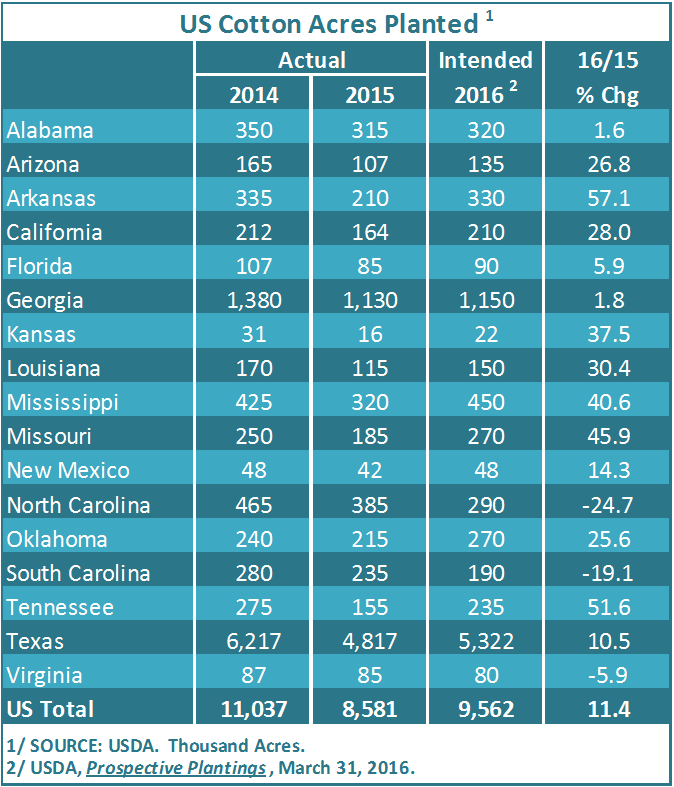

US cotton growers say they intend to plant 9.56 million acres this year. We’ve likely all seen or heard the numbers by now so there’s little reason to plow that ground again.

Prior to USDA’s Prospective Plantings report yesterday, there were at least two other acreage estimates out there—an estimate by the National Cotton Council (9.1 million acres) and the number given by USDA economists at the annual Outlook Forum (9.4 million acres).

At the time the Council number was released (early February), some observers and analysts thought the number was on the low side. But as cotton prices began to slide during February, some opinions were that maybe acreage could even be below the Council’s number. But in late February, USDA economists at their annual Outlook Forum quoted the 9.4 million acre number.

Cotton prices have since hit rock bottom in late February-early March but have currently “improved” and stand at about 59 cents, despite acreage being above earlier projections.

We all know that in the cotton business, perhaps more so than in any crop, acreage to actually be harvested and yield are ultimately much more important than acres planted. This is largely because of weather and weather-related risk in Texas.

So, spending a little time discussing acres planted is fine for now, but it will all ultimately come down to what the weather does now (as this will determine what intended acres actually get planted) and what happens during the growing season.

A few observations:

Texas growers intend to plant 5.32 million acres. This is 10.5% more than last year and about ¼ million acres more than the Council estimate back in early February. This higher number was largely expected. Texas growers “intended” to plant an even larger acreage (5.7 ma) last year, but were prevented from doing so by rain and delayed planting. Even last year’s June Acreage report had Texas at 5.2 million acres before being revised further down again due to weather. Many Texas growers have no or few alternatives to cotton, so even with lower cotton prices, 2016 acreage was expected to be consistent with what last year’s acreage could have been had the weather cooperated.

