costs | $366 | $192 | $366 | $192 |

| Fixed Costs | $97 | $97 | $97 | $97 |

| Return to Land | $237 | $190 | $137 | $137 |

|

| Central and East Mid Production |

| Yield | 160 | 50 | 160 | 50 |

| Direct Costs | $287 | $167 | $287 | $167 |

| Fixed Costs | $97 | $97 | $97 | $97 |

| Return to Land | $176 | $171 | $96 | $124 |

|

| Central and West Low Production |

| Yield | 120 | 30 | 120 | 30 |

| Direct Costs | $198 | $144 | $198 | $144 |

| Fixed Costs | $63 | $63 | $63 | $63 |

| Return to Land | $159 | $54 | $99 | $26 |

Yield and cost information from SDSU Extension 2020 Crop Budgets.

Fixed costs in this table do not include land costs.

Return to land is (Yield x Price) - (Direct Costs + Fixed Costs).

Source : sdstate.edu