By Cortney Cowley

The Tenth District farm economy remained weak in the second quarter of 2019, but farm income and credit conditions showed some signs of stabilizing. Despite extreme weather and flooding in parts of the Tenth District and continued trade uncertainty, higher corn prices and trade relief payments could have contributed to a slower pace of decline in expectations for farm income and credit conditions. Although farm income was still expected to decrease in the third quarter of 2019, the pace of decline was expected to be the slowest since 2014. In addition, District bankers reported that deposits grew at a faster pace in some states while farmland values remained steady.

Farm Income and Recent Weather Impacts

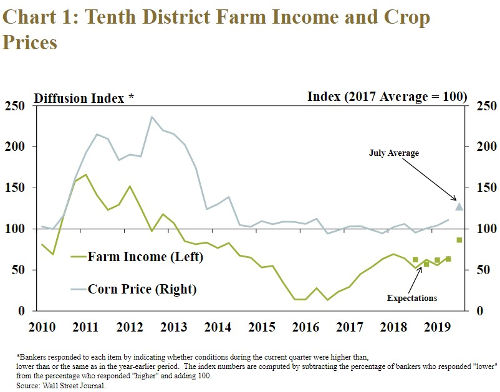

Farm Income in the Tenth District remained weak in the second quarter, but the pace of decline slowed. Slightly more than 40 percent of bankers reported that farm income was lower, compared with almost 75 percent and 60 percent at this time in 2016 and 2017, respectively (Chart 1). Following a nearly 20-year low in 2016, the pace of decrease in farm income has remained relatively stable since the end of 2017. Crop prices increased in the second quarter, and the United States Department of Agriculture announced a continuation of the Market Facilitation Program in 2019. These developments may have led to less pessimistic expectations about farm income in coming months.

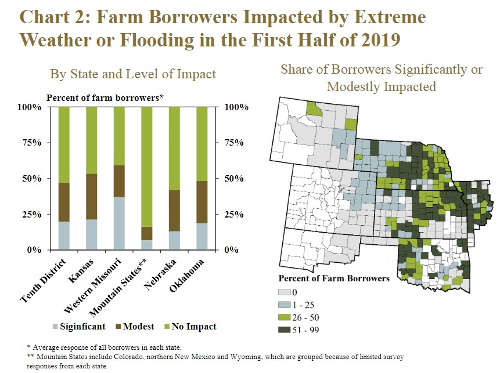

Despite expectations for higher crop prices and farm income, severe weather and flooding could dampen the outlook for some farm borrowers in 2019. In the Tenth District, almost 50 percent of farm borrowers were impacted by extreme weather or flooding (Chart 2, left panel). Although only 20 percent of farm borrowers were impacted significantly by weather, those directly impacted by flooding or extremely wet conditions could be at risk of lower yields and revenues. Areas of the District most severely impacted by weather were central Nebraska, northern and eastern Kansas, western Missouri, and western Oklahoma (Chart 2, right panel). Farm borrowers in the Mountain States, however, were less likely to experience impacts from severe weather.

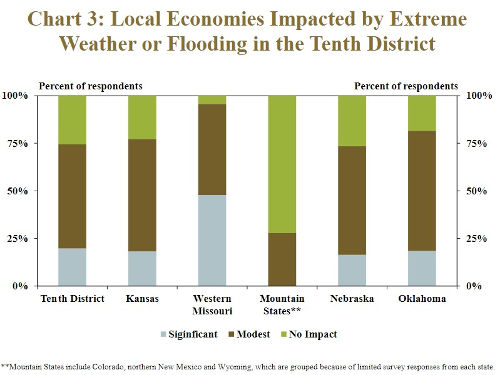

Bankers also reported that local economies were impacted by extreme weather and flooding. Local economies are comprised of local infrastructure, roads, bridges, railways, residential homes, and businesses. About 75 percent of bankers reported that their local economies were impacted, at some level, by adverse weather conditions in Kansas, Nebraska, and Oklahoma (Chart 3). A larger percentage of communities in western Missouri was significantly or modestly impacted by weather, likely due to their proximity to the Missouri River, which was subject to record flooding in the first half of 2019.

Although some areas of the District were significantly affected by extreme weather and flooding, the outlook for crop production and revenues still could be better than other areas of the United States. For example, weather likely weighed more heavily on planting progress in the Corn Belt than in the Tenth District (Chart 4). In the Corn Belt, corn and soybean plantings were 50 percent and 70 percent, respectively, behind the five-year average in May. Although progress was made during planting season in both regions, the share of corn and soybean acres that were planted in the Corn Belt still lagged both the historical average and planted acres in the Tenth District. Relatively better planting conditions could support higher crop revenues in the Tenth District.

Credit Conditions

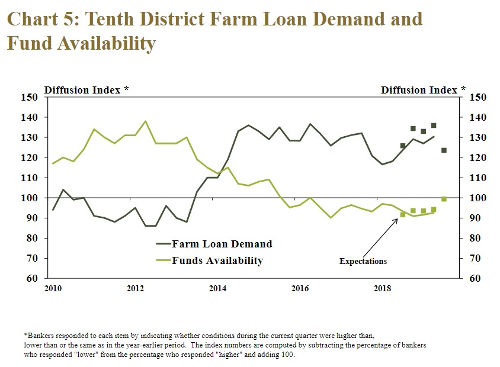

Demand for agricultural lending in the District remained high, but bankers anticipated slower growth in future months. In contrast with expectations in previous quarters, bankers anticipated a slower pace of increase in loan demand than in the current quarter (Chart 5). The extended period of low farm income and strong farm loan demand likely has placed downward pressure on liquidity at some banks. However, over 80 percent of respondents continued to indicate that availability of funds was unchanged from a year ago and looking ahead, nearly no change was expected across the region.

Alongside stable fund availability, deposits at agricultural banks throughout the District were higher than a year ago. Deposits at agricultural banks may have been supported by recent increases in crop prices and payments from the Market Facilitation Program in 2018. Similar to last year, about 35 percent of bankers reported higher deposit levels in the second quarter (Chart 6). However, only 26 percent reported lower deposits, down from over 35 percent in 2018.

Similar to trends in farm income, the pace of decline in credit conditions also showed signs of stabilizing in the second quarter. Slightly less than 30 percent of bankers reported that farm loan repayment rates were lower, compared with almost 50 percent and 40 percent, respectively, at this same time in 2016 and 2017 (Chart 7). Moreover, bankers expected farm loan repayment rates to decline at the slowest pace since 2014 in the next quarter. The pace of increase loan renewals and extensions remained relatively stable but was expected to slow in the next three months.

Click here to see more...