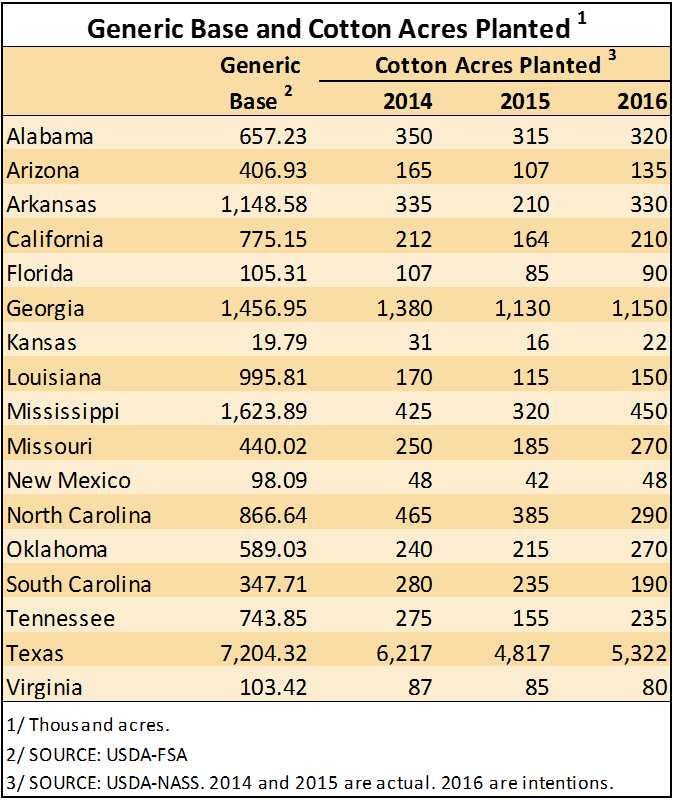

The Mid-South, in total, is expected up 46%. This is huge. As we all know, this area has largely shifted away from cotton during the past 5 or 6 years or so, due to better net returns from soybeans and corn. Mid-South acreage was down 450,000 in 2015, so if these numbers hold, 2016 will be back to 2014 levels. Because of the decline in cotton plantings in recent years, farms in the Mid-South have a lot of Generic Base compared to cotton acres planted. Corn and soybeans planted and assigned to Generic Base are eligible for ARC/PLC. To now make such a huge shift back to cotton, one factor might be that Mid-South growers could feel less confident about the corn and soybean outlook and/or ARC/PLC payments—despite cotton prices being down.

Of 17 cotton-producing states, acreage (intentions) are up in all but 3 states—North Carolina, South Carolina, and Virginia. Acreage is expected down 21%. Growers in the Carolinas and Virginia are coming off a disastrous 2015 crop where yield and quality were decimated by rainfall. Many growers are hurting financially. Corn is expected to be up in all 3 states. Peanuts are expected up in North Carolina. Reduced cotton plantings could be due to farmer’s decision to go with cheaper crops to grow—to have less invested and less at risk. Some farmers could also have difficulty getting the credit needed.

In Georgia, the National Cotton Council estimate for 2016 called for a 5% reduction. USDA acreage intentions estimate a 1.8% increase. The Council acreage number was thought to be low. This week’s USDA number looks closer to being more right. The key to Georgia’s cotton acreage for this year was peanuts. Would farmers again plant a high peanut acreage? Peanut acreage intentions in Georgia are 730,000 acres—down 55,000 acres from 2015 planting. A reduction of this magnitude is a bit surprising, given that Georgia has 753,000 acres of peanut base plus the eligibility for ARC/PLC for peanuts assigned to Generic Base. Under the new farm bill, peanut acreage is thought to at least be equal to its own base. When all is said and done, peanuts could be up a bit more and this could come from corn or soybeans but not likely cotton.

So, we have the estimates of what farmers say they intend to plant. What will actually be planted depends on several factors. Because of how the Loan and LDP/MLG program works, I wouldn’t expect a change in cotton prices to have much impact on cotton acres planted, unless Dec16 gets into the 60’s (around 65 to be more precise).

Any changes from the intentions are more likely to come from changes in the price of alternative crops like corn and soybeans. Change would also be due to the availability of contracts and storage in peanut-producing states.

Weather will also be a factor. If wet field conditions persist here in Georgia, this would push us past the optimal planting times for corn, and that acreage could shift likely to cotton or peanuts. Elsewhere, rain and wet conditions could shift cotton acres to soybeans.

Source:ufl.edu