By Alan Levitt

Strong overseas sales of milk powder, whey products and cheese pace U.S. efforts in world dairy market.

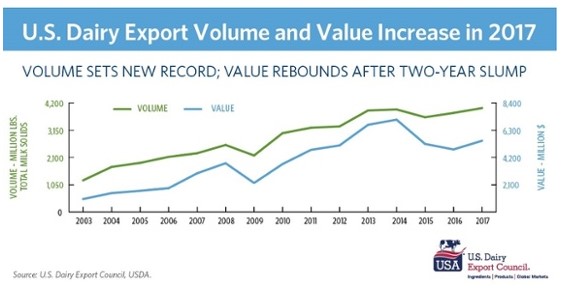

U.S. dairy exports reached $5.48 billion in 2017, up 14 percent from 2016, and the most in three years.

In volume terms, suppliers shipped 1.935 million tons of milk powder, cheese, butterfat, whey and lactose last year, up 6 percent, and surpassing the previous high volume exported in 2014, according to U.S. Dairy Export Council (USDEC) analysis of U.S. Department of Agriculture (USDA) year-end numbers released this morning.

On a total milk solids basis, U.S. exports were equivalent to 14.7 percent of U.S. milk production in 2017, up from 14.2 percent in 2016, and the highest percentage since 2014. Imports were equivalent to 3.4 percent of production.

Exporters enjoyed gains across most major markets. Mexico remained the number-one partner, with 2017 sales of $1.3 billion (+8 percent). Other notable increases in value came from China (+49 percent), Japan (+41 percent), Oceania (+50 percent), South Korea (+21 percent) and the Middle East/North Africa (MENA) region (+21 percent).

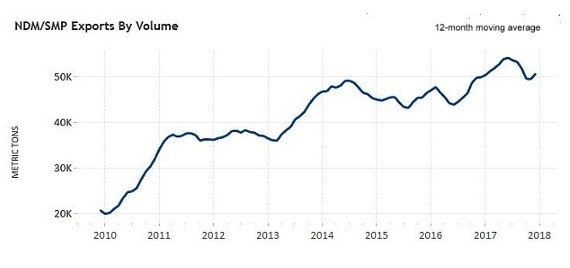

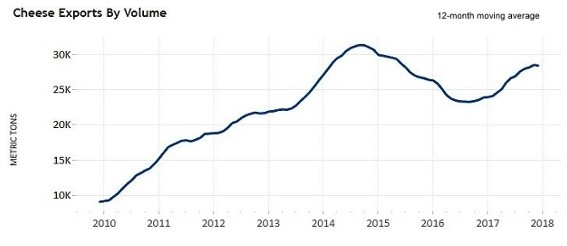

Nonfat dry milk/skim milk powder (NDM/SMP) and whey exports posted new record highs in 2017, while cheese shipments increased 19 percent. These three categories make up more than two-thirds of U.S. dairy exports.

Exports of NDM/SMP were 608,091 tons last year, up 1 percent from 2016. Nearly half of U.S. powder exports went to Mexico, where sales were down slightly. Gains in exports to China (+90 percent, +16,000 tons) and Japan (+249 percent, +9,000 tons) offset large declines in sales to Southeast Asia (-16 percent, -32,000 tons), primarily Indonesia, Vietnam and Philippines.

(Official USDA data continues to show an increase in WMP exports to Mexico. However, Mexican import data and trade sources don’t corroborate this, and we believe this volume represents SMP sales that were misclassified at the port. Therefore, we’ve adjusted NDM/SMP and WMP trade data for June 2016 to November 2017 to account for this misclassification.)

Total whey exports were 549,018 tons, up 9 percent vs. last year. Increases were driven by dry whey (+11 percent) and modified whey products (mostly permeate), (+15 percent). Shipments of whey protein concentrate (WPC) and whey protein isolate (WPI) were up just 2 percent and 3 percent, respectively.

Nearly 45 percent of U.S. whey sales went to China last year, and China purchases were up 16 percent (+35,000 tons). Sales of dry whey to China were 41 percent higher (+28,000 tons) and exports of modified whey were up 28 percent (+18,000 tons). This offset a 16-percent decline in sales of WPC (-12,000 tons).

Exporters also saw a 19-percent increase in whey sales to Mexico (+8,000 tons), led by a boost in shipments of WPC. Meanwhile, whey exports to Southeast Asia were lower in 2017 (-14 percent, -14,000 tons).

On WPI, exports to Japan nearly doubled (+2,000 tons), while shipments to Canada were down 14 percent (-1,300 tons).

Cheese exports reached a three-year high in 2017 at 341,085 tons, topping prior-year volumes in almost every month. Increases came from nearly every major market last year, led by Australia (+93 percent, +15,000 tons), South Korea (+23 percent, +10,000 tons), Mexico (+7 percent, +6,000 tons), Southeast Asia (+52 percent, +6,000 tons), Japan (+16 percent, +5,000 tons), the MENA region (+30 percent, +5,000 tons) and China (+44 percent, +4,000 tons).

Exports of butterfat increased 14 percent in 2017, to 27,653 tons. Exports to the MENA region (mostly Saudi Arabia and Egypt) almost doubled (+2,300 tons), while sales to Canada were 25 percent higher (+2,200 tons). Shipments to Mexico dropped 55 percent (-5,100 tons).