By Josh Maples

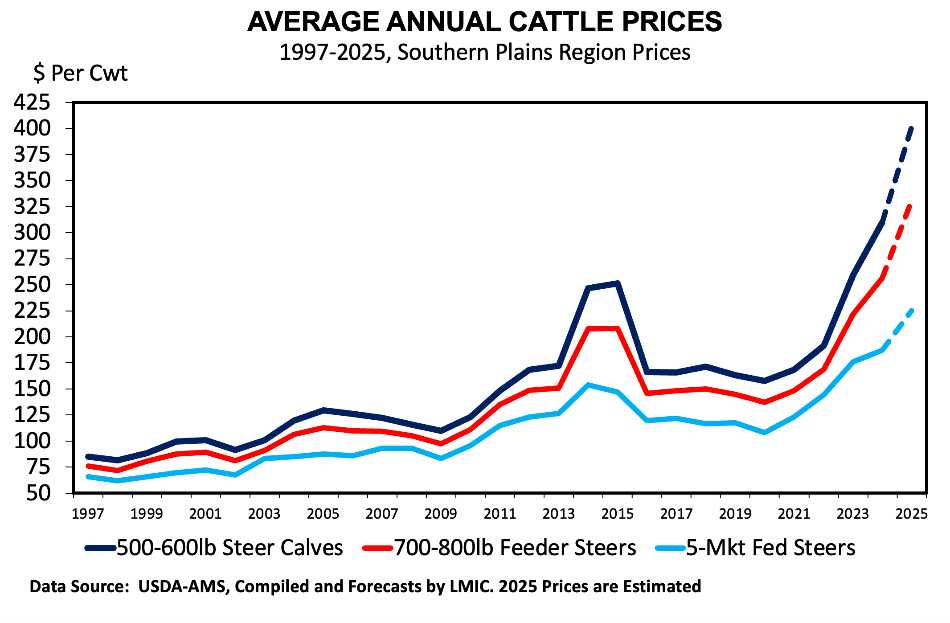

Cattle prices are starting the year strong again. Auction prices are above year-ago levels across cattle classes and weights. 2025 marked the fifth consecutive year of annual increases in fed cattle prices. Over the past 35 years, the only other stretch of five consecutive years of increases was 2010-2014. Whether 2026 will be another year of increasing prices is just one of many stories to track in 2026 for the U.S. beef cattle sector. However, many of the themes will likely be most impacted by the possibility and pace of beef herd expansion.

Despite multiple years of favorable prices, there’s been little sign of widespread heifer retention just yet. That could change somewhat when the annual USDA Cattle Inventory report is released at the end of January. However, it appears unlikely at this point to expect that report to suggest any meaningful expansion has occurred. It is more likely the report may confirm that rebuilding the herd will be a more prolonged effort this time than it was a decade ago. The number of beef cows expected to calve in 2026 will likely be very similar to 2025 and driven by reduced cow culling in 2025, but the beef heifer retention stat is the number I’ll be watching closest.

The number of heifers retained for beef cow replacement has declined each year since 2017. The next report will shed light on how much retention occurred in 2025 and whether it will break the 8-year trend of declining replacements. In total, there were about 1.5 million fewer heifers for beef cow replacement at the start of 2025 compared to the start of 2017. Herd expansion was in full force in 2014 and 2015, however, the number of beef heifers held for replacement had already been increasing since 2011. Even if the 2026 report shows an increase in heifers retained during 2025, it will take a few years to meaningfully rebuild supplies. Replacement heifers were 16 percent (884 thousand head) lower at the start of 2025 than at the start of 2014.

Source : osu.edu