By Don Shurley

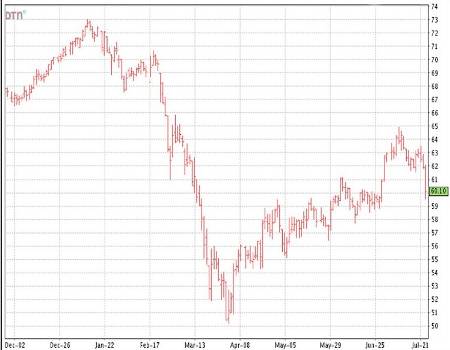

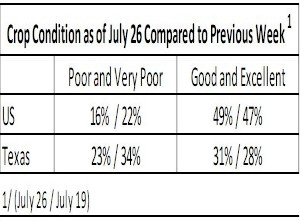

New crop December futures made its run to near 65 cents a couple of weeks ago. That rally was fueled by US crop conditions/concerns and strong export shipments. Price has since trended down—hammered by 2 consecutive down days to close out last week—down almost 2 ½ cents total on Thursday and Friday.

For the better part of 2 months prior to the rally to near 65, price was stuck in a range of mostly 57 to 60 cents. With the August USDA numbers looming (the first survey-based estimates), the direction this market takes is in the balance. Will 60 cents hold and give us a foundation for potentially another rally or will price retreat back to the previous 57-60 rut? At this writing, price has recovered a bit—back to 61.

Reports suggests the weakness that has developed is due to new recent political friction between the US and China (that might sour trade between the 2 countries), improved weather, and export sales cancellations.

Tensions between the US and China are at a peak. Last week the Trump administration ordered the Chinese consulate in Houston closed amid allegations of stealing information. China retaliated by closing the US consulate in Chengdu. With cotton demand already weak and a large quantity of sales to China yet to be shipped, any escalation in diplomatic tensions between the US and China creates more uncertainty in demand.

For the week ending July 16, export sales were a weak 17,300 bales. Sales cancellations were 19,000 bales. A lot is being made of these cancellations and the week before as well. Cancellations are problematic but magnified by weak new sales.

As of July 16, with 2 weeks remaining in the 2019 crop marketing year, there were 1.39 million bales in 2019 crop sales to China yet to be shipped. New 2020 crop sales to date to China total 1.26 million bales. Escalating tensions between the US and China threaten both 2020 and remaining 2019 sales and shipments.

For the week ending July 16, shipments to all destinations totaled 281,800 bales—12.5% below the previous week. With 2 reporting weeks remaining in the 2019 crop year, shipments need to average 430,000 bales per week or 42% above the pace of the last 2 weeks to meet USDA’s projection of 15.2 million bales for the marketing year.

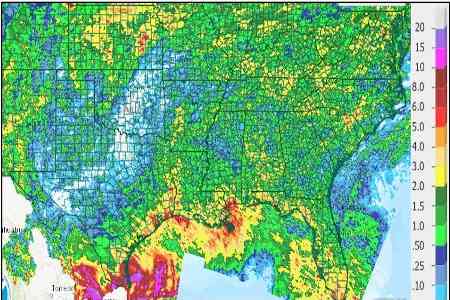

Over the past week, the Cotton Belt has received rainfall. Even most of Texas received at least some precipitation. Category 1 Hurricane Hannah brought wind and rain along the Coastal Bend area but NASS says that damage reports are not yet available. Tropical Storm Gonzalo has dissipated and is not a threat.

The US crop is currently projected at 17.5 million bales. We have said in this space previously that a diminished US crop may not be enough to take us to higher prices. Last week’s activity should be proof of that. If we are going to make another run at 65 cents or better, fears and uncertainty over demand and trade must subside. The US crop may even have to get a little smaller or production reduced somewhere else in the World. The preferred combination is a good US crop with much improved demand but that may be down the road a ways.

Source : ufl.edu