By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

By Gary Schnitkey and Krista Swanson et.al

Department of Agricultural and Consumer Economics

University of Illinois

This article analyzes if the US December cash price can help inform the annual farm program decision between ARC-CO (Agriculture Risk Coverage – county) and PLC (Price Loss Coverage). The analysis finds that the ratio of US December cash price for the current crop year to the reference price for the next crop year was 81% accurate in predicting whether ARC-CO or PLC paid the most per base acre in the next crop year. Accuracy improved the more the ratio differed from 100%. A follow-up article will address the 2022 decision when the US December 2021 cash price is released.

Program Overview

ARC-CO is a revenue decline program, where decline is defined relative to 86% of a county benchmark based on revenue from the market for 5 recent crop years. PLC is a low US price program, where low is defined relative to 100% of a reference price set by Congress. ARC-IC (ARC – individual), a third program option, makes payments when average per acre actual revenue from all program crops planted on an ARC-IC farm unit is less than 86% of its per acre benchmark revenue. An ARC-IC farm unit is the sum of a producer’s share in all FSA farms the producer enrolls in ARC-IC in a state. ARC-CO and PLC pay on 85% of base acers while ARC-IC pays on 65% of base acres. ARC-CO and ARC-IC have a 10% per acre payment cap while PLC has a payment cap dependent on the difference between a crop’s reference price and loan rate. Crop insurance’s Supplemental Coverage Option (SCO) is available if PLC, but not ARC-CO or ARC-IC, is elected. For additional discussion of these program options see Data Note 1.

Decision Framework and Data

A trade-off exists in making the ARC-CO – PLC decision: assistance from ARC-CO but not PLC when revenue declines and market price is above the reference price vs. larger assistance from PLC than ARC-CO when market price is below the reference price. The relationship between a program crop’s market and reference price is critical. Hence, the prediction variable is the ratio of US December cash price to the effective reference price for a program crop (hereafter, December cash-reference price ratio). The December cash price is reported at the end of January, which is late in the sign up period. To illustrate the calculation, the December 2019 cash price for wheat was $4.64 and the 2020 wheat reference price was $5.50. The resulting ratio is 84% ($4.64/$5.50), indicating PLC is expected to pay more per base acre for 2020 wheat. If the ratio exceeds 100%, ARC-CO is expected to pay more. The December cash price is from Quick Stats (USDA (US Department of Agriculture), NASS (National Agricultural Statistical Service). The Reference price as well as program payments are from USDA, FSA (Farm Service Agency).

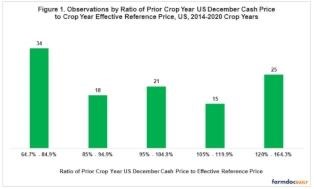

Crop years examined are 2014-2020. ARC-CO and PLC were program options and data are complete. Roughly 50% of the 113 program crop – crop year observations have a December cash-reference price ratio below 85% or above 120% (see Figure 1 and Data Note 2). The middle 50% of observations are spread fairly evenly across 85%-95%, 95%-105%, and 105%-120% categories.

Prediction Accuracy

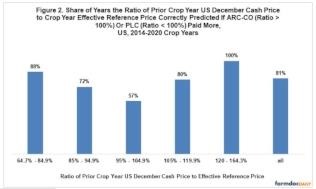

To restate the prediction rule, PLC is expected to pay more per base acre if the December cash-reference price ratio is less than 100%. If the ratio equals or exceeds 100%, ARC-CO is expected to pay more per base acre. This prediction rule correctly predicted which program paid more 81% of the time (see Figure 2). Except for the middle category, accuracy exceeded 70% and was 100% when the ratio exceeded 120%. For the middle category of 95%-104.9%, the prediction rule’s accuracy was slightly over 50%. An accuracy of close to 50% was not unexpected for the middle category since the prediction rule does not lean strongly to one program over the other.

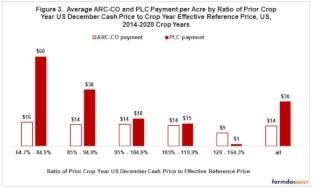

Another decision factor is average payment per base acre. It was much higher for PLC when the December cash-reference price ratio was less than 95% and especially 85% (see Figure 3). PLC’s payment was higher because (1) payment starts at 100% of the effective reference price vs. 86% of the effective reference price for ARC-CO, assuming normal yields, and (2) PLC’s payment cap per acre is much larger. ARC-CO paid more per base acre when the ratio exceeded 120%. PLC rarely made payments if the ratio exceeded 120%. When the ratio exceeds 120%, high prices dampen ARC-CO payments. ARC-CO and PLC made similar average payments per base acre when the December cash-reference price ratio was between 95% and 120%.

Summary Observations

The ratio of the current crop year’s US December cash price next crop year’s effective reference price was 81% accurate in predicting if ARC-CO or PLC would pay more per base acre the next crop year.

The past does not always predict the future, but, assuming the historical experience of 2014-2020 remains relevant, the US December cash – reference price ratio provides useful information when deciding between ARC-CO and PLC.

This ratio was particularly useful when less than 95% (PLC pays more) or above 105% (ARC-CO pays more).

It is worth noting that choosing the “wrong” program for the next crop year does not mean payment will be zero or even small. On average, non-trivial payments are made by ARC-CO when the price ratio was less than 95% and by PLC when the price ratio was between 100% and 120%.

A follow-up article will address the 2022 crop year program decision when the US December 2021 cash price is released at the end of January 2022.

Data Notes

- ARC’s benchmark revenue is determined using 5-year Olympic averages (removes high and low values) of county (ARC-CO) or farm (ARC-IC) yield and US crop year price. The effective reference price is a floor on a year’s price. PLC payment yield is fixed by farm for each program crop. ARC-IC calculations are more complex. Situations when ARC-IC is an option to consider are discussed by Zulauf, et al. in an October 29, 2019 farmdoc daily article.

- There are currently 23 covered program commodities. Seed cotton was not a program commodity for the 2014-2017 crop years. No US December cash price is reported for crambe, mustard, rapeseed, medium-short grain rice, safflower, and sesame. California price for medium-short grain rice is used for temperate Japonica rice. California accounts for almost all US production.

Source : illinois.edu