What Does the Latest StatsCan Acreage Mean?

In the last Pulse Market Insight, the StatsCan acreage report was a key market event we advised watching. This is an important survey because it involves nearly 25,000 farmers and the phoning happens after planting is mostly complete. Even though it has its shortcomings, it’s still the best survey out there. And since Canada is the largest exporter of peas and lentils in the world, the trade follows (and debates) these numbers closely. That’s especially the case this year when global supplies of most pulses are razor thin.

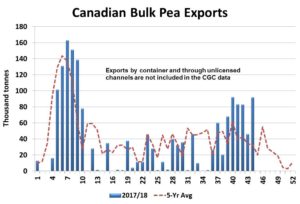

At a high level, there wasn’t much change to StatsCan’s pea acreage numbers. Seeded area of 4.27 million acres is 16% higher than last year but is nearly unchanged from the April seeding intentions report. That means the trade’s assumptions for the past few months aren’t really affected. That said, it confirms the potential for a very large 2016 pea crop, especially with conditions still very positive.

The one difference in this June acreage report is that it shows green pea plantings will actually be 8% lower than last year while yellow pea acreage is estimated to be up 22%. That’s not surprising, given the price relationships this year, but it could mean a return to a more normal premium position for green peas.

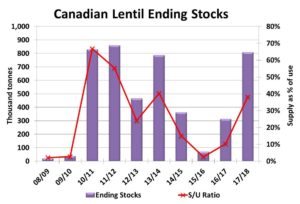

This latest StatsCan report had a large boost to lentil seeded area at 5.84 million acres, 700,000 tonnes more than April intentions and 1.9 million tonnes (48%) above last year’s total. Some observers had been calling for even more acres but it’s still a surprise to many. This acreage together with exceptional crop conditions (so far) could mean a very heavy supply outlook even with a sizable boost to exports.

The breakdown by type showed red and large green lentil acreage expanding by a similar proportion, so production of both types should expand considerably. Small greens saw the smallest percentage increase and that portion of the market could strengthen relative to the others.

In its April intentions report, StatsCan had shown a drop in 2016 chickpea acres, but that was corrected in this report, with seeded area now at 175,000 acres, 40% more than last year. Even so, that’s not a huge amount and won’t really pressure the market, especially with exceptionally strong global demand for large calibre kabulis.

Dry bean acreage is now estimated to rise 10% versus a similar sized decline in the intentions report. That said, StatsCan doesn’t report seeded area for all provinces and types, so the final answer will come from crop insurance acreage reports.

Of course, now that these acreage numbers are “known”, all the attention shifts to the crop condition and yield outlook. But that’s a column for another day.

Source : Albertapulse