By Aaron Smith

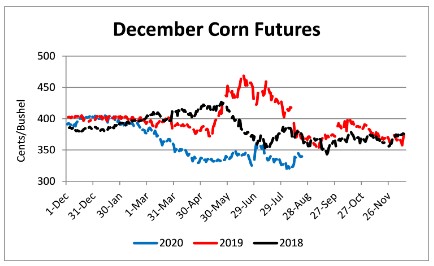

December corn futures were able to hold most of last week’s 20 cent gain, trading mostly between $3.35 and $3.45 for the week. The yield loss from last week’s derecho is still being assessed in parts of Iowa, Illinois, and Wisconsin. Even if 250-500 million bushels were lost due to the storm, the US is still looking at a potential record crop. Prices are unlikely to advance beyond $3.50 unless losses are greater than anticipated.

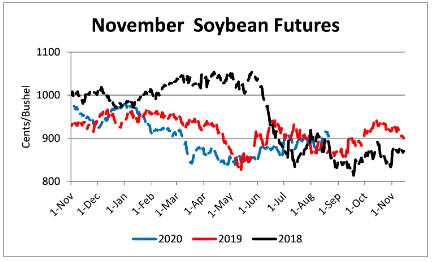

November soybeans established a five month high this week at $9.17 ½. Large export sales to China for the 2020/21 marketing year have been the catalyst for the rally in soybeans that have pushed prices up over 40 cents the past two months. Continued strong export sales will be needed if further gains are to be achieved. Even with strong demand, a record projected U.S. yield (53.3 bu/acre) and anticipated record plantings in Brazil will provide headwinds for maintaining the rally. Getting some downside price protection should be considered for producers that have limited 2020 production priced. For example, buying an $8.80 November put option for 8 cents would provide low cost protection in case trade relations soured between China and the US while allowing the producer to participate in any continued market rallies.

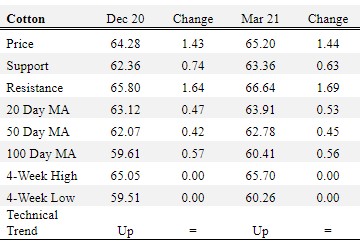

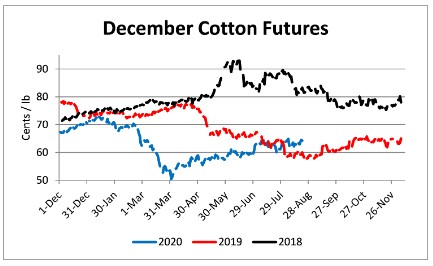

December 2020 cotton futures are approaching 65 cents, a key area of resistance. Even if cotton is able to breakout above 65 cents it seems unlikely that it will be able to hold prices at or above this level. There is an abundance of cotton reserves in the US and overseas and with demand uncertainty it seems more likely that prices will start to trend lower even with national abandonment projected at 24%, up from 16% last year. Getting some downside price protection should strongly be considered.

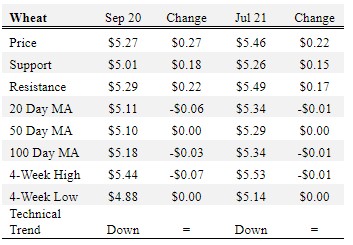

Wheat prices are trending up for a second straight week. Sales should be considered when prices exceed $5.30, particularly if bin space is needed for corn harvest. Prices have been oscillating between $4.80 and $5.40 since the end of April.

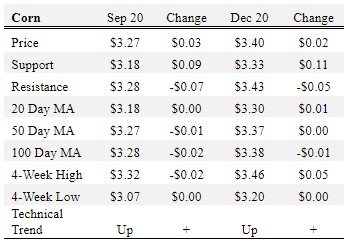

Corn

Ethanol production for the week ending August 14 was 0.926 million barrels per day, up 8,000 barrels from the previous week. Ethanol stocks were 20.27 million barrels, up 0.520 million barrels compared to last week. Corn net sales reported by exporters for August 7-13 were down compared to last week with net sales of 2.4 million bushels for the 2019/20 marketing year and 28.5 million bushels for the 2020/21 marketing year. Exports for the same time period were down 10% from last week at 47.1 million bushels. Corn export sales and commitments were 97% of the USDA estimated total exports for the 2019/20 marketing year (September 1 to August 31) compared to the previous 5-year average of 104%. Across Tennessee, average corn basis (cash price-nearby futures price) weakened at Northwest and strengthened or remained unchanged at Mississippi River, West-Central, North-Central, and West elevators and barge point. Overall, basis for the week ranged from 5 under to 16 over, with an average of 7 over the September futures. September 2020 corn futures closed at $3.27, up 3 cents since last Friday. For the week, September 2020 corn futures traded between $3.20 and $3.32. Sep/Dec and Sep/Mar future spreads were 13 and 26 cents.

Nationally the Crop Progress report estimated corn condition at 69% good-to-excellent and 10% poor-to-very poor; corn dough at 76% compared to 59% last week, 50% last year, and a 5-year average of 69%; and corn dented at 23% compared to 11% last week, 13% last year, and a 5-year average of 24%. In Tennessee, the Crop Progress report estimated corn condition at 74% good-to-excellent and 5% poor-to-very poor; corn silking at 100% compared to 98% last week, 99% last year, and a 5-year average of 100%; corn dough at 86% compared to 70% last week, 92% last year, and a 5-year average of 94%; and corn dented at 43% compared to 11% last week, 57% last year, and a 5-year average of 61%. In Tennessee, new crop cash corn contracts ranged from $3.14 to $3.56. December 2020 corn futures closed at $3.40, up 2 cents since last Friday. Downside price protection could be obtained by purchasing a $3.50 December 2020 Put Option costing 17 cents establishing a $3.33 futures floor. March 2021 corn futures closed at $3.53, up 4 cents since last Friday.

