By Kenny Burdine

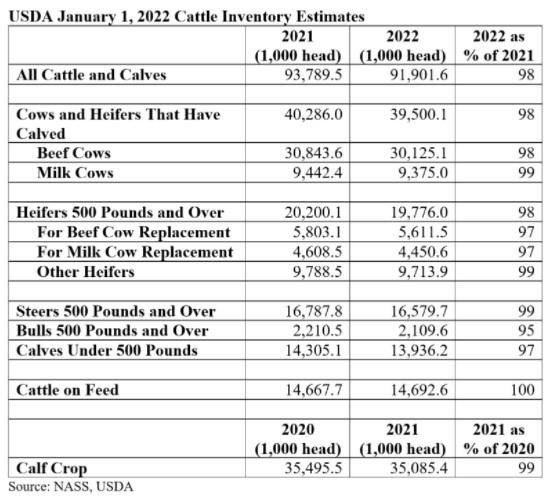

USDA-NASS released their January 1, 2022 cattle inventory estimates this afternoon. Beef cow slaughter was significantly higher in 2021, so expectations were for continued contraction of cattle inventory. The USDA report confirmed that and provided some perspective on the magnitude of these decreases. Total calves and calves were down by 2%, which was a slightly larger decrease than pre-report estimates. As an economist in a predominantly feeder cattle state, I tend to pay more attention to the number of beef cows in the US, which was down by about 2% as well.

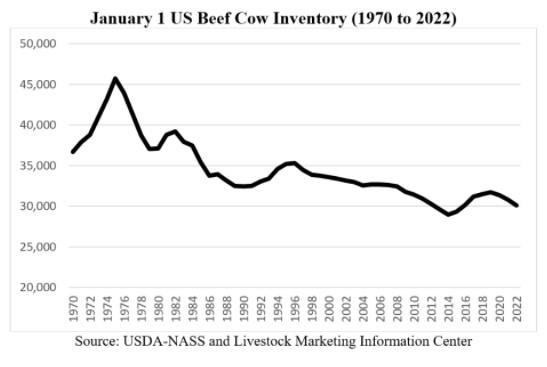

An important note to the report was that the January 1, 2021 beef cow inventory estimate was revised downward by about 1%. Perhaps a better way to put beef cow numbers in perspective is to consider the total change in beef cow inventory over the last three years. From the recent high in 2019, beef cow inventory is down by more than 1.5 million head, which is about 5%. Calf crops are getting smaller and will continue to do so in the coming year, which is bullish for feeder cattle markets. The chart above plots US beef cow inventory going back to 1970.

Heifer retention is also important as it provides some perspective on future trends in beef cow inventory. January heifer retention estimates were down by more than 191 thousand head from 2021, which is about 3%. This suggests continued contraction is likely during 2022, baring significant changes throughout the year.

The cattle on feed estimate from today’s report is also worth discussion and stands out a bit as it actually shows a slight increase from last January. For perspective, I would point back to the January Cattle on Feed report, which reflects on-feed inventories at feedyards with one-time capacity over 1,000 head. First, heifers on feed were higher in that report, which is consistent with fewer heifers being held for replacement and continues to point to a decreasing cow herd going forward. More females are moving into the beef system. Secondly, and most significantly, December placements were up 6% in 2021. But, the largest increases were in the lower placement weight categories, which suggests they may be more a function of dry conditions in the Southern Plains forcing producers to move cattle out of wheat grazing programs. If this is the case, those are cattle that would have been placed on feed this spring, so it speaks more to the timing of their placement, than total cattle supply.

The USDA report is summarized in the table below and the full report can be accessed here.

Source : osu.edu