Overview

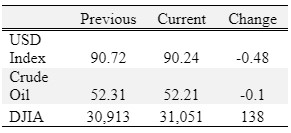

Corn, soybeans, and wheat were down; cotton was up for the week.

This week corn, soybean, and wheat markets took a step back. March corn was down 41 cents from last week’s high of $5.41 ½; March soybeans were down 125 cents compared to last week’s high of $14.36 ½; and March wheat was down 59 cents compared to last week’s high of $6.93. The correction across markets was not unexpected as corn, soybean, and wheat futures had gained $1.75/bu, $4.50/bu, and $1.10/bu since August. A decrease in prices was inevitable. The question moving forward is: Is this a temporary decline, brought on by an overheated market, or is this the start of down trend? I would tend to lean toward the former rather than the latter and would suggest that futures are looking to find a new trading range rather than start a downtrend. The under lying supply and demand numbers supported the August 2020-January 2021 rally, but you can only have so many weeks with double digit gains before the market declines and seeks a to establish a new trading range. Next week we are likely to see some volatility as markets seek a path forward. Nearby soybean futures should find support near $12.50, corn near $4.50, and wheat near $6.00.

Harvest futures also pulled back this week and now December corn is at $4.30, November soybeans at $11.12, and wheat at $6.24. Hopefully producers got some 2021 production priced before the correction on Friday. With this correction, now may be a good time to take a deep breath and revisit where your pricing is relative to your marketing plan. There is still plenty of time in the marketing year, but to take advantage of high prices in futures markets producers need to get some 2021 production priced.

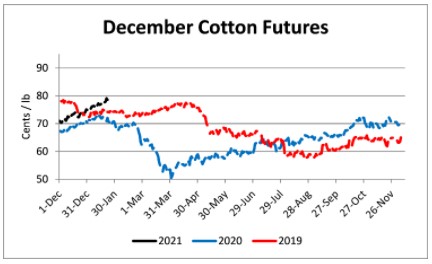

Cotton futures were up for the week, but experienced a sharp pull back on Friday losing over a cent off the nearby futures contact and 0.57 cents off the December contract. Harvest prices near 79 cents are a very good price to get started and if cotton futures breach 80 cents pricing up to 50% of projected 2021 production should be considered.

Corn

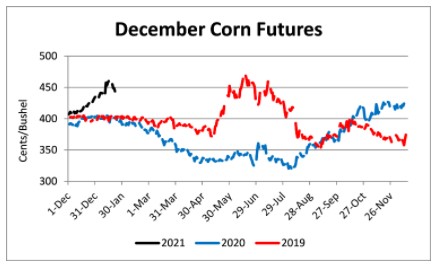

Ethanol production for the week ending January 15 was 0.945 million barrels per day, up 4,000 barrels from the previous week. Ethanol stocks were 23.628 million barrels, down 0.064 million barrels compared to last week. Corn net sales reported by exporters for January 8-14 were up compared to last week with net sales of 56.6 million bushels for the 2020/21 marketing year and 1.8 million bushels for the 2021/22 marketing year. Exports for the same time period were down 39% from last week at 34.9 million bushels. Corn export sales and commitments were 72% of the USDA estimated total exports for the 2020/21 marketing year (September 1 to August 31) compared to the previous 5-year average of 56%. Across Tennessee, average corn basis (cash price-nearby futures price) weakened at Northwest, North-Central, West-Central, West, and Mississippi River elevators and barge points. Overall, basis for the week ranged from 5 over to 43 over, with an average of 25 over the March futures at elevators and barge points. March 2021 corn futures closed at $5.00, down 31 cents since last Friday. For the week, March 2021 corn futures traded between $4.99 and $5.34. Mar/May and Mar/Dec future spreads were 3 and -70 cents. May 2021 corn futures closed at $5.03, down 31 cents since last Friday.

Corn | Mar 21 | Change | Dec 21 | Change |

Price | $5.00 | -$0.31 | $4.30 | -$0.30 |

Support | $4.84 | -$0.21 | $4.15 | -$0.25 |

Resistance | $5.31 | -$0.16 | $4.54 | -$0.13 |

20 Day MA | $4.95 | $0.16 | $4.41 | $0.06 |

50 Day MA | $4.54 | $0.08 | $4.22 | $0.04 |

100 Day MA | $4.23 | $0.06 | $4.06 | $0.03 |

4-Week High | $5.41 | $0.00 | $4.65 | $0.00 |

4-Week Low | $4.41 | $0.18 | $4.17 | $0.07 |

Technical Trend | Up | = | Up | = |

December 2021 corn futures closed at $4.30, down 30 cents since last Friday. Downside price protection could be obtained by purchasing a $4.40 December 2021 Put Option costing 45 cents establishing a $3.95 futures floor.

Soybeans

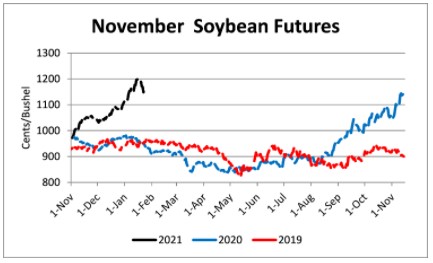

Net sales reported by exporters were up compared to last week with net sales of 66.8 million bushels for the 2020/21 marketing year and 30.5 million bushels for the 2021/22 marketing year. Exports for the same period were up 17% compared to last week at 87.4 million bushels. Soybean export sales and commitments were 95% of the USDA estimated total annual exports for the 2020/21 marketing year (September 1 to August 31), compared to the previous 5-year average of 75%. Across Tennessee, average soybean basis weakened or remained unchanged at West-Central, Mississippi River, West, North-Central, and Northwest elevators and barge points. Basis ranged from 5 under to 41 over the March futures contract. Average basis at the end of the week was 26 over the March futures contract. March 2021 soybean futures closed at $13.11, down 105 cents since last Friday. For the week, March 2021 soybean futures traded between $13.05 and $14.21. Mar/May and Mar/Nov future spreads were 0 and -199 cents. May 2021 soybean futures closed at $13.11, down 103 cents since last Friday. March 2021 soybean-to-corn price ratio was 2.62 at the end of the week.