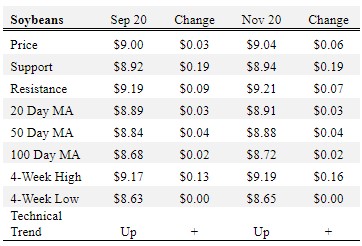

Soybeans

Net sales reported by exporters were down compared to last week with net sales cancelations of 0.5 million bushels for the 2019/20 marketing year and net sales 94.5 million bushels for the 2020/21 marketing year. Exports for the same period were down 19% compared to last week at 33.0 million bushels. Soybean export sales and commitments were 106% of the USDA estimated total annual exports for the 2019/20 marketing year (September 1 to August 31), compared to the previous 5-year average of 104%. Across Tennessee, average soybean basis strengthened at Northwest, North-Central, and West-Central and weakened at West and Mississippi River elevators and barge points. Basis ranged from 2 over to 32 over the September futures contract. Average basis at the end of the week was 18 over the September futures contract. September 2020 soybean futures closed at $9.00, up 3 cents since last Friday. For the week, September 2020 soybean futures traded between $8.99 and $9.17. Sep/Nov and Sep/Jan future spreads were 4 and 11 cents. September soybean-to-corn price ratio was 2.75 at the end of the week.

Nationally the Crop Progress report estimated soybean condition at 72% good-to-excellent and 7% poor-to-very poor; soybeans blooming at 96% compared to 92% last week, 88% last year, and a 5-year average of 94%; and soybeans setting pods at 84% compared to 75% last week, 64% last year, and a 5-year average of 79%. In Tennessee, soybean condition was estimated at 73% good-to-excellent and 6% poor-to-very poor; soybeans blooming at 92% compared to 84% last week, 89% last year, and a 5-year average of 92%; and soybeans setting pods at 73% compared to 58% last week, 71% last year, and a 5-year average of 78%. In Tennessee, new crop soybean cash contracts ranged from $8.93 to $9.48. Nov/Dec 2020 soybean-to-corn price ratio was 2.66 at the end of the week. November 2020 soybean futures closed at $9.04, up 6 cents since last Friday. Downside price protection could be achieved by purchasing a $9.10 November 2020 Put Option which would cost 21 cents and set an $8.89 futures floor. January 2021 soybean futures closed at $9.11, up 8 cents since last Friday.

Cotton

Net sales reported by exporters were up compared to last week with net sales of 128,000 bales for the 2020/21 marketing year and 4,900 for 2021/22 marketing year. Exports for the same time period were up 31% compared to last week at 421,500 bales. Upland cotton export sales were 48% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 45%. Delta upland cotton spot price quotes for August 20 were 59.42 cents/lb (41-4-34) and 61.67 cents/lb (31-3-35). Adjusted World Price (AWP) decreased 0.32 cents to 48.6 cents.

Nationally, the Crop Progress report estimated cotton condition at 45% good-to-excellent and 22% poor-to-very poor; cotton setting bolls at 80% compared to 71% last week, 83% last year, and a 5-year average of 82%; and cotton bolls opening at 15% compared to 9% last week, 23% last year, and a 5-year average of 14%. In Tennessee, cotton condition was estimated at 69% good-to-excellent and 17% poor-to-very poor; cotton squaring at 98% compared to 94% last week, 100% last year, and a 5-year average of 99%; and cotton setting bolls at 88% compared to 79% last week, 90% last year, and a 5-year average of 90%. December 2020 cotton futures closed at 64.28, up 1.43 cents since last Friday. For the week, December 2020 cotton futures traded between 62.68 and 64.72 cents. Dec/Mar and Dec/Dec cotton futures spreads were 0.92 cent and 0.08 cent. Downside price protection could be obtained by purchasing a 65 cent December 2020 Put Option costing 2.9 cents establishing a 62.1 cent futures floor. March 2021 cotton futures closed at 65.2 cents, up 1.44 cents since last Friday. December 2021 cotton futures closed at 64.36 cents, up 0.79 cents since last Friday.

Wheat

Wheat net sales reported by exporters were up compared to last week with net sales of 19.2 million bushels for the 2020/21 marketing year. Exports for the same time period were down 13% from last week at 15.0 million bushels. Wheat export sales were 42% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 43%.

Nationally the Crop Progress report estimated winter wheat harvested at 93% compared to 90% last week, 92% last year, and a 5-year average of 96%; spring wheat condition at 70% good-to-excellent and 6% poor-to-very poor; and spring wheat harvested at 30% compared to 15% last week, 14% last year, and a 5-year average of 43%. In Tennessee, August 2020 wheat cash contracts ranged from $5.16 to $5.35. September 2020 wheat futures closed at $5.27, up 27 cents since last Friday. September 2020 wheat futures traded between $5.00 and $5.27 this week. September wheat-to-corn price ratio was 1.61. Sep/Dec and Sep/Jul future spreads were 8 and 19 cents. December 2020 wheat futures closed at $5.35, up 26 cents since last Friday. December wheat-to-corn price ratio was 1.57. July 2021 wheat futures closed at $5.46, up 22 cents since last Friday. Downside price protection could be obtained by purchasing a $5.50 July 2021 Put Option costing 37 cents establishing a $5.13 futures floor.

Source : tennessee.edu