By Kenny Burdine

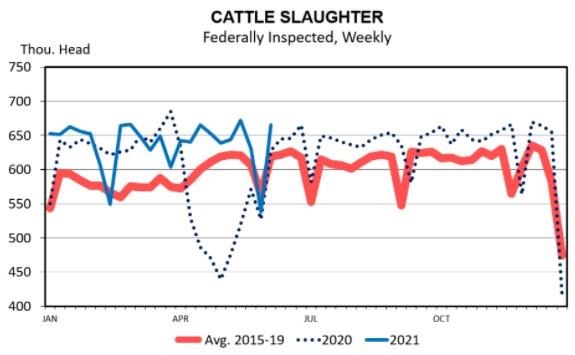

The JBS cyber-attack was another blow dealt to a cattle market that has been hit with challenge after challenge since last spring. James did a good job last week talking through the impacts on slaughter volumes and how quickly they returned to pre-attack levels. We saw something similar in the spring of 2020 as slaughter levels pushed back towards pre-COVID levels. I think both of these responses speak to the resiliency of our meat system and I am including the weekly slaughter chart again this week. High boxed beef prices are also creating incentives to push cattle through the system.

Market reactions to shocks like these are always interesting to watch. The price response in the cattle markets to the cyber-attack was relatively limited as the market seemed to view this as a short term impact. Conversely, the market response to COVID was much greater, as the impacts were expected to last longer and there was a lot more uncertainty about what would happen. In both cases, the impacts on feeder cattle markets were smaller due to the time lag that exists between the sale of feeder cattle and their eventual movement into the beef system.

As an illustration, feeder cattle markets have been much more impacted by rising corn prices than they were the JBS cyber-attack. There was little reason to believe that the attack would influence the market several months into the future, but new crop 2021 corn prices are up roughly $1 per bushel from spring. That is a factor that is expected to impact markets for some time and will definitely impact the values of feeder cattle moving through markets this summer.

I think this is an important distinction to make with respect to feeder cattle and fed cattle markets. Both will be impacted by shocks, but fed cattle are much more vulnerable to short-term shocks. For something to impact feeder cattle values, the market really has to perceive that the impacts will be longer-lasting. It is also important to understand that markets are constantly changing and making adjustments to these shocks. Uncertainty and volatility just seem to be the norm in cattle markets right now.

As I write this on the morning of June 14th, fall CME© feeder cattle futures have pushed back into the upper $150’s. Granted, they are still about $5 per cwt off of their spring highs, but they have gained back about two-thirds of the ground they lost between early April and early May. For producers with feeders to sell in summer or fall, the market is offering another pricing opportunity that is worth consideration. This is especially true for stocker operators that placed calves into grazing programs this spring. The drop in the fall board this spring really made a lot of people question the profitability of those programs and the recent run-up is improving that outlook.

There is a natural tendency to be afraid of pricing cattle too early and leaving money on the table, which often prevents producers from moving on a market like we currently have. Is it possible that the market will return to the levels we saw in early April? Absolutely. But, we have no way to know if that will happen. Risk management is not about cherry-picking highs in the market. It’s about managing downside price risk over time. And, I think it’s a good time to review where the market is and see if this is an opportunity worth taking advantage of.

Source : osu.edu