Soybeans | Mar 21 | Change | Nov 21 | Change |

Price | $13.11 | -$1.05 | $11.12 | -$0.85 |

Support | $12.66 | -$1.24 | $10.65 | -$0.88 |

Resistance | $13.89 | -$0.66 | $11.88 | -$0.27 |

20 Day MA | $13.46 | $0.26 | $11.42 | $0.16 |

50 Day MA | $12.44 | $0.21 | $10.87 | $0.13 |

100 Day MA | $11.35 | $0.17 | $10.27 | $0.09 |

4-Week High | $14.36 | $0.00 | $12.03 | $0.00 |

4-Week Low | $12.42 | $0.58 | $10.75 | $0.16 |

Technical Trend | Up | = | Up | = |

November 2021 soybean futures closed at $11.12, down 85 cents since last Friday. Downside price protection could be achieved by purchasing an $11.20 November 2021 Put Option which would cost 79 cents and set a $10.41 futures floor. Nov/Dec 2021 soybean-to-corn price ratio was 2.59 at the end of the week.

Cotton

Net sales reported by exporters were down compared to last week with net sales of 292,400 bales for the 2020/21 marketing year and 39,500 bales for the 2021/22 marketing year. Exports for the same time period were up 17% compared to last week at 322,400 bales. Upland cotton export sales were 86% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 76%. Delta upland cotton spot price quotes for January 20 were 79.59 cents/lb (41-4-34) and 81.84 cents/lb (31-3-35). Adjusted World Price (AWP) increased 0.47 cents to 66.7 cents. March 2021 cotton futures closed at 81.56, up 0.86 cents since last Friday. For the week, March 2021 cotton futures traded between 80.6 and 83.06 cents. Mar/May and Mar/Dec cotton futures spreads were 1.1 cents and -3.09 cents. May 2021 cotton futures closed at 82.66 cents, up 1.04 cents since last Friday.

Cotton | Mar 21 | Change | Dec 21 | Change |

Price | 81.56 | 0.86 | 78.47 | 1.45 |

Support | 80.81 | 0.73 | 77.74 | 1.53 |

Resistance | 82.93 | 1.19 | 79.40 | 1.87 |

20 Day MA | 79.62 | 1.14 | 76.14 | 1.05 |

50 Day MA | 75.65 | 0.85 | 73.21 | 0.71 |

100 Day MA | 72.04 | 0.62 | 70.36 | 0.52 |

4-Week High | 83.06 | 0.98 | 79.20 | 1.75 |

4-Week Low | 74.40 | 0.12 | 72.15 | 0.00 |

Technical Trend | Up | = | Up | = |

December 2021 cotton futures closed at 78.47 cents, up 1.45 cents since last Friday. Downside price protection could be obtained by purchasing a 79 cent December 2021 Put Option costing 6.42 cents establishing a 72.58 cent futures floor.

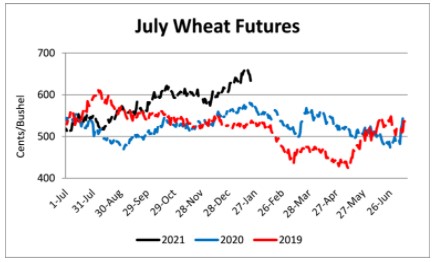

Wheat

Wheat net sales reported by exporters were up compared to last week with net sales of 12.1 million bushels for the 2020/21 marketing year. Exports for the same time period were down 26% from last week at 9.7 million bushels. Wheat export sales were 80% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 82%. March 2021 wheat futures closed at $6.34, down 41 cents since last Friday. March 2021 wheat futures traded between $6.33 and $6.91 this week. March wheat-to-corn price ratio was 1.27. Mar/May and Mar/Jul future spreads were 2 and -10 cents. May 2021 wheat futures closed at $6.36, down 40 cents since last Friday.

Wheat | Mar 21 | Change | Jul 21 | Change |

Price | $6.34 | -$0.41 | $6.24 | -$0.33 |

Support | $6.16 | -$0.29 | $6.07 | -$0.30 |

Resistance | $6.68 | -$0.17 | $6.54 | -$0.26 |

20 Day MA | $6.46 | $0.09 | $6.35 | $0.08 |

50 Day MA | $6.17 | $0.04 | $6.12 | $0.03 |

100 Day MA | $6.02 | $0.04 | $5.98 | $0.03 |

4-Week High | $6.93 | $0.00 | $6.70 | $0.00 |

4-Week Low | $6.07 | $0.18 | $6.00 | $0.12 |

Technical Trend | Up | = | Up | = |

In Tennessee, new crop wheat cash contracts ranged from $6.34 to $6.72. July 2021 wheat futures closed at $6.24, down 33 cents since last Friday. Downside price protection could be obtained by purchasing a $6.30 July 2021 Put Option costing 40 cents establishing a $5.90 futures floor.

Source : tennessee.edu