2017 is shaping up to be another year of tight margins for cattle producers. As much as ranchers would like to limit expenses during market downturns, some expenditures can’t be postponed. Bulls fall into this category. The necessity of having an adequate number of bulls goes without saying. When bull buying time and lackluster market conditions coincide there are a few things to keep in mind that can help prevent the situation from having a negative impact on your operation.

When making purchasing decisions, try to consider value over price. Cutting corners rarely results in a positive outcome in the long run. Buying an inferior quality bull now might save you a few dollars in initial cash outlay, but will likely cost you substantially more over the long run than purchasing a quality animal would have. Bear in mind that the registered cattle market will also be softer this year, although the purebred market typically lags behind the movement of the commercial cattle prices.

The value associated with a bull takes many forms. One of the first forms that can go by the wayside, when buyers are thinking only about price, is the opportunity for risk management and improved calf performance that comes with purchasing a bull with known EPD values. Expected Progeny Differences (EPDs) are figures that predict the performance of a bull’s calves. The science and math behind EPDs can be mind boggling, but the application of the information is fairly straightforward and should be utilized by all cattle producers. The predictive power of EPDs has significant value because it enables bull buyers to stay away from bulls whose calves have a genetic propensity towards negative traits (ie. higher birth weights), and focus on bulls whose calves will be more likely to exhibit positive traits (ie. higher weaning weights).

Purchasing a bull without data is a risk not worth taking. Think about the cost of a calf lost due to calving difficulties, or the earning potential given up by selecting a bull whose calves have substandard growth potential. Remember, a bull will sire numerous calves over his productive lifetime, so even small advantages in performance can have substantial cumulative effects. Why would you give up the opportunity to make an informed selection decision by buying a bull without data?

Assuming you are planning on utilizing performance data in your bull selection process (if not, read the previous paragraphs again), there are some basic steps that can be taken to maximize the value associated with your decision.

Step 1) Identify the type of production system in which the bull will be utilized, and what traits are most economically significant in that type of system. How will the bull’s progeny be marketed or utilized? If all progeny are sold at weaning, the list of significant traits are pretty short: calving ease and weaning weight. If heifers sired by the bull are going to be kept the list gets much longer, as all of the maternal characteristics come into play. If calves are marketed based on carcass merit, then even more factors become economically significant. Beware of single trait selection, but also recognize that you also can’t effectively select for all traits simultaneously. Focus your selection pressure on traits with the largest return on investment.

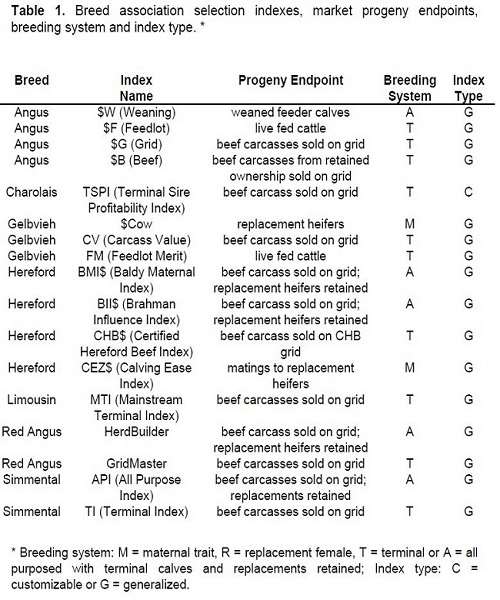

Step 2) Identify the selection tools available that address these traits. By this point in the process a decision will have to be made regarding which breed of bull you are looking for (this can be a lengthy conversation in and of itself), because the specific resources available will differ from breed to breed. There are specific EPDs that are linked to many economically significant traits. These EPDs are an excellent place to start, but when many traits are being considered simultaneously a simpler technique is to utilize Economic Selection Indices. These indices, which are expressed as $ values, incorporate the economic value of multiple EPDs. Because Economic Selection Indices consider values based on economic significance, it is crucial that bull buyers utilize an index that accurately reflects their operation.

Step 3) Utilize the tools to select bulls that are the most likely to provide the greatest value to your operation. Effectively using EPDs and Indices, like any other tool, takes some practice and basic understanding. To maximize the effectiveness of the selection tools be sure you are familiar with breed averages, and percentile breakdowns for various traits. (See list below) This will help you better understand how well the bulls you are considering stack-up within the breed. EPD accuracy (possible change), and the units of measure are also important to keep in mind to help determine what constitutes a meaningful difference between individual bulls.

Source: ufl.edu