By Rabail Chandio and Nathan Cook

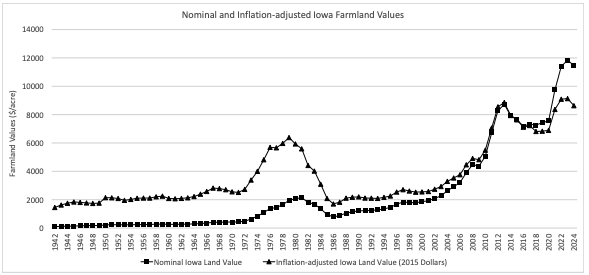

The annual Iowa State University Land Value Survey found that average farmland values increased 0.7%, or $83, to $11,549 per acre. The nominal value of an acre of farmland this year increased over last year’s nominal value, but is still about $286 per acre lower than the 2023 peak of $11,835.

Rabail Chandio, assistant professor and extension economist at Iowa State University, is responsible for the annual survey. Chandio said that she typically considers changes of less than 5%, whether up or down, as more of an adjustment than a true market change. “Changes of that size often reflect variation across counties and crop reporting districts rather than a consistent statewide trend,” she said. “It wasn’t a boom or a bust, just a very uneven adjustment, with the story changing as you move across the state. Strong yields, limited land supply and solid livestock income helped prop up values in some areas, but lower commodity prices, high interest rates and rising costs pulled them down in others.”

When the nominal value increases, but the inflation-adjusted value decreases as it did this year, it can still be helpful for farmers, but only to a point, Chandio said. “A farmer selling land this year will receive more dollars than last year, and that can still support goals like paying down debt (whose real burden also shrinks with inflation), transitioning to retirement or reinvesting elsewhere. In that sense, the higher nominal price provides some benefit,” she said.

However, when inflation-adjusted values fall, additional money from land sales won’t stretch as far as it might have previously. “Sellers may find that the proceeds won’t buy as much machinery, land or inputs as they would have a few years ago. So, while selling today can still improve a farmer’s financial position, the real economic gain is smaller than the nominal price increase suggests,” Chandio said.

Despite the small growth in farmland values, there were many factors putting downward pressure on farmland values this year. Chandio said one of those factors is federal interest rates, which only saw modest cuts in 2025. “Because we haven’t seen any major reductions, the market is still feeling the weight of the rate hikes from 2022 and 2023. And since interest-rate effects take years, up to a decade, to be fully capitalized in land values, those post-COVID increases are still working their way through the system,” Chandio said.

Commodity markets also put some pressure on land prices this year. Chandio called commodity prices “soft” but said that tariffs likely only played a small and indirect role in this year’s farmland values. “Tariffs may have been part of the background noise, but they weren’t a major driver of farmland values,” she said. Farmers, she said, are still just facing very tight margins on commodities, even with lower production costs.

Source : iastate.edu