By Carl Zulauf

Department of Agricultural, Environmental

and Development Economics

Ohio State University

and Joana Colussi

Department of Agricultural and Consumer Economics

University of Illinois

Expanding production of field crops in the southern hemisphere, particularly South America (see June 26, 2023 farmdoc daily), raises the issue of relative variability of production in the northern and southern hemisphere. The two hemispheres not only have different harvest windows but also different agro-climates, including weather and soils. Although production of corn, soybeans, and wheat is more variable in the southern than northern hemisphere, production variability is less for the world than for the northern hemisphere. A key reason is likely that deviations from trend production for the two hemispheres are unrelated.

Data:

This article uses data for the 1977/78 – 2022/23 crop years from the Production, Supply, and Distribution Online database (US Department of Agriculture, Foreign Agriculture Service). The southern hemisphere is defined to be South America, Oceania, and Sub-Saharan Africa. Rest of the world is the northern hemisphere. The data starts with the first year soybean production data are reported for Argentina and Brazil. Data for the 2022 crop year are projections as of mid-July 2023.

Method:

Deviation of production is calculated as the percent difference of reported production for a year from trend production for the year. Trend production is estimated within sample for each crop-hemisphere combination. For corn and soybeans, the estimated equations are curvilinear, indicating production has increased at an increasing rate since 1977/78 for both hemispheres and the world. For wheat, the equations are linear, indicating production has increased at a constant rate for both hemispheres and the world. The time trend variable explains 93% or more of year-to-year change in production except 73% for southern hemisphere wheat. The Data Note contains the trend equations.

Southern Hemisphere Share:

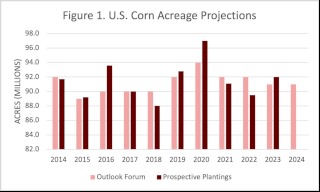

Share of world corn produced in the southern hemisphere increased slowly from 14% in 1977/78 to 18% in 2010/11 (see Figure 1). It has increased somewhat faster since 2010/11 as Brazil’s safrinha (i.e. second) corn crop expanded, reaching 23% in 2022/23. In contrast, southern hemisphere share of world soybean production increased notably from 18% in 1977/78 to 55% in 2012/13-2014/15, but has not increased since. Southern hemisphere share of world wheat production has fluctuated between 6% and 10%. A slight uptrend may exist.

Variability of Production:

Production variability, as measured by the standard deviation of the annual percent variation of production from trendline, is higher for the southern than northern hemisphere for each crop (see Figure 2). Relative to variability of production in the northern hemisphere, variability of production in the southern hemisphere is highest for wheat (14.8% vs. 4.7%, a 10.1 percentage point difference) and lowest for corn (8.8% vs. 7.0%, a 1.8 percentage point difference). Soybeans clearly is in the middle (12.5% vs. 7.1%, a 5.4 percentage point difference).

Although production variability is higher for the southern than northern hemisphere, production variability is lower for the world than for the northern hemisphere due to the interplay of several factors. Three are discussed. One is share of production. The higher is the southern hemisphere’s share, the more important is its higher variability. The second is difference in variability. The higher is variability in the southern relative to northern hemisphere, the more southern hemisphere variability impacts world variability. The third is the correlation of deviations from trend production by year for the two hemispheres. It is near zero for each crop: +0.05 for corn, +0.04 for soybeans, and +0.03 for wheat.

Deviation from trend production in one hemisphere is thus not related to deviation from trend production in the other hemisphere. The uncorrelated deviations dampen world variability. Southern hemisphere production dampens world variability the most for corn because southern hemisphere production variability also is lowest for corn. Southern hemisphere production dampens world wheat variability the least because southern hemisphere production variability is highest for wheat and its share of world production is smallest for wheat.

Discussion

Even though production variability is higher in the southern than northern hemisphere, southern hemisphere production dampens world production variability.

A primary reason is that deviations from trend production for the two hemispheres are uncorrelated.

Southern hemisphere production has especially dampened world variability of corn production.

Lower world production variability from southern hemisphere production should reduce the need for world stocks, assuming all other factors remain the same.

Data Note – Estimated Trend Production Equations:

(units are in million metric tons; time is a count variable starting with 1 for 1977/78):

corn southern hemisphere trend production = 65.85 – 1.97 (time) + 0.14 (time squared); R2 = 98%

corn northern hemisphere trend production = 338.04 +1.31 (time) + 0.28 (time squared); R2 = 97%

corn world trend production = 403.89 – 0.66 (time) + 0.41 (time squared); R2 = 98%

soybean southern hemisphere trend production = 12.79 + 0.39 (time) + 0.09 (time squared); R2 = 98%

soybean northern hemisphere trend production = 62.10 + 0.51 (time) + 0.04 (time squared); R2 = 96%

soybean world trend production = 74.90 + 0.90 (time) + 0.13 (time squared); R2 = 98%

wheat southern hemisphere trend production = 25.88 + 0.84 (time); R2 = 73%

wheat northern hemisphere trend production = 386.85 + 7.01 (time); R2 = 93%

wheat world trend production = 412.73 + 7.85 (time); R2 = 94%

Source : illinois.edu